Examples of assets, liabilities, and equity

Assets on the left side of the accounting equation must stay in balance with liabilities and equity on the right side of the equation:

Assets = liabilities + equity

Assume that a firm issues a $10,000 bond and receives cash. The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account).

Here’s the impact on the equation:

$10,000 increase assets = $10,000 increase liabilities + $0 change equity

Using accounting software can help ensure that each journal entry you post keeps the formula in balance. If you use a bookkeeper or an accountant, they will also keep an eye on this process.

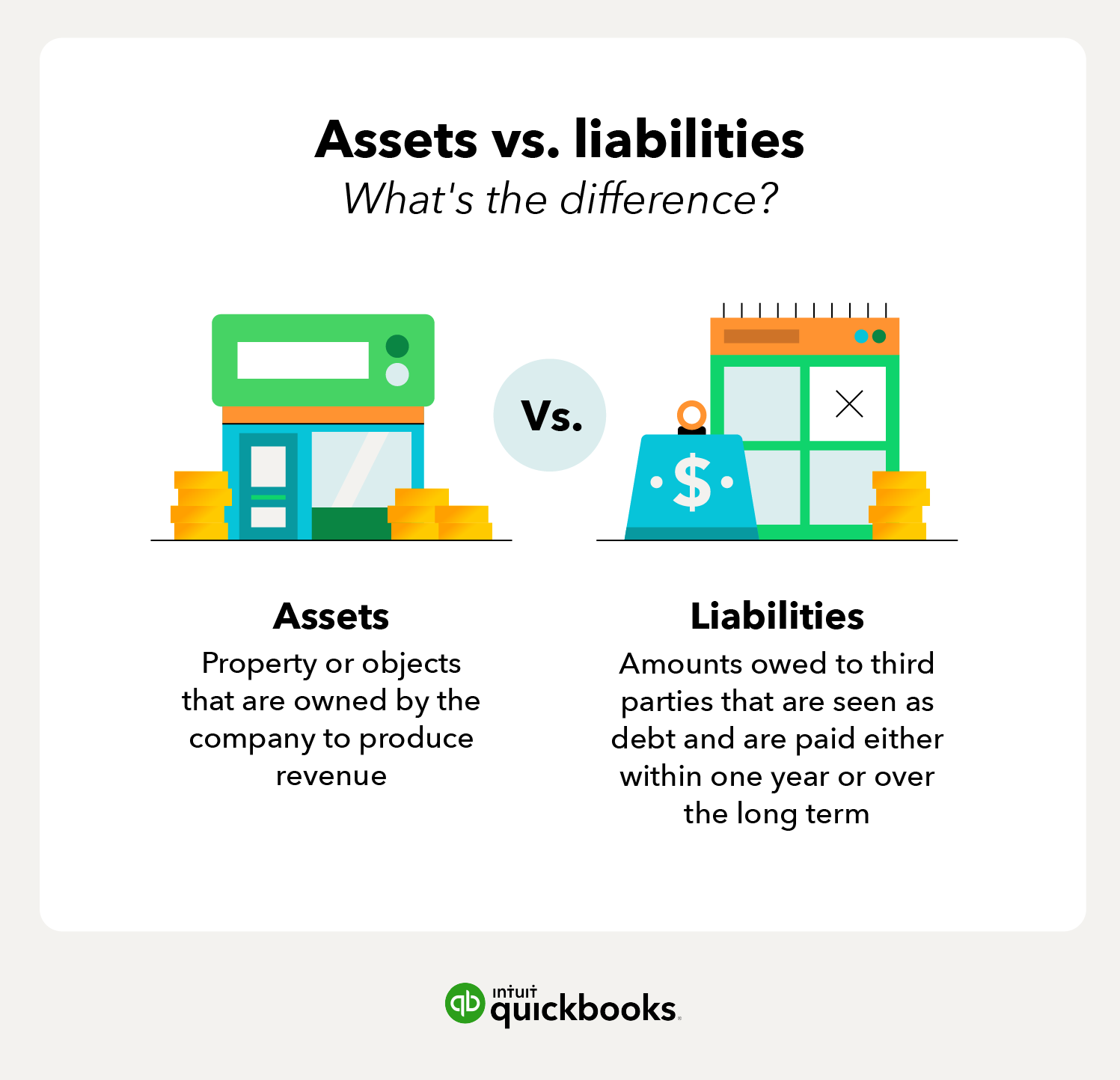

