What is a pay stub?

Pay stubs are written pay statements that show each employee’s paycheck details for each pay period.

Nothing makes employees happier than being paid on time by an employer they trust. As a small business owner, you can foster trust with your team by ensuring that your employees can access pay stubs with accurate information about the current pay period.

So, what is a pay stub? A pay stub is a statement you create through payroll processing as an attachment to your employee’s paycheck. Keep reading to learn what information you can find on a pay stub and the best practices to follow as an employer and employee.

What information is on a pay stub?

A pay stub contains information that can help an employee keep track of their income, budget their expenses, and verify the accuracy of their payroll records. Here is what you can typically find on a pay stub:

Gross wages

Gross wages are the full amount an employer pays before deductions. This pay often includes more than the employee’s regular wages. Overtime pay and additional income, such as paid time off, bonuses, and payroll advances, are also included.

Gross pay is calculated differently for salaried and hourly employees. Here is how to calculate both types:

- Salary: Multiply their hourly pay rate by their number of hours worked

- Hourly: Divide their annual salary by the number of pay periods in the year

Typically, pay stubs for hourly workers show the number of hours the employee worked. If the employee works over 40 hours in a week and is eligible for overtime pay, those hours should also be on their pay stub.

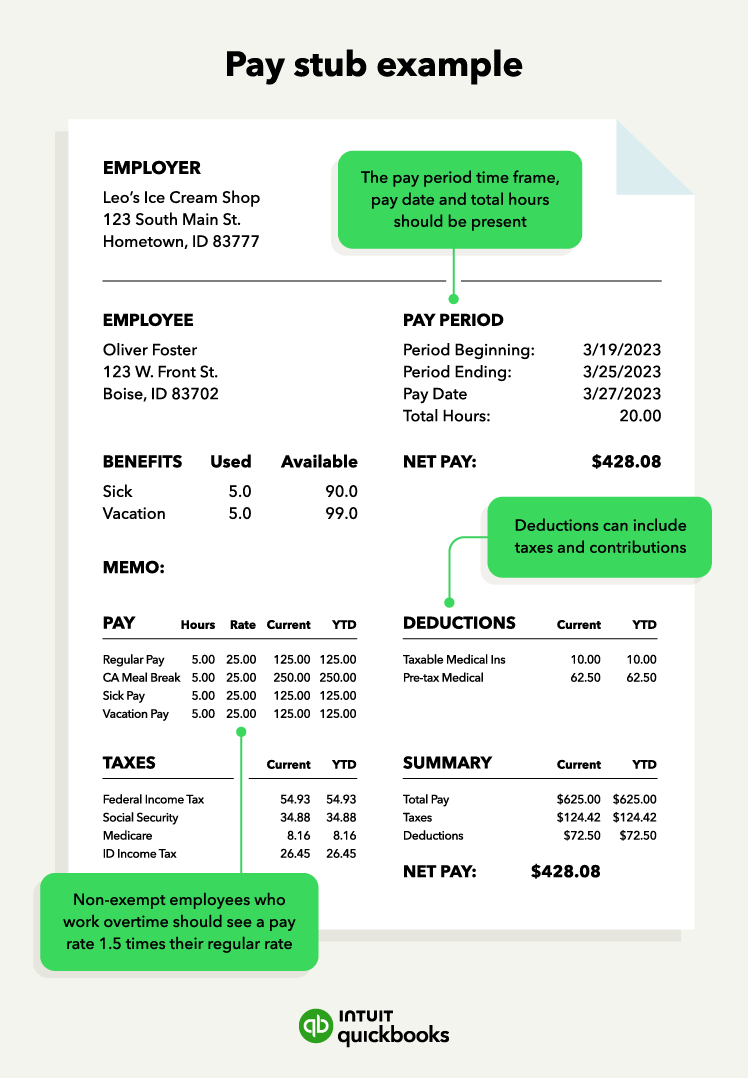

Deductions

Deductions are cash amounts taken out of the employee’s gross wages. They include taxes, contributions, and even allowances like meals. Typically, on pay stubs, deductions are shown in two places:

- Current deductions are deductions being taken out of the current pay period.

- Year-to-date deductions are totals for each type of deduction.

For instance, FICA taxes are taken out for each pay period. So the pay stub would show an amount deducted for that pay period and the total amount deducted for the year.

Contributions

Contributions are another kind of deduction. But if the contribution comes from the employer, it may be included in the employee’s gross wages. Contributions will vary depending on the benefit opportunities offered by the employer.

For instance, an employee might request that a small percentage of their paycheck be put toward an employee stock purchase plan (ESPP) or ask to take a small sum out of each paycheck as a nonprofit donation.

Net pay

Net pay is the amount left over from the employee's gross pay after deductions. Net pay is often called take-home pay. It’s the amount the employee receives when paid, either by direct deposit or a paper check.

Depending on the size of the deductions, an employee’s net pay may be significantly lower than their gross pay. On the employee’s pay stub, net pay is recorded for the pay period and cumulatively for the year.

Garnishments

Garnishments only apply to employees who are legally obligated to withhold a portion of their earnings by a court. Child support and large debt payments are example scenarios where courts may require this situation.

Paid time off (PTO)

Your pay stub should always show any period when employees were paid while taking time off. This is important for both employers and employees in case there is a dispute with the payment amount.

Pay period

The pay period section will showcase the period beginning and ending date, the total amount of hours worked, and the date the employee will receive payment.

Pay rate

The pay rate refers to the amount paid for hours worked. If you are a non-exempt employee that qualifies for overtime pay, you should see a pay rate 1.5 times greater than your regular pay rate for weeks you work over 40 hours.

Contact information

The contact information of both the employer and the employee should be readily available on the pay stub to ensure accurate payroll processing. A pay stub will typically include both names and physical addresses.

Pay stub example

If your business is small and doesn’t offer many benefits, your employees’ pay stubs will look pretty simple. Here’s what a simple pay stub might look like:

No matter the length of your pay stub, keep a copy of it for your financial records.

Pay stub best practices for 2024

To create a smooth payroll experience, it’s important to keep your financial records and employee data well organized and secure.

Reliable accounting software could help keep this information at your fingertips.

Here are some more tips for handling pay stubs with grace:

- Know all state and local requirements

- Include the necessary information

- Make pay stubs easy to access

- Work with a trusted payroll service company

Finally, consider removing any barriers an employee might encounter when trying to retrieve a pay stub. Moments that require employee pay stubs—like applying for a loan or filling out a rental application—can be stressful. As an employer, you can reduce that stress by making it easy for employees to access the necessary documents.

Next steps for streamlining your payroll process

No payroll process is complete without a properly formatted pay stub. What is a pay stub? It’s the document that tells your employees the background story of their paychecks, and it’s vital for the bookkeeping needs of everyone involved.

If you are curious to learn more about the cost of hiring a new employee, check out our employee cost calculator to help you make an informed decision.

Pay stub FAQ

Still have pay stub questions? We’ve got answers.

Danielle Higley is a copywriter for TSheets by QuickBooks, a time tracking and scheduling solution. She’s been a contributor to MSN.com, FiveThirtyEight, and a variety of HR and business blogs where she can put her affinity for long-form storytelling to best use. Read more