To find your company’s bottom line, use this net income formula:

Revenue – expenses = net income (net profit)

Net income is an important indicator of your business’s profitability. To calculate net income, also known as net profit, follow these steps:

Step 1: Determine Total Revenue

Revenue refers to sales and any transaction that results in cash inflows. If you sell an asset for a gain, the gain is considered revenue. Company revenue is a line item at the top of the income statement.

Step 2: Calculate Total Expenses

Sum all costs your company incurs, including cost of goods sold, salaries, rent, and other operating expenses.

Step 3: Subtract Total Expenses from Total Revenue

This result is your net income, showing what the company earns after covering all its costs.

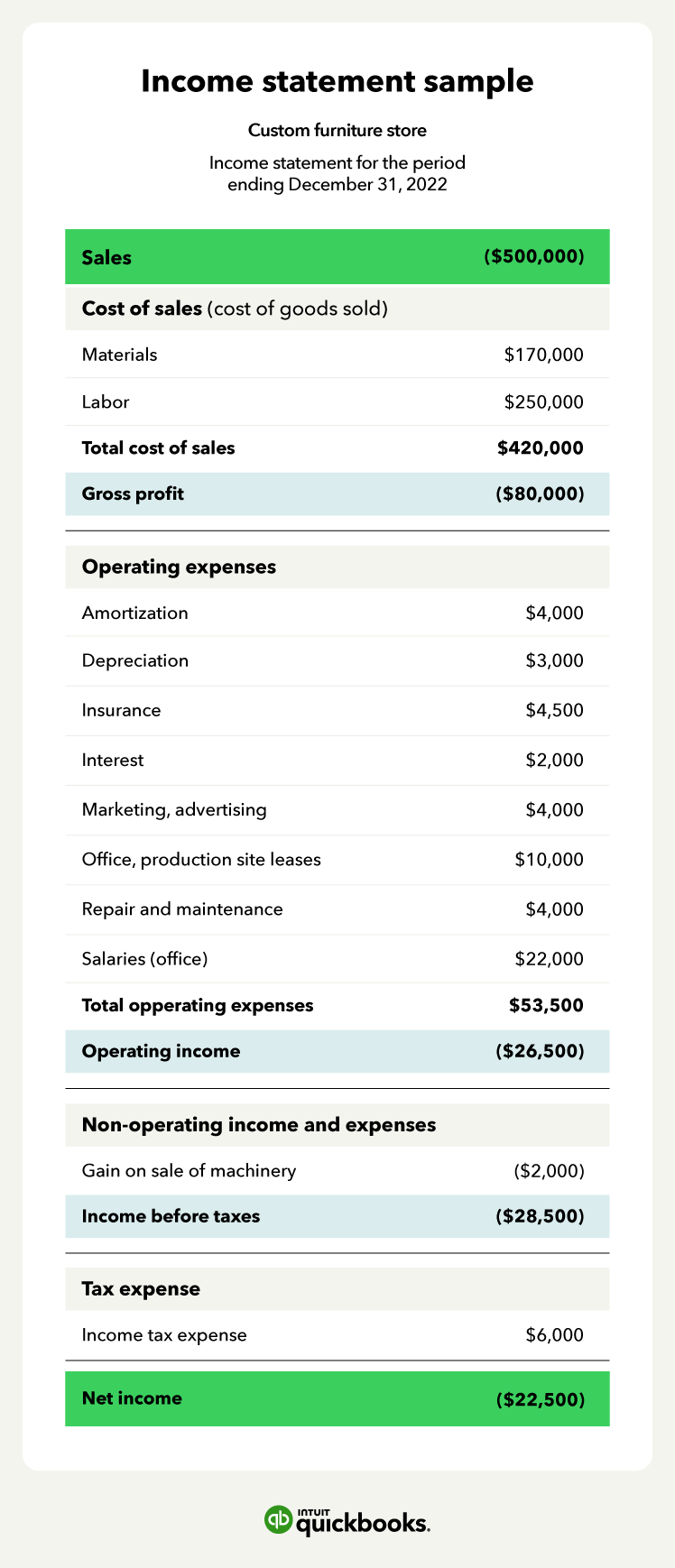

Businesses take on expenses to generate more revenue, and net income is the difference between revenue (inflow) and expenses (outflow). Expenses are grouped toward the bottom of the income statement, and net income (bottom line) is on the last line of the statement.

Business owners should use a multi-step income statement that also separates the cost of goods sold (COGS) from operating expenses.

Net income vs. gross profit

The income statement calculates net income, which is the balance you have after subtracting additional expenses from the gross profit.

Here are some details that explain gross profit:

- The total revenue minus the COGS

- COGS includes direct materials, including wood and metal materials used to build furniture

- COGS also includes direct labor or labor costs that are directly related to furniture production

So for example, a hypothetical furniture company named Craft earned $120,000 in revenue for the current year. If its total COGS for the current year is $18,000, that leaves a gross profit of $102,000.

Operating income is another metric to keep in mind. It represents profit generated from day-to-day business operations. Well-managed businesses can consistently generate operating income, and the balance is reported below gross profit.

Now that you’re familiar with the terms you’ll encounter on an income statement, here’s a sample to serve as a guide.

How much should my retained earnings be?

The appropriate level of retained earnings varies significantly based on factors like industry norms, your company's growth stage, and financial strategies. Here are key considerations to help gauge your retained earnings:

1. Industry Standards

Different industries have varying benchmarks. For instance, tech startups often reinvest heavily to fuel growth, whereas mature utility companies might pay more dividends.

2. Growth Phase

- Startups might have low or negative retained earnings due to reinvestment needs.

- Growth-phase companies often retain more earnings for expansion.

- Mature companies might pay more dividends, resulting in lower retained earnings.

3. Financial Stability

Stable companies might retain more earnings as a safeguard against economic downturns, while those with less risk may distribute more dividends.

4. Future Capital Needs

If significant capital investments are anticipated, retaining earnings to cover these costs can be more advantageous than external financing.

5. Debt Levels

High-debt companies may retain more earnings to reduce debt and improve financial health.

6. Shareholder Expectations

The dividend preferences of shareholders can influence retained earnings, especially in dividend-focused industries.

Regular Evaluation

Regularly assess your retained earnings in the context of your business objectives and shareholder needs, perhaps with the help of financial advisors.

The goal is to maintain a balance that supports your business's health and strategic goals while meeting shareholder expectations.