Assets and liabilities for better decision-making

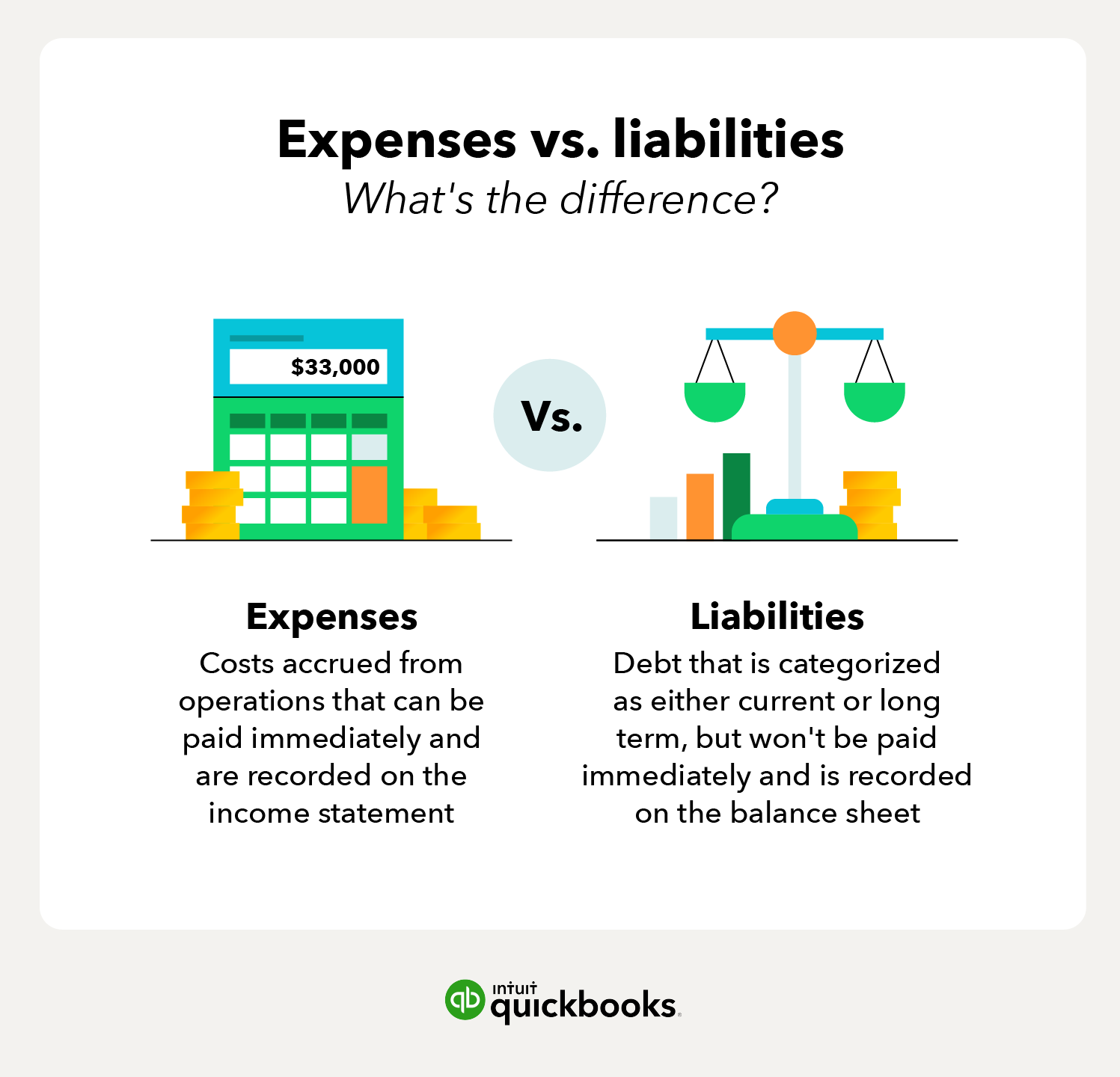

Assets and liabilities are key factors to making smarter decisions with your corporate finances and are often showcased in the balance sheet and other financial statements. Accounting software can easily compile these statements and track the metrics they produce.

The balance sheet is one of three financial statements that explain your company’s performance. Review your balance sheet each month, and use the analytical tools to assess the financial position of your small business. Using the balance sheet data can help you make better decisions and increase profits.