FLSA regulations are an outline for employee rights in the workplace, enacted in 1938 in the Fair Labor Standards Act (FLSA). In August 2017, a federal judge ruled new FLSA overtime regulations, which would affect 4 million workers, invalid. The Department of Justice launched an appeal, and as of December 2017, new rules have yet to be finalized.

FLSA Rules and Regulations

Find out how federal labor laws affect your business and how to avoid the pitfalls

New FLSA Rules and Regulations

FLSA rules that affect the majority of small businesses include the following:

Minimum wage.

Currently $7.25 per hour.

Hours worked.

This refers to the time during which an employee is required to perform their duties.

Child labor.

This is intended to ensure young people receive an education and have safe working conditions.

Overtime

Record keeping.

Employers are required to display an FLSA poster and keep time and pay records for all employees.

2018 FLSA Changes

FLSA changes have been on the table since 2016, but the Department of Labor (DOL) has not yet made their final decision on what changes it wants to implement. Here are the most recent FLSA changes and events:

October 2018

The Trump administration formally announces its intention to issue a Notice of Proposed Rulemaking in March 2019, “to determine the appropriate salary level for exemption of executive, administrative, and professional employees.”

April 2018

The Department of Labor announces their intentions to, once again, propose new plans for overtime regulations at the start of 2019. They begin gathering views and ideas from participants through public listening sessions.

October 2017

The Department of Justice challenges Judge Mazzant’s decision, giving another strong indication that the DOL still wants to change the FLSA overtime rule and keep its authority over federal overtime regulations. The current threshold at which a salaried worker will be excluded from overtime remains $23,000.

August 2017

Judge Mazzant officially confirms his previous decision: The new overtime rule is invalid.

July 2017

The Department of Labor indicates that the FLSA overtime rule might still be changed by publishing a new Request for Information (RFI) in the Federal Register. The RFI asks how much salaried employees should earn before they are exempt from overtime.

November 2016

U.S. District Judge Amos Mazzant blocks the new overtime rule at the last minute. Some employers stand by the changes they made to employee salaries, while others decide to roll them back.

September 2016

Texas attorney, General Ken Paxton, backed by 20 states, files a lawsuit challenging the new rule. Paxton’s suit claims the new overtime rule “limits workplace flexibility” and “forces employers to cut their workers’ hours.”

Summer/Fall 2016

Many employers adopt new systems, like employee time tracking, and consult attorneys to help them prepare for the changes. The deadline given for employers to make the changes is December 1, 2016.

May 2016

The Obama administration announces changes that would give salaried employees making $47,476 or less a chance to earn overtime.

FLSA FAQs

Related Questions and Resources

Wage and hour lawsuits are on the rise — is your business at risk?

FLSA wage and hour lawsuits have increased a staggering 456 percent since 1995. And that’s just the start of why business owners are concerned. Not only does a successful FLSA prosecution mean you’ll be paying back wages, penalties, and your own legal fees, but you’ll be paying your employee’s legal fees.

Does your industry or state have a target on its back? How much are businesses in your state paying out for wage and hour lawsuits?

What if I’m hit with an FLSA lawsuit?

Knowing the laws, creating policies and procedures that safeguard your company and employees, and knowing your options for facing the worst case scenario are crucial to the health and success of your business. Get expert advice on how to handle a wage and hour lawsuit.

Don’t run into expensive overtime

Not only is overtime expensive, but it’s also one of the most common areas employers struggle with when it comes to FLSA compliance. Understanding overtime laws, which employees qualify for overtime, being aware of potential pitfalls, and adopting technology to aid compliance can make all the difference in avoiding lawsuits.

How can I avoid a wage and hour lawsuit?

Knowing the most common pitfalls and the most common mistakes business owners make can help you avoid painful — and costly — consequences. There are seven deadly sins of wage and hour lawsuits. How many do you know?

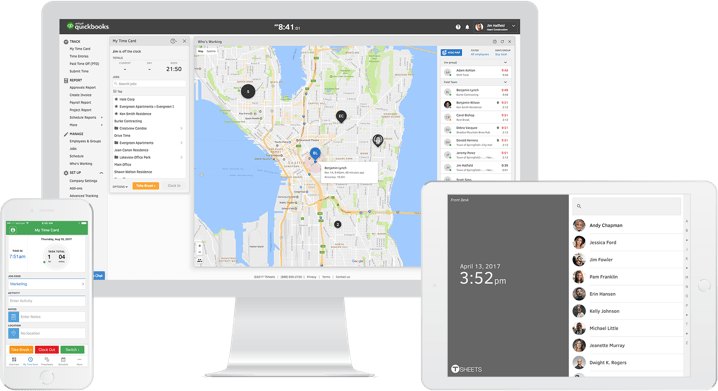

Employee time tracking supports FLSA compliance

Did you know that employers are required to track time for all nonexempt employees — and keep those time tracking records for two years? If the words “organized,” “accurate,” and “easily accessible” don’t apply to your current method of timekeeping, it’s time for a change.

Compliance assistance is available from the US Department of Labor, but cloud-based, mobile time tracking can make all the difference when it comes to complying with the FLSA. Plus, it can help you prepare for changes to overtime regulations, keep overtime in check, and protect your company in the event of a lawsuit.