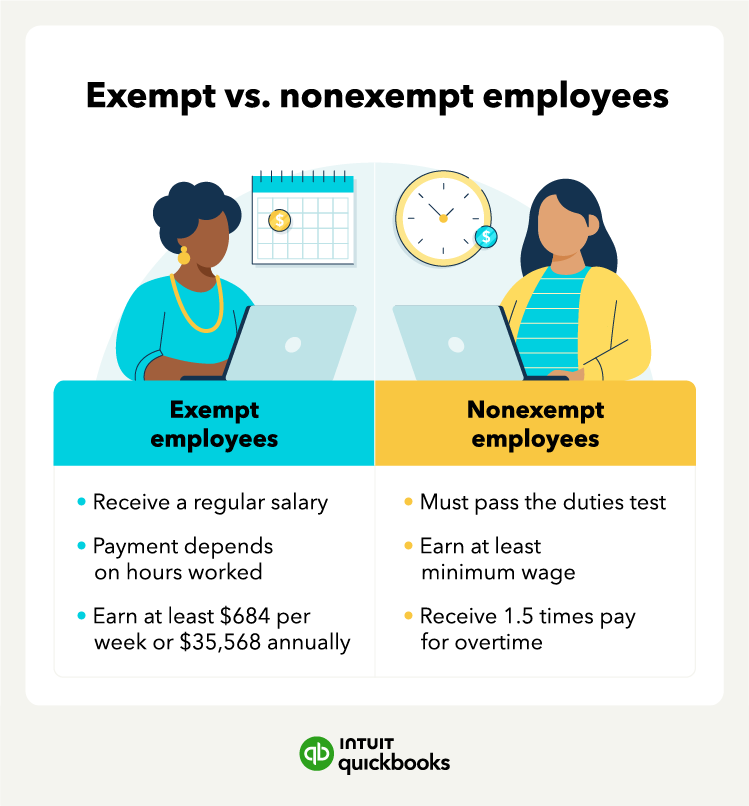

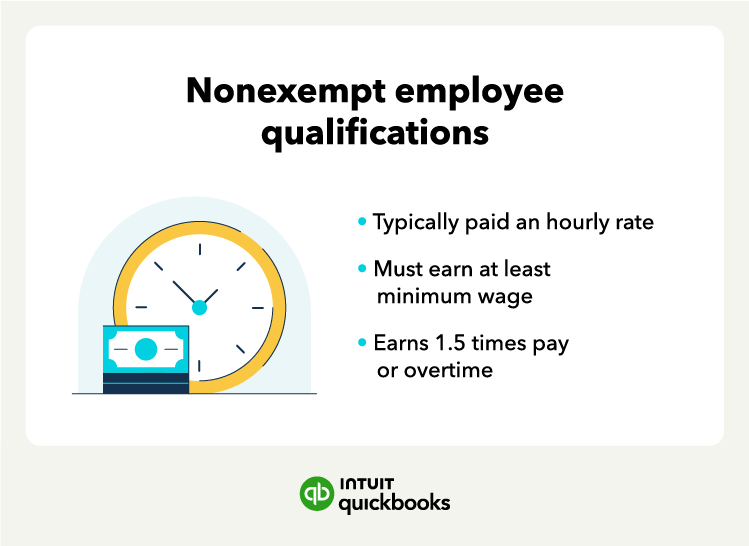

Without exception, a nonexempt employee must be paid at least minimum wage in the country and state of their employment.

This type of employee should also:

- Be paid by the hour

- Receive overtime over a 40-hour workweek

- Be paid time-and-a-half for overtime

Although nonexempt employees are typically paid by the hour, they can also receive a salary or commission as long as they are paid overtime.

These employees also have rights and protections under the FLSA, such as breaks, meal periods, and recordkeeping requirements.

