Key components of the statement of owner's equity

- Beginning equity: The equity at the start of the period.

- Additions: Net income, additional capital contributions.

- Subtractions: Withdrawals by the owner, net losses.

- Ending equity: The equity at the end of the period reflecting all changes.

By preparing an owner's equity statement, businesses can effectively track and report changes in their equity, ensuring transparency and accuracy in their financial records.

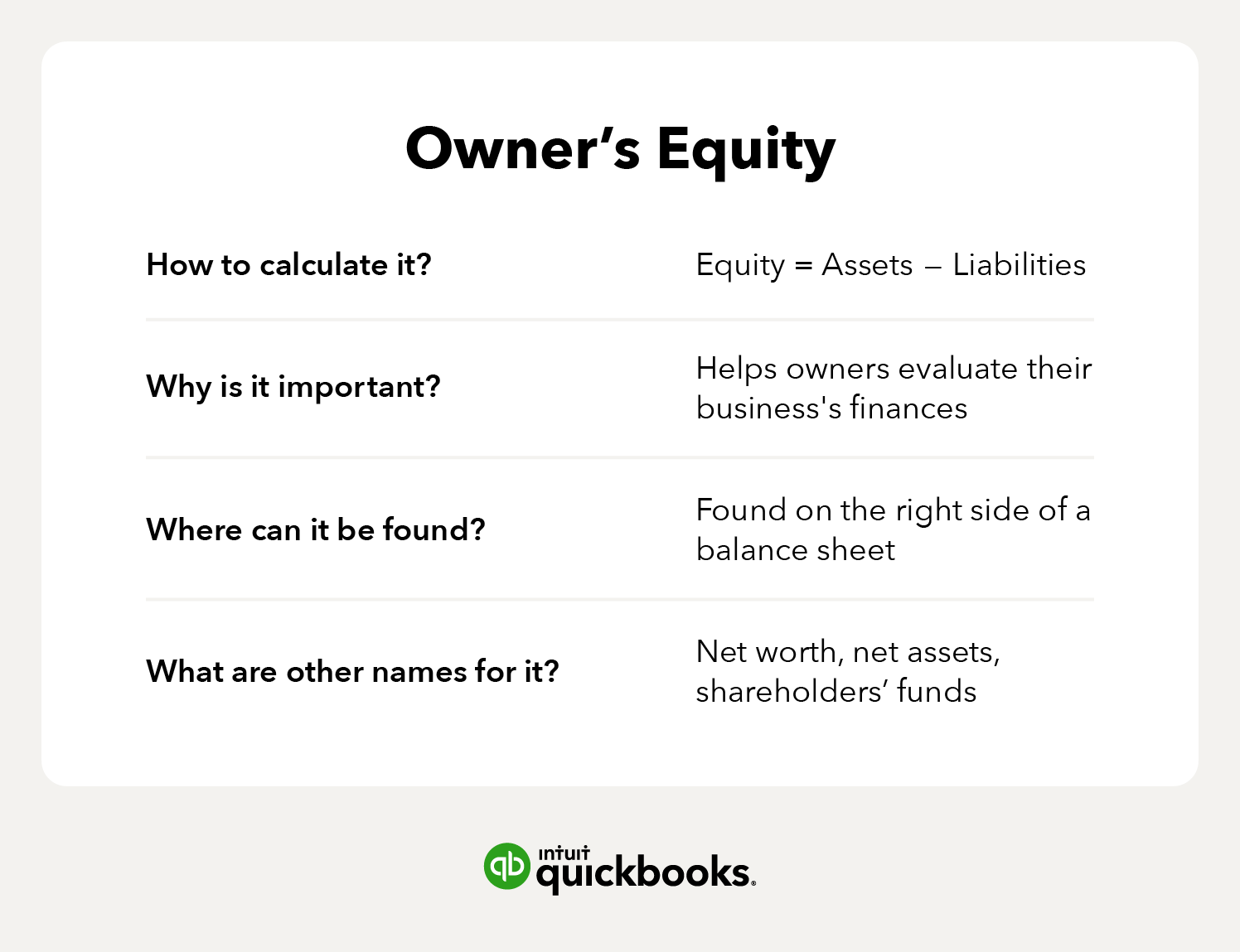

Owner’s equity on a balance sheet

Owner’s equity is part of the financial reporting process. The amounts for liabilities and assets can be found within your equity accounts on a balance sheet—liabilities and owner’s equity are usually found on the right side, and assets are found on the left side.

