What is Payroll? Payroll Basics & Examples Small Business Owners Need to Know in 2024

Payroll is the process a business uses to pay its employees. It involves tracking and paying all the compensation an employee earned during a certain time.

While almost everyone has gotten a paycheck, until you’re a business owner, you probably haven’t given a lot of thought to the question: what is payroll? The payroll process might seem confusing at first glance, but with the right information and enough time, any small business owner can make sure their employees are paid correctly and on time.

Why payroll is important?

Payroll is one of the most important parts of doing business. For many companies, it can be the largest expense they incur.But having the right team will make the difference between success and scraping by, so let’s learn how to ensure your team gets paid. Completing payroll correctly not only ensures that your employees are paid correctly and on time but that they and your business are paying all of the necessary taxes as required by law.

The payroll process simplified

The payroll process can get pretty complicated, but if you break it into smaller steps, not only will it make more sense, it will make the process easier and faster.

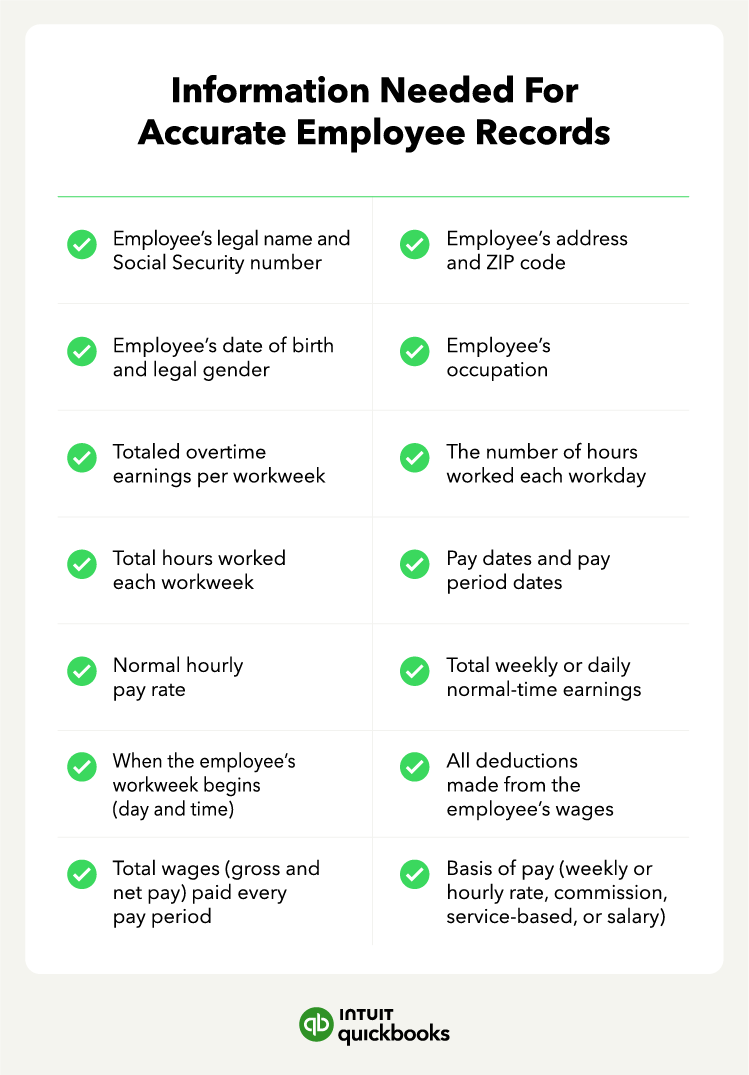

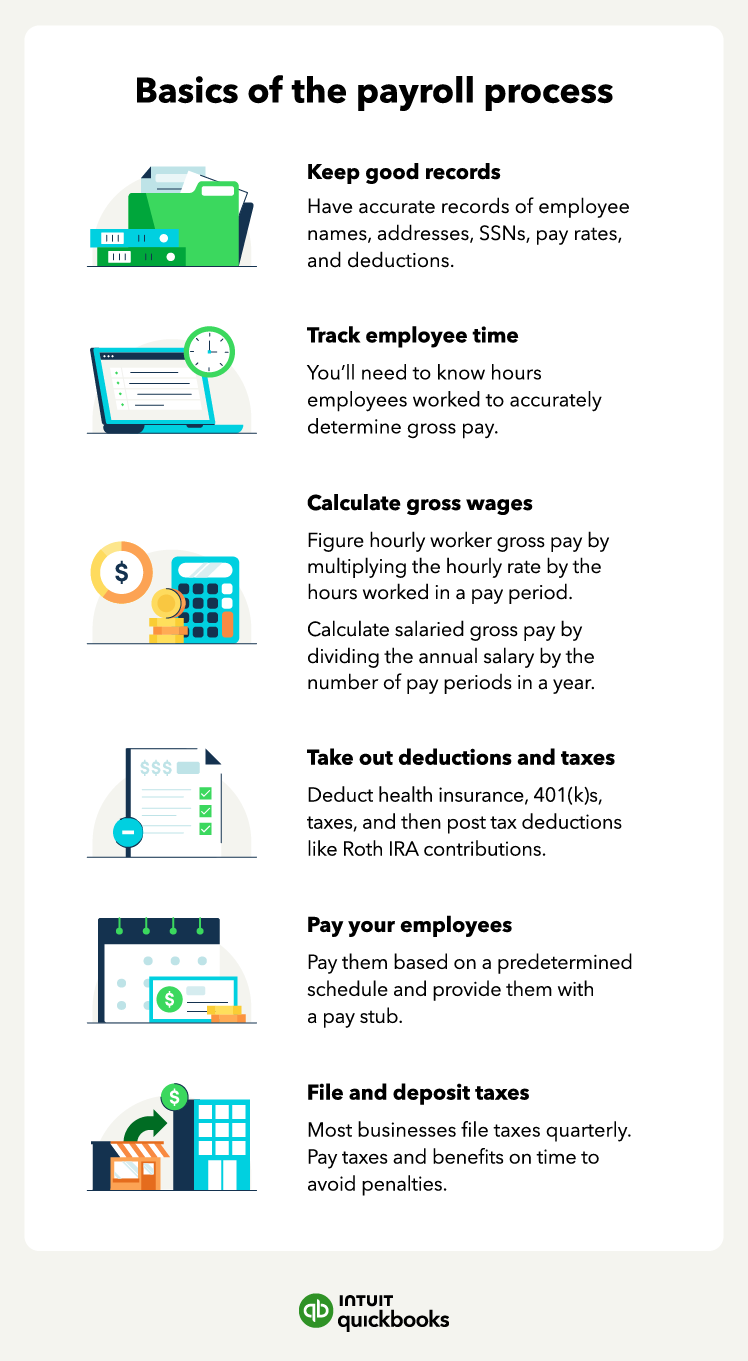

1. Keep records

The first step in completing payroll is part of the ongoing process of keeping accurate records. Whenever you hire a new employee, have them fill out the paperwork you’ll need for payroll purposes as part of your onboarding checklist. You should have records of your employees’:

- W4 forms: This IRS form includes the worker’s personal information like their legal name, address, and Social Security number, as well as information about their tax withholdings.

