Get 70% off Payroll & QuickBooks for 3 months*

Ends July 29th.

Get help planning and managing your payroll with a free paycheck calculator, tax glossary, and tax map.

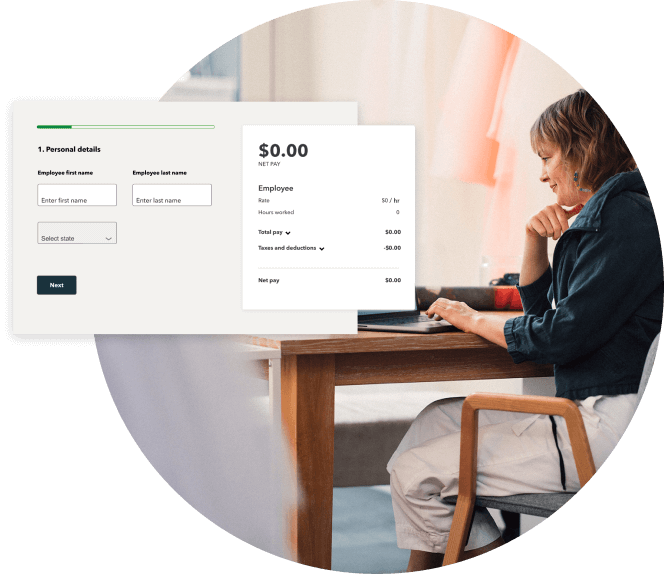

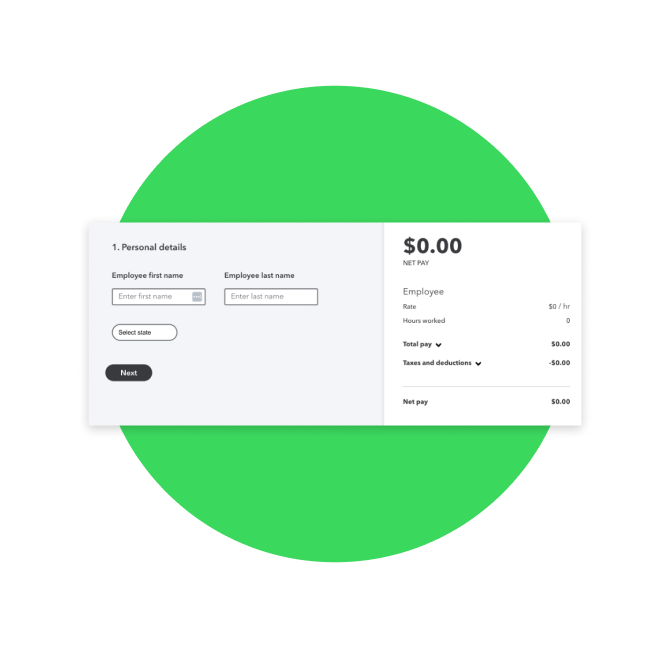

Paycheck calculator

Great for both employers and employees, this tool helps calculate paychecks based on pay type, pay rate, bonus, commission, overtime, federal/state taxes and more. The paycheck details can be downloaded as a PDF.

Payroll glossary

Have you come across a payroll term you’d like to learn more about? This tool lets you search and find answers quickly, and in many cases provides links you can use to dig deeper into the subject.

Payroll tax map

Because each state is different, finding accurate payroll tax law information can be difficult and confusing. This map makes it easy to find up-to-date tax laws that apply to your state, plus links and contact info for appropriate agencies.