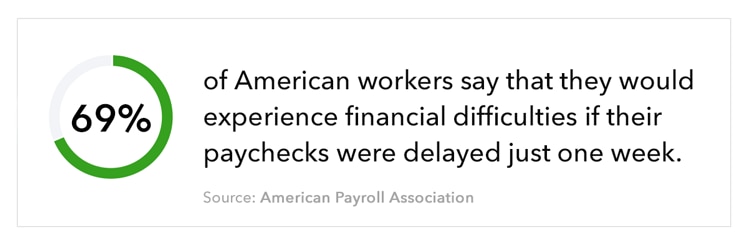

As a small business owner, one of your many responsibilities is taking care of your internal team—after all, they’re the people who keep your business in motion. Ensuring that your team gets paid accurately and on time should be among your top priorities as a manager.

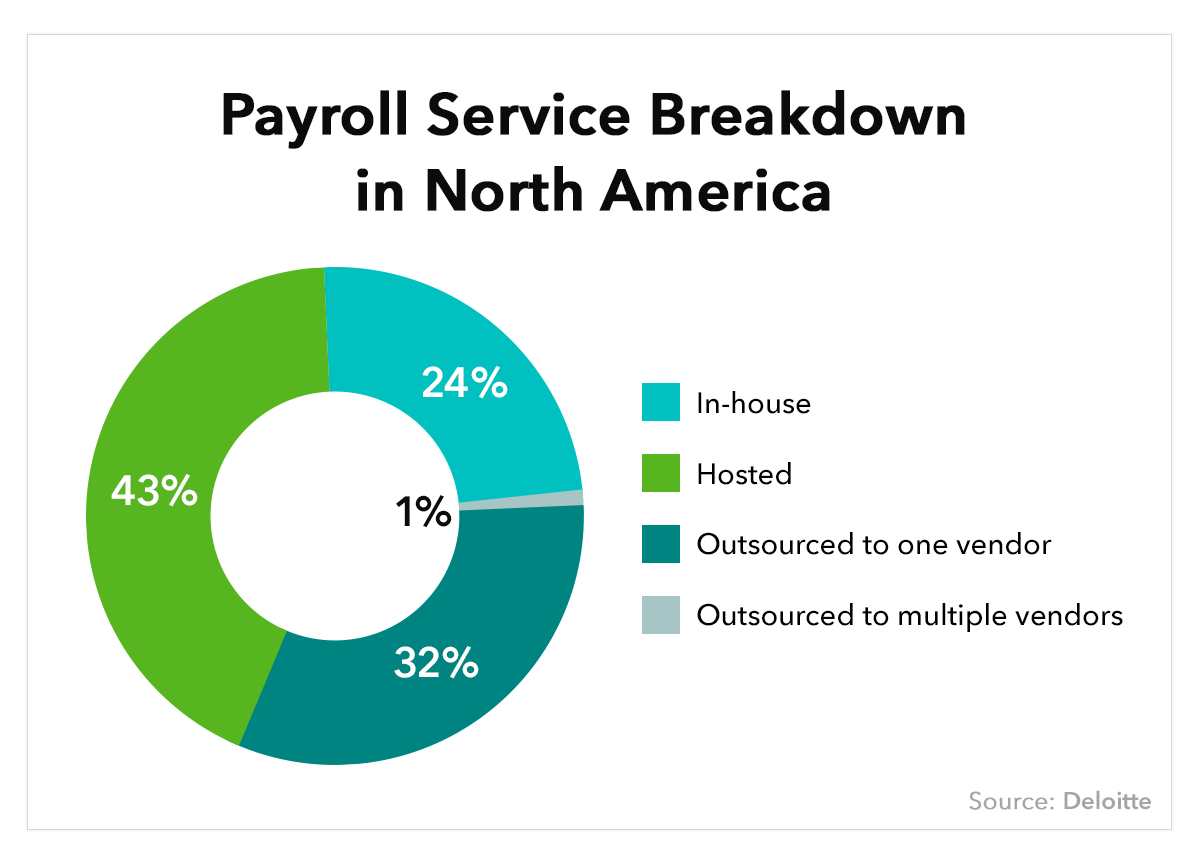

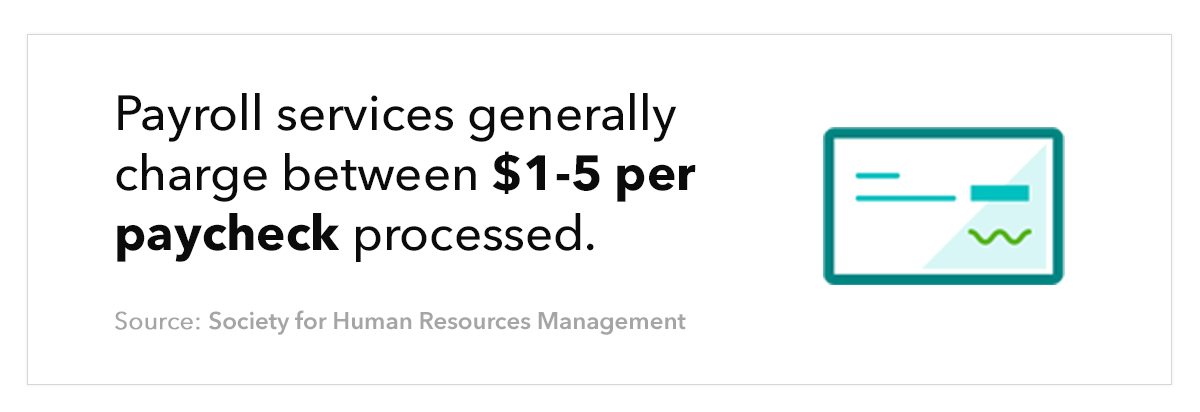

When it comes to executing payroll, you have two options: outsourced and in-house payroll. In this post, we’ll take a look at the differences between in-house payroll and outsourced payroll processing, as well as benefits and drawbacks of each.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.