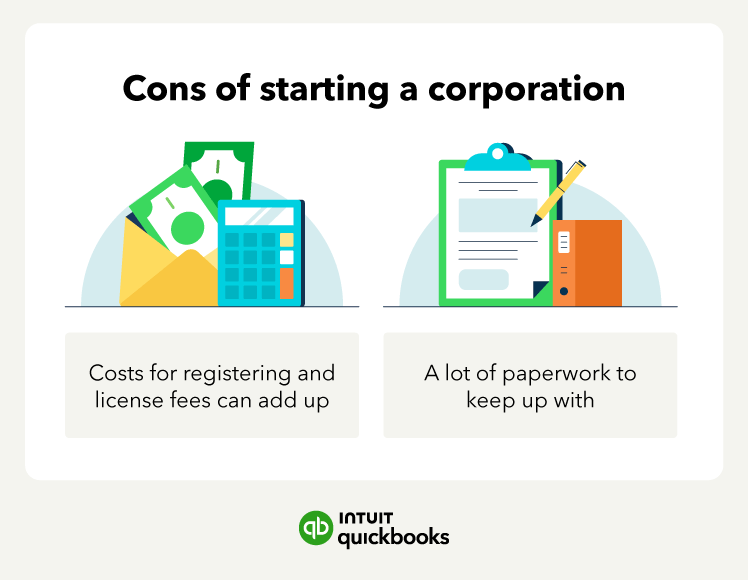

Cost

The fees to register a corporation vary from state to state, but they often cost a couple hundred dollars. This is different from a sole proprietorship, which exists automatically without owners having to pay any filing fees.

In addition to filing fees, you’ll have to pay for things like business license fees. And you’ll have to do this in every state, and potentially every county, in which you operate.

Administrative duties

There is a lot of paperwork involved in operating a corporation. Again, this varies from state to state, but you may need to file annual reports or other similar documents to remain compliant. Other things you’ll need to keep on file include:

- Certificate of incorporation

- Corporate bylaws

- Certificate of good standing if operating in another state

- Corporate minutes

If there are only a couple of owners involved in your small business—such as yourself and one or two others—then the administrative upkeep may not be worth it, and you may be better off selecting another business structure.

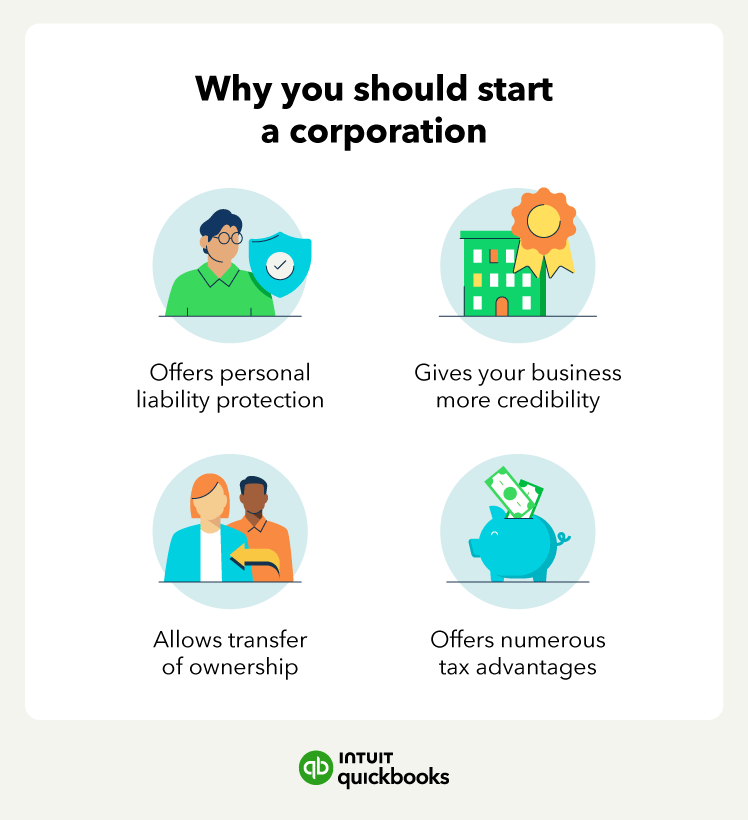

Start your business with confidence

While the process for incorporation is complicated, there are many benefits to doing so. If you elect this business structure, it’s vital to fulfill corporate requirements in order to maintain corporate personhood and liability protection.

Make sure you perform due diligence when filing and seek legal assistance if needed. If you register correctly, choosing a C-corp structure and maintaining proper documentation could put your company in a position for long-term success. Consider accounting software, like QuickBooks, to keep your business finances organized and future-proof.