Hiring your first employee is a big accomplishment. And learning to run payroll is no small feat. So we designed a collection of articles, videos, and tools to help you hire employees and learn payroll fast.

Hiring employees

New to hiring? Check out these resources to help you hire the right way, the first time.

- Learn everything you need to know about hiring your first employee.

- Learn how to create an employee handbook. This resource can help you decide what to include.

- Check out our ebook to learn how to manage your staff.

Understanding payroll

Now that you know a thing or two about hiring, it’s time to learn payroll. Let’s start with the basics:

- Learn how to calculate payroll, including gross wages, taxes, and benefits.

- Learn how to set up your first payroll, including determining pay schedules and deductions.

- Learn more about employee pay stubs.

State payroll resources

Many states have unique payroll laws. Here are some resources for learning the rules in your state:

- The Department of Labor (DOL) lists each state’s payday requirements.

- The National Conference of State Legislatures outlines the penalties for violating state labor laws, including those related to payroll.

- This QuickBooks tool can help you determine which payroll taxes are paid in each state and contact relevant state departments.

Federal payroll and hiring resources

A few federal laws and resources to keep in mind:

- The Fair Labor Standards Act (FLSA) sets the nation’s minimum wage and labor law requirements.

- The Equal Employment Opportunities Commission (EEOC) requires employers to keep payroll records showing equal pay for equal work.

- The (SBA) has payroll resources and loan programs for eligible businesses struggling due to the coronavirus.

Find payroll resources that are right for you

IRS resources

If you’re hiring contractors or employees, you’ll need to understand what makes them different and how employment taxes work.

Free paycheck calculator

Calculate paychecks for hourly or salaried employees. You’ll get an accurate picture of their gross pay (including overtime, commissions, bonuses, and more).

Accurate tax forms

Wondering which tax forms to use? Full-time employees need a Form W-2 and contractors and self-employed workers need a Form 1099.

Payroll guidance

Find additional articles about paying your team, staying compliant, payroll processing, tax forms, expenses, hiring best practices, and more.

Learn the basics

Hiring a team is a big step. Set yourself up for success with our free ebook, which covers:

- Labor laws

- Payroll taxes and tax forms

- Costs associated with hiring employees

- Considerations for hiring contractors

Payroll training videos

Learn payroll with one of our easy payroll training videos

See how it works

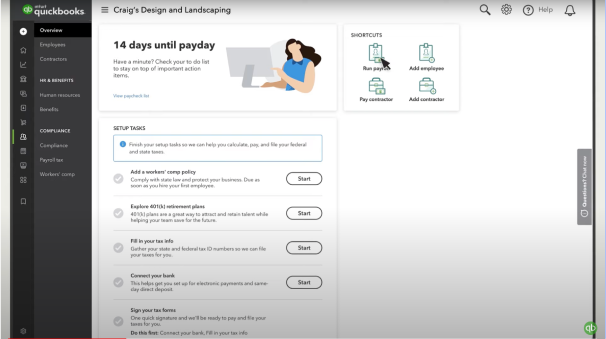

See how QuickBooks payroll makes it easy to pay your whole team.

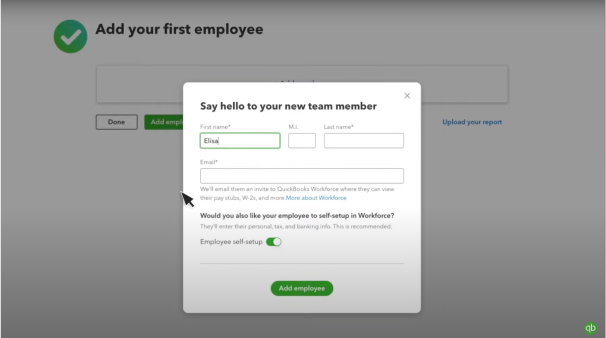

Setting up payroll

Review the basics of adding employees and preparing for your first payroll.

How to run payroll online

Run payroll for your small business.