Start saving in minutes

Set up in as little as 20 minutes and start saving for a retirement you deserve.**

Build a strong team

Attract talent and match contributions so your team can grow with you.

Keep more money

Affordable 401(k) plans by Guideline fit your budget and free up your cash.**

Access 401(k) plans in QuickBooks Payroll

QuickBooks teamed up with Guideline to keep 401(k) plans affordable and easy to manage.** Set up automatic contributions or let employees decide how much comes out of each paycheck.

Retirement plans for every budget

Pick the plan that’s right for you:

- Starter: A simplified 401(k) with limited features and easy administration.

- Core: A foundational 401(k) with robust features and more plan design options.

- Enterprise: Our most custom 401(k) with exclusive pricing options and premium support.

How it works

Get QuickBooks Payroll

Sign up for QuickBooks Payroll or sign into your account to access retirement plans for your team.

Pick a 401(k) plan

Choose the right plan and set contribution levels for your business and employees.

Start saving

Pick a start date and start saving for retirement right away.

Explore 401(k) plans. Sign up

Expert support at your fingertips

- Call a Guideline expert to get answers to all your 401(k) plan, training, and onboarding questions.**

- Get personalized support from a dedicated account manager for an additional monthly fee.

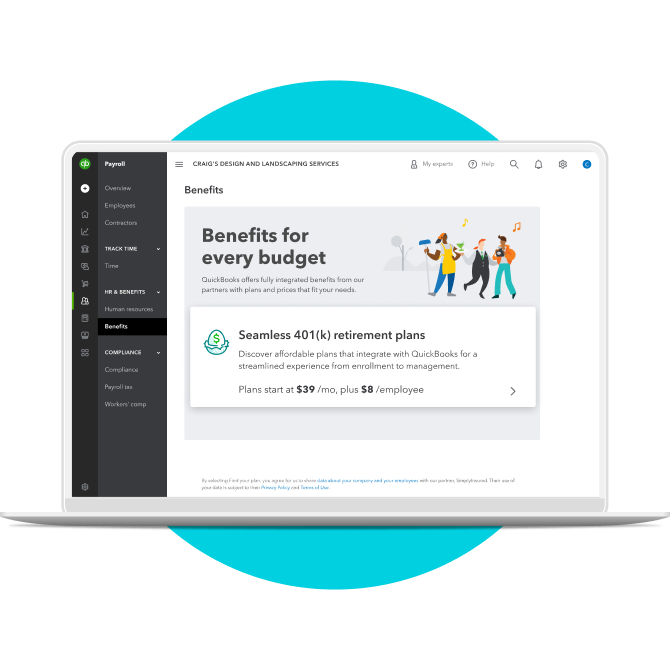

Benefits for every budget

Find everything you need from employee benefits to hiring and management tools.

Healthcare packages

Prioritize your team’s well-being with affordable packages that include medical, dental, and vision insurance by Allstate.**

401(k) plans

Retain top talent with an affordable plan by Guideline, match contributions, and help employees save for their future.**

Workers’ comp

Stay compliant by connecting a policy by Next.** Pay as you go, simplify annual audits, and get automatic calculations.**

HR advisor

Talk to a certified HR advisor by Mineral to stay compliant, hire and onboard your team quickly, and scale with confidence.**