Although small business owners say increasing revenue is their main goal in 2024, the business landscape is more competitive than ever.

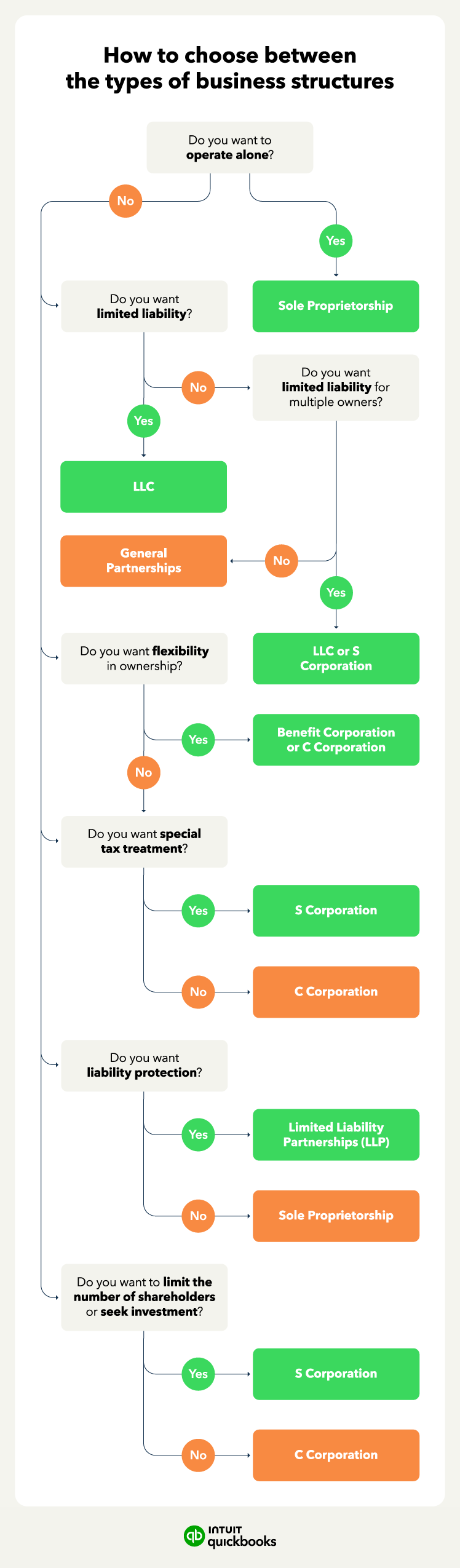

As an entrepreneur navigating this dynamic environment, sifting through the types of business structures will be a cornerstone of your success.

Our guide will illuminate the nine most common business structures, providing a comprehensive overview of their legal, tax, and liability implications. Whether you're a solopreneur or planning a larger enterprise, choosing the right structure is the first step to your success.

Jump to:

- Sole Proprietorship

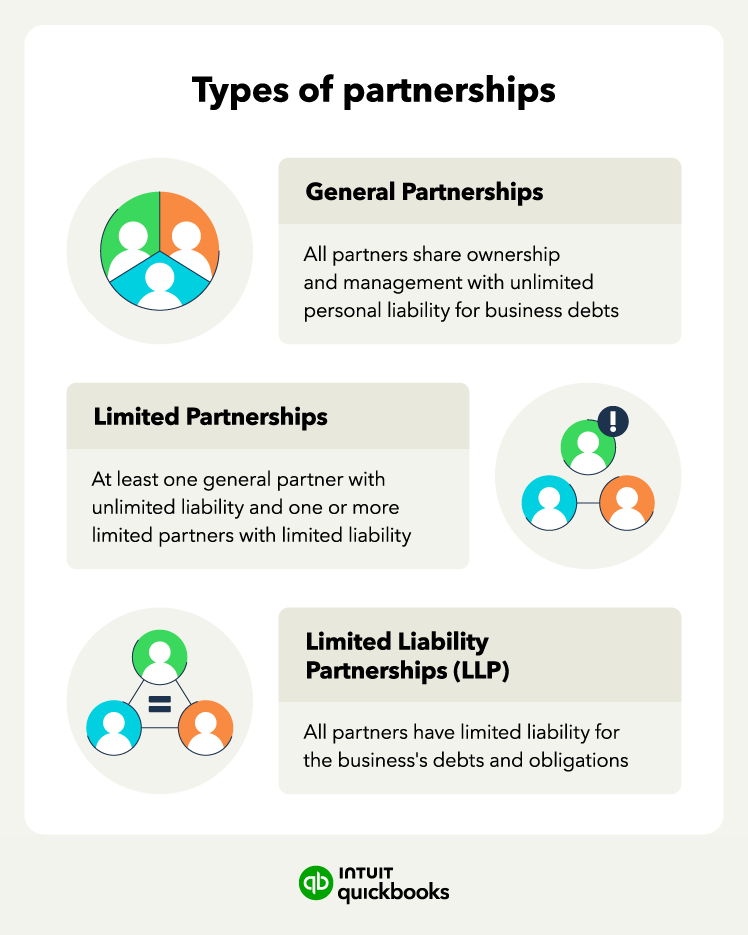

- General Partnerships

- Limited Partnerships

- Limited Liability Partnerships (LLP)

- Limited Liability Company (LLC)

- C Corporation

- S Corporation

- Nonprofit corporation

- Benefit corporation