Alternative business funding options to bridge loans for short-term immediate funds include:

- Merchant cash advances provide a lump sum of immediate funds in exchange for a percentage of future credit card sales, making it a quick and accessible option for short-term funding.

- Small Business Administration (SBA) loans: If you qualify, SBA loans can provide favorable terms and lower interest rates for eligible businesses.

- Invoice factoring involves selling accounts receivables at a discount to a third party in exchange for immediate cash. Invoice financing works for businesses with large amounts of outstanding invoices.

- Business lines of credit provide a revolving credit line for immediate funding needs, with the flexibility to repay and borrow as needed.

These alternatives differ from bridge loans in structure and repayment terms, and they may not require specific collateral.

Repayment terms also vary. Bridge loans typically have a fixed repayment schedule, while cash advances, invoice factoring, and lines of credit may offer more flexible terms.

What are your funding options?

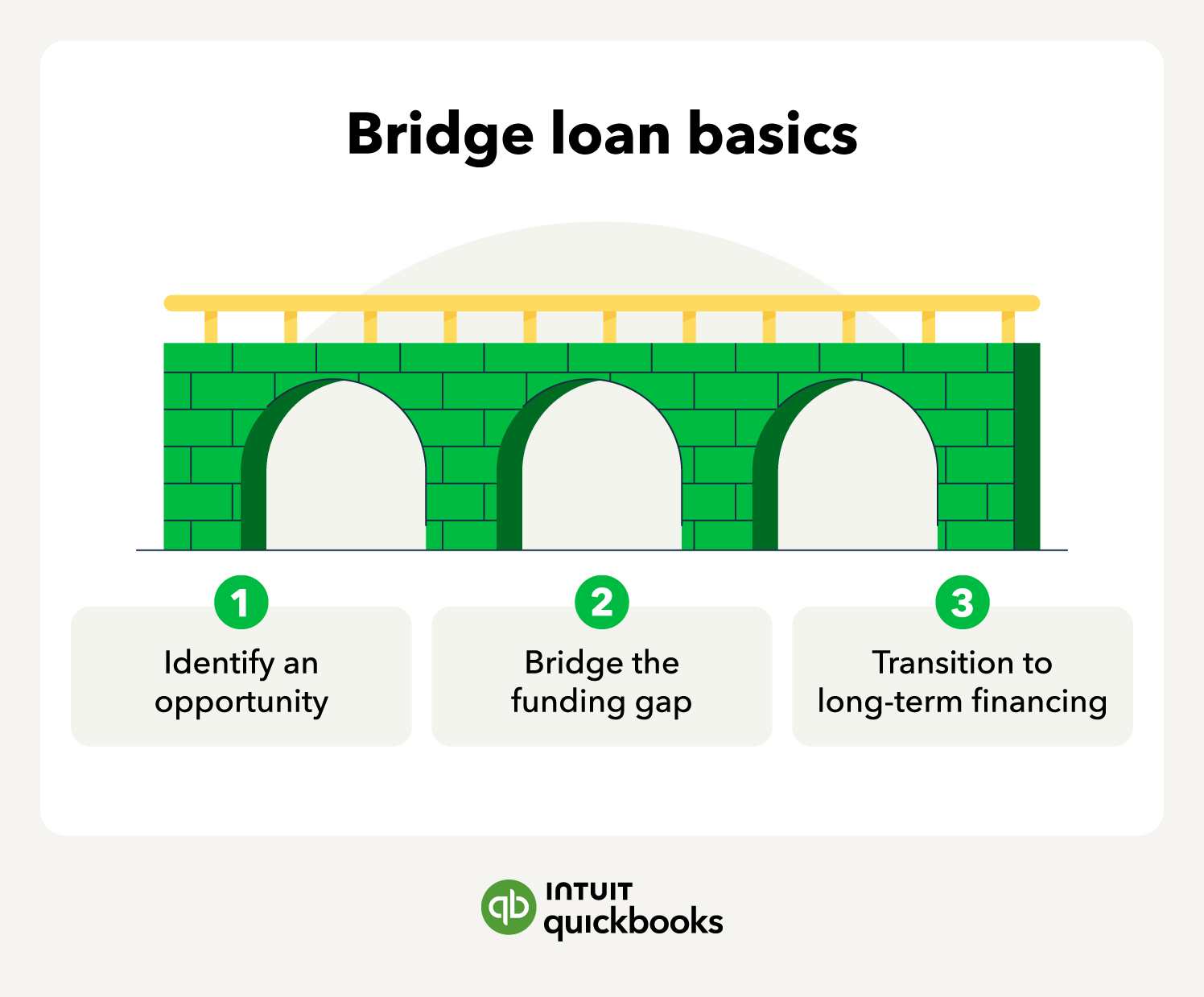

When researching and applying for a business bridge loan, there are several factors to consider, from interest rates to repayment terms. Bridge loans are short-term and usually have a sense of urgency—it’s imperative to make informed and strategic decisions.

But as a small business owner, you have more fast and flexible funding options than you might expect. For example, business term loans like QuickBooks Term Loan can provide funding in 1-2 days with flexible terms.