- Salary or wage information: This can be as simple as knowing what an employee makes per year or it can be a complex combination of hourly wages, overtime pay, tips, bonuses, and commissions.

- Benefit contributions and reimbursements: Some of an employee's wages will go toward paying for benefits like health insurance and retirement plans. Common reimbursements include college tuition reimbursement or health insurance-related benefits for preventive care.

A good rule of thumb is to record anything that can change the pay an employee might receive to factor in those costs while you prepare payroll.

Here is what you’ll need to keep records up-to-date:

- Employee’s legal name and Social Security number

- Employee’s address and ZIP code

- Employee’s date of birth and legal gender

- Employee’s occupation

- When the employee’s workweek begins (day and time)

- The number of hours worked per workday

- Total hours worked each workweek

- Basis of pay (weekly or hourly rate, commission, service-based, or salary)

- Normal hourly pay rate

- Total weekly or daily normal-time earnings

- Totaled overtime earnings per workweek

- All deductions made from the employee’s wages

- Total wages (gross and net pay) paid every pay period

- Pay dates and pay period dates

2. Track time

Time tracking can vary based on a few factors. There are many different ways to track how much an hourly employee works in order to pay them based on their wages, including digital and physical time clocks. Other employees, including freelancers or contractors, might submit their hours to you without you having to track them on your own.

For salaried employees, it isn’t always necessary to track their time. Tracking requirements can vary from state to state and based on the employee’s title, so make sure you’ve classified them correctly and meet any tracking requirements.