- Liabilities: Includes debts or other obligations in which your business owes money, whether it be now or in the future

- Assets: The value of the items your business owns, like real estate and equipment

Note: If your business is acquired, the sales that the business made minus any liabilities that are owed are not transferred to the new owner during the acquisition.

What’s included in owner’s equity?

Several items are included in owner’s equity within the balance sheet, such as:

- (+) The money invested into your business: When you put money or assets (e.g., equipment, vehicles, etc.) into your business, these investments directly increase your equity.

- (+) Profits your business has generated since it was founded: When your business makes a profit and you leave it in the company, that adds to your equity. It’s a good sign that your business is growing and building value.

- (-) Minus any money you’ve taken out of your business: Every withdrawal you make (e.g., paying yourself) reduces your equity. Taking out too much too often can lead to negative equity.

- (-) Minus any money lost by the business: Businesses face tough times and lose money, and these losses reduce equity. If the losses continue over time, it can make it difficult for your business to recover unless you take action (e.g., cut costs, increase revenue, etc.

This applies to businesses structured as sole proprietorships. However, if you’ve structured your business as a corporation, owner’s equity works a little differently. It’s usually called shareholders’ equity and there are additional factors to consider.

- (+) Outstanding shares: These are the total number of shares that have been issued to investors. When people buy shares, the money they pay helps grow the company’s shareholders’ equity. The more shares sold, the higher the equity.

- (+) Additional paid-in capital: This is the money investors pay for shares beyond their face value (i.e., par value). For example, if a share’s par value is $1 but someone pays $5, the extra $4 is additional paid-in capital. That extra amount adds to shareholders’ equity.

- (-) Dividends and distributions: When a corporation pays dividends to its shareholders, it lowers retained earnings and reduces equity because the funds leave the business.

- (-) Treasury stock: Sometimes, companies buy back their own shares. These treasury stocks reduce equity since the company uses its funds to repurchase shares.

Owner’s equity examples

Let’s look at a couple examples of how owner’s equity can change for your business.

Example 1: You own a local coffee shop. At the end of the year, you take a look at your financials and it shows your assets (e.g., coffee machines, cash, inventory, furniture, etc.) amount to $100,000. Your liabilities (e.g., loans, unpaid bills, debts, etc.) total out to $40,000.

When you plug this information into the equity formula (equity = assets - liabilities), your equity would be $60,000.

Example 2: Let’s say you run a clothing store. At the end of the month, you check your financial information. Your assets equal $50,000, which can include inventory, cash, equipment, and anything else your store owns. Your liabilities amount to $20,000 due to loans, supplier invoices, and other outstanding payments.

Using the equation, you can figure out your equity:

$50,000 (assets) - $30,000 (liabilities) = $20,000 (equity)

Can owner’s equity be negative?

Yes, owner's equity can be negative. This situation occurs when a company's liabilities exceed its assets, resulting in a deficit. Here are some reasons why owner's equity might be negative:

- Accumulated losses. If a company has incurred significant losses over time, these losses can outweigh any profits and capital contributions, leading to negative owner's equity.

- High debt levels. When a company has substantial liabilities, such as loans and other debts, these can surpass the total value of its assets, resulting in negative equity.

- Excessive withdrawals. If the owner withdraws more money from the business than the profits it generates, it can deplete the equity and result in a negative balance.

- Large dividend payments. In corporations, paying out large dividends that exceed retained earnings can lead to negative equity.

Implications of negative owner's equity

Negative owner’s equity can impact the business in several ways:

- Financial health. Negative equity indicates that the company is in poor financial health and may face difficulties meeting its obligations.

- Creditworthiness. Lenders and investors may view negative equity as a red flag, making it harder for the company to secure financing.

- Bankruptcy risk. Prolonged periods of negative equity can increase the risk of bankruptcy or insolvency.

Example

- Assets: $50,000

- Liabilities: $70,000

- Owner's equity: Assets - Liabilities = $50,000 - $70,000 = -$20,000

In this example, the owner's equity is -$20,000, indicating that the company owes more than it owns.

Negative owner's equity is a serious issue that requires attention. It often necessitates strategic changes to improve the company’s financial position.

Additional forms of equity

Equity doesn’t just apply to companies—it can also refer to any type of ownership of something after taking out debts. Below are some common variations of equity to be aware of:

- Stock: Any security that represents an ownership interest in a company

- Shareholder’s equity: Retained earnings or losses plus any funds contributed to the business by shareholders or the owner

- Real property value: In real estate, this value represents the difference between a property’s fair market value and the amount someone still owes on the mortgage

- Risk capital: The amount of money that remains after a business repays its creditors after going bankrupt or liquidating its assets