If you’re a small business owner, chances are good you’re the one handling payroll. Figuring out how to process payroll can be intimidating, but don’t worry. Processing payroll is easier than you think. This guide will take you through the payroll process step by step, so you’re confident and ready for payday.

Payroll processing is the act of managing employee payments. It covers everything from entering an employee into your payroll software to giving them their paychecks. The basic payroll processing steps involve collecting employee information, and setting up a schedule, and issuing payments, all while keeping accurate records.

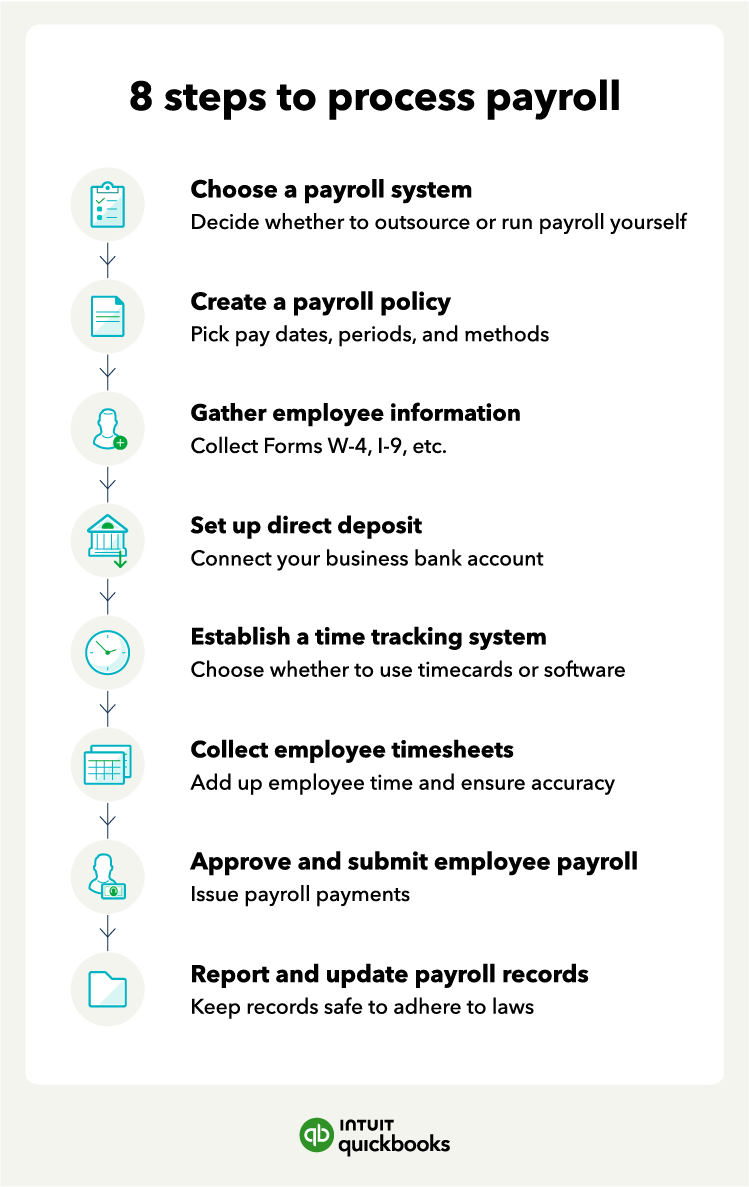

For processing employee payroll, there are eight basic steps from start to finish:

3. Gather employee information

5. Establish a time-tracking system

1. Choose a payroll system

How does payroll work? Processing payroll isn’t just about compensating your employees. It’s part of operating your business legally—according to state laws and the Fair Labor Standards Act (FLSA).

The FLSA has several requirements that fit into your payroll process—from tracking employee time at work to recordkeeping. You’ll want to remember those regulations when figuring out how to process payroll.

There are three basic payroll systems:

- Manual payroll means you’re doing payroll by hand, typically on paper or in a spreadsheet.

- Outsourced payroll means hiring someone else to handle everything from payroll taxes to bookkeeping.

- Payroll software varies by plan or product. Most providers offer everything from basic payroll assistance to additional payroll services that may include time tracking or even human resource services.

Before you commit to one system over another, consider factors like business growth, employee benefits, and the complexity of your state’s payroll taxes and laws.

2. Create a payroll policy

After deciding on the type of payroll, whether in-house or outsourcing payroll, it’s time to set up a payroll policy. First, you’ll want to review your local labor laws, state overtime laws, and federal labor laws. A common FLSA violation to watch out for is unpaid overtime, which can happen accidentally when you don’t know the rules.

