All business owners are responsible for maintaining payroll records on behalf of each employee. This includes documentation detailing how wages are determined, payroll taxes, and more. But why is it so important that you hold onto them?

There are federal and state laws that require employers to keep payroll records for several years. The main purpose of keeping payroll files for each employee is to remain in compliance with regulatory bodies like the Internal Revenue Service (IRS) and the U.S. Department of Labor (DOL). However, maintaining detailed payroll records for several years can also benefit your business directly. Payroll records can be used to make decisions about raises, protect your business against claims of unfair or incorrect payment, and more.

To protect your business, use this guide to payroll records, so you know what’s required of you. Use the links below for quick answers to your questions.

- What are payroll records?

- Why do you keep payroll records?

- Federal laws and recordkeeping requirements

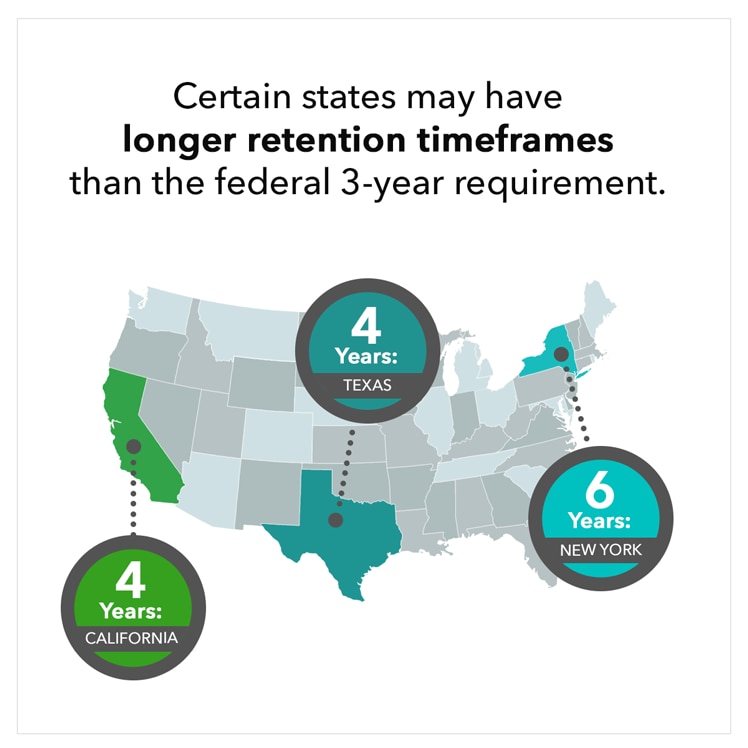

- State laws and recordkeeping requirements

- What should be included in payroll records?

- How long do you need to keep payroll records?

- What should be done with payroll records after the retention time frame passes?

- Where should you store payroll records?

- FAQ

- What are certified payroll records? How long do you need to keep them?

- How long do you need to keep terminated employee files?