Salary vs. hourly pay

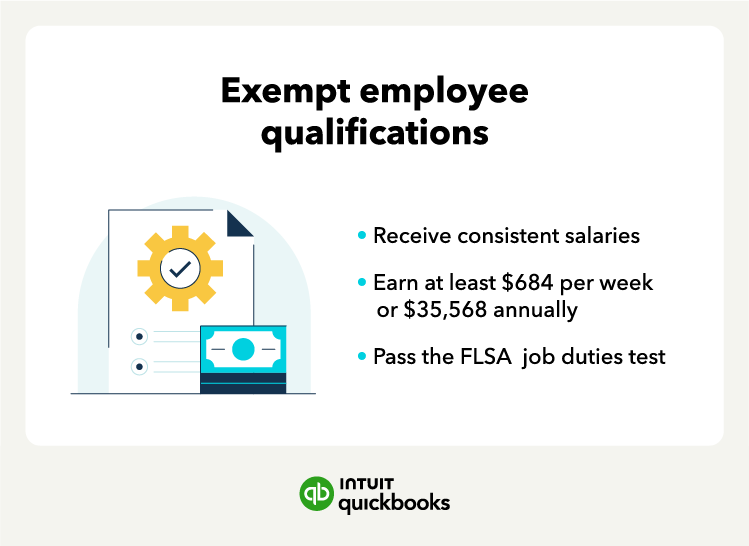

Exempt employees are usually paid a salary, which means they receive a fixed amount of money per year, although the number of hours they work can vary. They are expected to complete their job responsibilities, regardless of the hours required to get the job done.

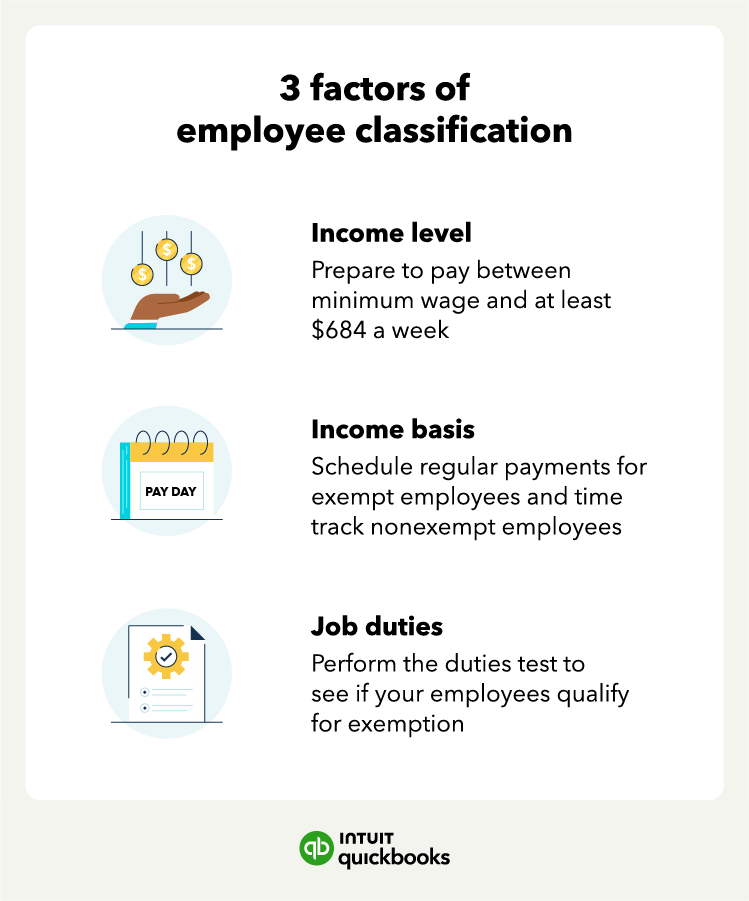

Understanding your employees’ compensation type can help you navigate payroll and time tracking with ease:

- Payroll: you’ll be able to set up a recurring payment in the form of a salary for exempt employees

- Time tracking: you’ll be able to track the hours your nonexempt employees work and know once they qualify for overtime

Nonexempt employees are usually paid an hourly wage, which means they receive a set amount of money for each hour they work. Nonexempt employees typically have set hours and shifts to track how many hours they work.