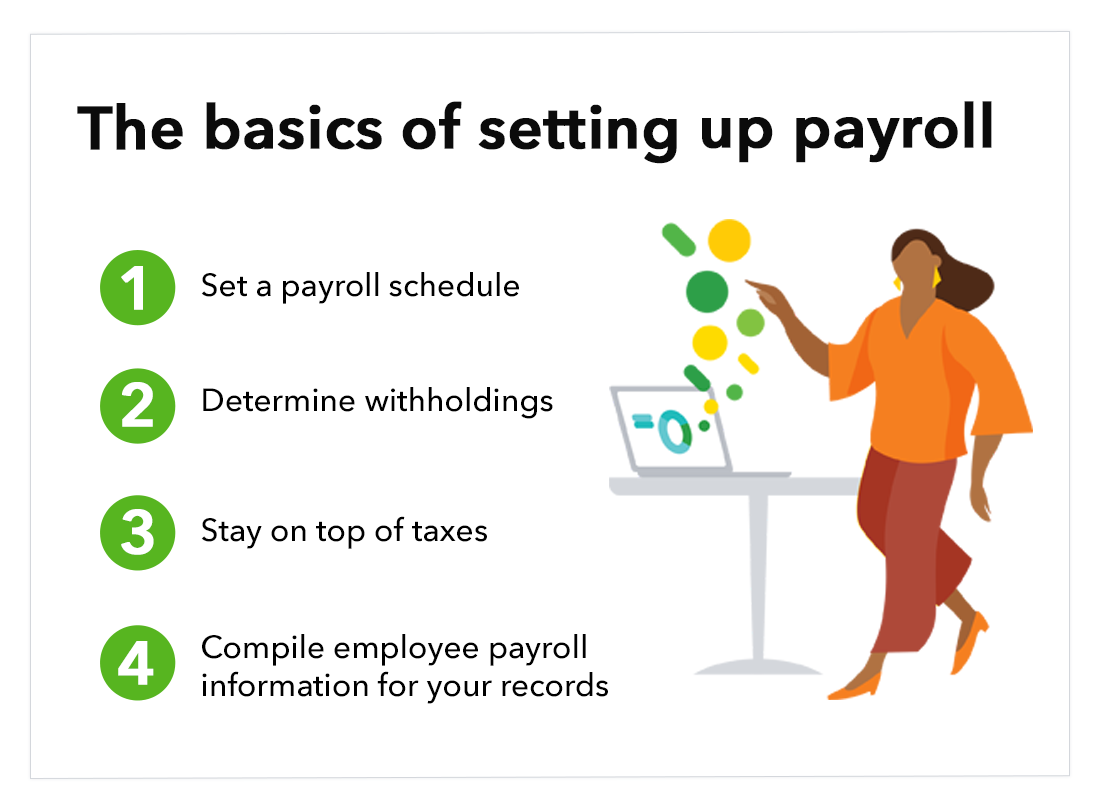

There are a few steps you need to take before your startup can begin hiring. One of the most important things you must attend to is setting up a payroll system.

So what is payroll ? In general terms, payroll is the process of paying your employees. The term refers not only to the distribution of paychecks but also to processes like financial bookkeeping and calculating relevant payroll taxes. With a well-functioning payroll system in place, you can track employee hours, issue paychecks on time, and pay payroll taxes. A good payroll system will also help your startup stay in compliance with regulatory laws by making necessary deductions for things like Social Security and Medicare.

In this article, we’ll take a closer look at what payroll services are and how they can help your startup. Read on for a general overview of payroll services for startups or click on any of these links to skip to the section you’re most interested in: