Get 70% off Payroll & QuickBooks for 3 months*

Ends July 29th.

Manage payroll and access tools and services in one place

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty from an error made while using Payroll Elite.**

Manage Forms W-2

Easily file, preview, print, and distribute employee Forms W-2. You can also correct forms anytime.

Manage paid time off

Set up and track employee paid time off and manage paid, unpaid, sick, and vacation time.

Free direct deposit

Keep cash longer and pay workers at your pace with direct deposit at no additional cost.**

Access HR services

Get resources on compliance, hiring best practices, and more. Talk to a Mineral, Inc. HR advisor and get policies made just for you.**

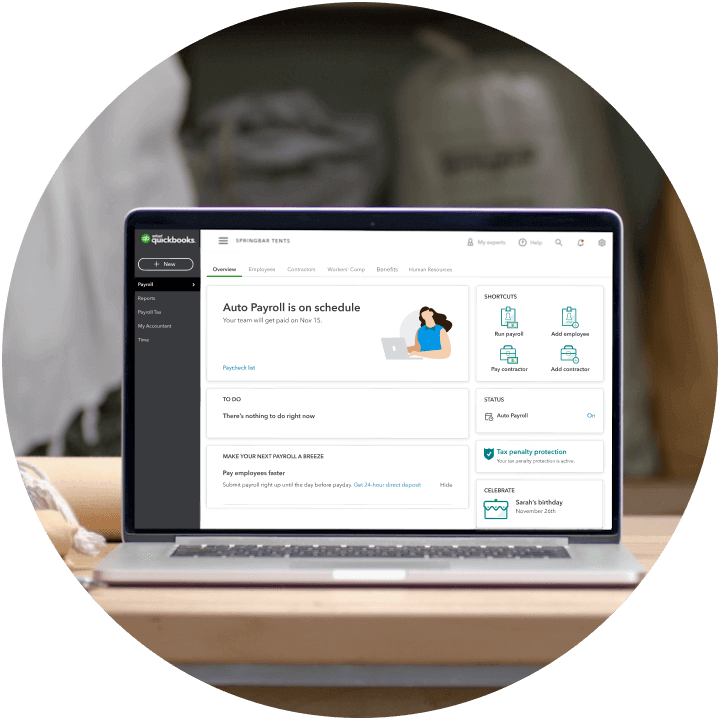

Auto Payroll

Free up valuable time and set your payroll to run automatically.**

File taxes

We’ll calculate, file, and pay your payroll taxes automatically once payroll setup is complete.**

View pay stubs

Customize, print, or email pay stubs and set up notifications so employees know when their paychecks and pay stubs are ready.

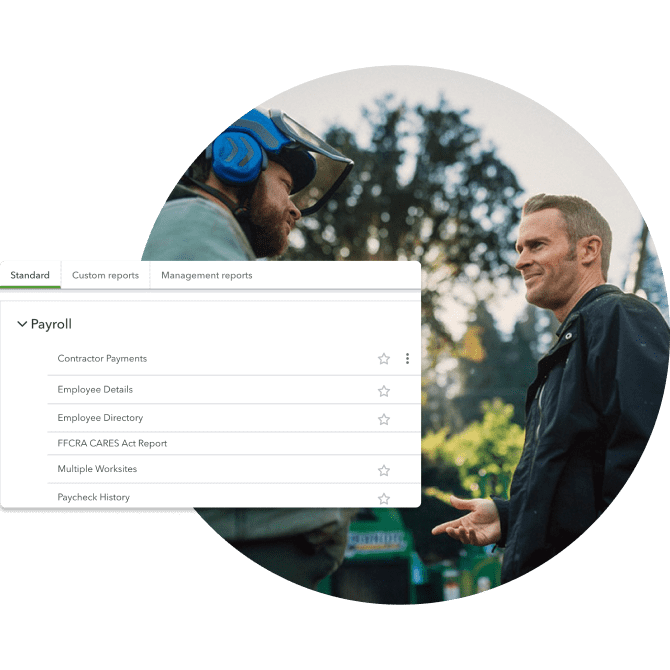

Make smart moves with automated payroll reports

Get real-time small business insights with automated reports for balance sheets, cash flow statements, and more. Access reports for:

- Employee hours

- Earnings

- Taxes withheld

- 401(k)

Payroll doesn’t stop with a paycheck

QuickBooks Online Payroll offers seamless software integrations, so you can easily:

- Add or connect workers’ comp with Next, where you can find the best policy for your business.**

- Support employee health with affordable medical, dental, and vision insurance, by our partner Allstate Health Solutions.**

- Access helpful resources or talk with a personal HR advisor, powered by Mineral, Inc. to help you stay compliant.**

Stay compliant

QuickBooks Payroll has what you need to stay compliant, from labor law posters to expert support. Plus, you’ll get quick access to Forms W-2, W-9, and more.

Why use QuickBooks Online Payroll software?

Small business owners can pay and manage their teams with integrated payroll, and access HR, health benefits, and more. Our payroll software also includes same-day direct deposit and automatic tax filing, which is backed by tax penalty protection.