3. Calculate gross wages

For your payroll to be accurate, you’ll need to calculate each employee’s gross pay using payroll software or a paycheck calculator. Gross wages are the amount of money an employee is paid based on their wages, hours worked, and any tips, bonuses, or commissions. The formula for calculating gross pay for hourly employees is:

- Hourly rate x total hours worked in the pay period = gross pay

Determining gross pay for a salaried employee is different. Instead of having an hourly wage that is multiplied by the number of hours they worked, you take their yearly salary and divide it by the number of pay periods and pay them that amount. The formula for calculating gross pay for a salaried employee is:

- Salaried employees = Yearly salary / number of pay periods in year = gross pay

Salaried employees may not see a lot of variance in their regular paychecks unless they earn commission or bonuses.

What is the difference between salary and payroll?

The difference between salary and payroll is pretty simple. Payroll is the process used to pay an employee, while a salary is the amount of gross pay an employee receives per year.

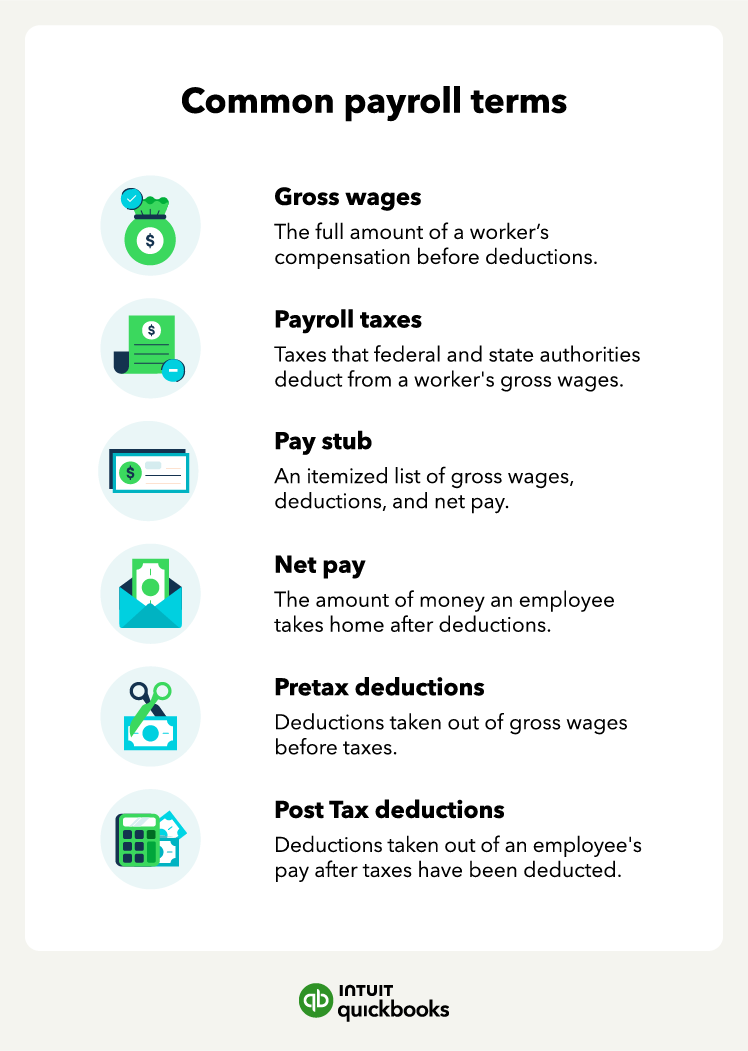

4. Take out taxes and other deductions

Employee payroll taxes and other payroll deductions are usually the most complicated part of the payroll process. Luckily, modern accounting software can streamline the process greatly by automatically deducting the correct amounts based on an employee's W-4. If you aren’t using accounting software, you can still do payroll, it will just take more time.

Start this process by taking out pretax deductions like:

- 401(k) plans (and some other types of retirement plans)

- Flexible Spending Account (FSA) and Health Savings Account (HSA) contributions

- Health insurance plans

- Certain types of life insurance plans

After you’ve made all pretax deductions, you’ll move on to payroll taxes. Understanding which taxes need to be paid is a good way to start the process.

You’re required to deduct the following kinds of taxes from most of your employees:

- Income taxes: Income taxes are deducted and paid to the federal government, as well as (most) state governments. The IRS has tax tables to help you determine what an employee owes in federal taxes.

- FICA: FICA (Federal Insurance Contributions Act) is the tax that contributes to credits for your future Social Security benefits. FICA is taxed at 7.65% (6.2% of that is for Social Security while the remaining 1.45% is for Medicare).

After taxes have been deducted from the employee’s gross pay, you’ll deduct any voluntary deductions the employee has, including:

- Certain life insurance plans

- Roth IRAs

- Union dues

- Garnished wages

- Long-term disability insurance plans

The remaining money is the employee’s net pay. The net pay is the amount of money they will receive on payday.

