See what onboarding forms, docs, and tools you need to get your team up and running quickly.

Payroll questions your team is asking

Check out our handy ebook to learn how to set up payroll policies and profiles for your employees.

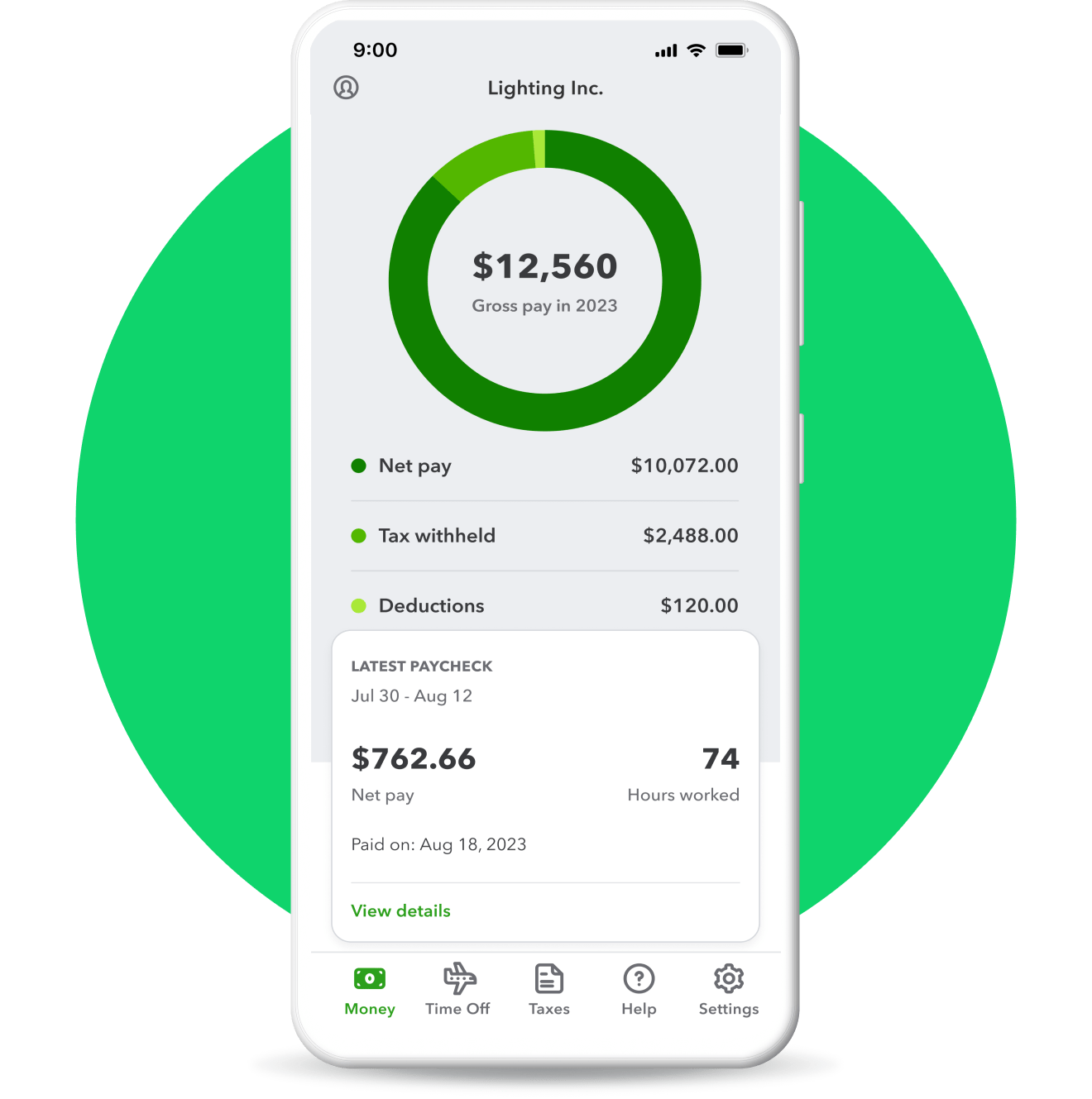

QUICKBOOKS WORKFORCE

Your team’s pay stub and time tracking hub

Your team can clock in and out with a tap, access pay stubs, W-2s, and other important pay details with the QuickBooks Workforce app.**