Here are other things to include in your payroll policy:

- Pay dates, including the length of each pay period and when you pay employees after that.

- Payment methods, such as how you’ll pay employees—usually by direct deposit or paper check.

- Payroll deductions and withholdings, including your procedures for paying the appropriate payroll taxes.

- Payroll benefits and how they will impact the employee’s paycheck.

Once this is in place, you’re ready to start collecting employee information.

3. Gather employee information

Now it’s time to get the necessary information from your employees to ensure you’re paying them the correct amount, as well as making the necessary withholdings and deductions. That means collecting certain forms like Form W-4.

Such documents will provide each employee’s personal information, Social Security number, and tax filing status. If your payroll includes employee health insurance or retirement savings, you’ll need documentation showing the employee has approved additional deductions.

Lastly, if you plan to offer direct deposit, now is the time to get employee consent and collect their banking information.

4. Set up direct deposit

As a business owner, you can set up direct deposit directly through your business’s bank account or through your payroll service provider. Direct deposit is convenient for both your and your employees. If your employees have opted for direct deposit, they’ll have to give you some information:

- Bank name

- Account type (checking or savings)

- Account number

- Bank routing number

Once you have all that, the next step is to transfer that information to your payroll software or bank.

5. Establish a time-tracking system

With a payroll policy, employee info, and a direct deposit in place, it’s time to track hours. The FLSA requires employers to maintain accurate records of work hours for all nonexempt employees. In most cases, non-exempt (as opposed to exempt) includes hourly employees.

One way to maintain those records is to track hours manually and ask employees to write down when they clock in and out. Otherwise, you might try a time-tracking software that holds onto employee timesheet records for you. Either way, you’ll want to train employees to track their time as soon as possible.

6. Collect employee timesheets

Depending on the payroll processor, those timesheets may already be sitting inside your payroll software, waiting for approval. If not, now is the time to import them into your payroll software. If you have paper time cards, you’ll need to add up the hours, check for any mistakes, and transcribe the numbers to your payroll records.

Congratulations—the payroll date is nearing. It’s almost time to officially run your payroll, so it’s time to submit it.

7. Approve and submit payroll

Once you approve all your employee time cards, you’re ready to run payroll and issue payments. Approval is one of the most important steps when running payroll for employees. This is your chance to make sure all the hours add up and are correct so payroll is accurate.

8. Report and update payroll records

Now that the payroll payments are on their way to employees, it’s time to update your payroll records. Those records must show you withheld all necessary taxes and deductions.

Payroll records are important for other reasons too. For instance, the Age Discrimination in Employment Act (ADEA) requires employers to keep all payroll records for three years. That information must include any employee benefit plans (including retirement or insurance) and any written seniority or merit system.

Tips to improve payroll processing

There are ways to ensure your payroll runs as smoothly as possible. Here are some tips and tricks to help get you through your payroll cycle:

- Calculate your total payroll costs: Keep track of all expenses related to payroll, including wages, overtime hours, bonuses, and benefits. An accurate overview of the total payroll costs will help with budgeting and financial planning.

- Make payments and reports on time: You’ll want to adhere to all payment and reporting deadlines established by federal, state, and local authorities. Timely submission of payroll taxes, tax withholdings, and other required reports will prevent penalties and unnecessary audits.

- Keep excellent records: Maintain detailed and organized payroll records as you process payroll, including employee information, wage rates, tax withholdings, and benefit plan details. This ensures compliance with recordkeeping requirements and provides documentation in case of audits or disputes.

- Remain up-to-date with payroll laws: Regularly review and ensure you’re in compliance with minimum wage and other relevant payroll laws. This helps avoid legal issues and maintains fair compensation for employees.

- Use payroll software: Implement payroll software like QuickBooks that automates payroll and paycheck calculations, tracks employee hours, and simplifies how you process payroll. This reduces the chances of errors and streamlines the overall payroll workflow.

The more complicated your payroll, or the more components and calculations you have, the more likely you’ll want to try payroll software or outsource payroll altogether.

Next steps for streamlining your payroll process

Automated payroll and time-tracking tools can reduce the time to process payroll. One reason is that most payroll processing solutions calculate payroll taxes for you, which could take a while if done by hand.

Meanwhile, payroll services like QuickBooks Payroll can remove that hassle, as well as help speed up the time that your employees get their paycheck with direct deposit.

Process payroll FAQ

Related:

- https://quickbooks.intuit.com/r/payroll/payroll-expenses/

- https://quickbooks.intuit.com/r/payroll/automate-payroll/

- https://quickbooks.intuit.com/r/payroll/payroll-reconciliation/

- https://quickbooks.intuit.com/r/payroll/cost-of-payroll/

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor's degree in finance from Appalachian State University.