5. Pay the employee

While most employees choose to receive their earnings through direct deposits into their bank accounts, some people still prefer to receive a paper check. No matter which method they prefer, make sure you provide them with a physical or electronic pay stub for their records. A pay stub should have an itemized list of deductions.

6. File and deposit taxes

As an employer, you’re responsible for filing and paying the taxes you deducted from your employees' checks. For most businesses, this means quarterly payments to the IRS and the state.

Avoid paying late because it can cost your business more money in the form of penalties that you will be required to pay.

How does payroll work for contractors or freelancers?

Paying independent contractors or freelancers is usually more simple than paying employees. You will pay them based on the terms agreed upon, but you do not need to collect taxes or other deductions for these workers. Contractors handle their own payroll, meaning they’re responsible for filing and paying payroll taxes.

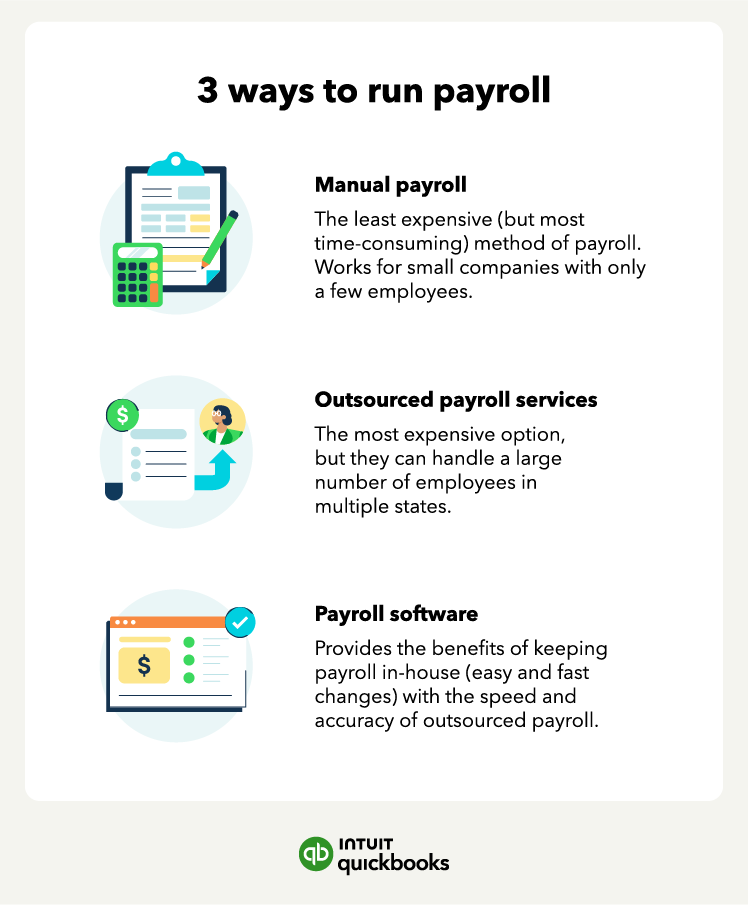

How to run payroll: 3 payroll systems to choose from

There are three ways that you can run payroll for your company: doing it yourself manually, hiring a professional payroll service, or using payroll software. Each method has its advantages and disadvantages, so make sure you spend some time researching which is right.

Manual payroll

Performing manual payroll is the most time-consuming method of running payroll. Because each employee’s wages and taxes have to be calculated individually by hand, you may need a full-time accountant or payroll specialist to handle the load, depending on the size of your workforce.

Keeping payroll in-house does have some advantages, though. It is the most affordable way to do payroll (if you can do it quickly and don’t have a large number of employees). If you do manual payroll, you can implement any changes to an employee's classification or deductions quickly and easily.

Professional payroll services

Professional payroll services are one of the easier ways to run payroll because someone else does all the work for you. All you have to do is collect employee information and turn it over to them, and they take care of everything: from deducting taxes to depositing employee pay. These companies are a natural choice for businesses with lots of employees as well as businesses that have locations in multiple states.

The downside to this expertise is the expense. While trying to hire enough employees in-house to handle payroll would probably be more expensive, payroll services can take a sizable bite out of your budget.

Payroll software

Using payroll software is like having a combination of a powerful, knowledgeable payroll services team with the lower cost of handling payroll manually in-house. With payroll software, you can enter an employee’s salary and deduction information, and check it before each pay period to ensure everything is right, and the software does a lot of the work for you.

A potential downside is that this software may be a little pricey for companies with a small number of employees. It will still be less expensive than a payroll service but more costly than doing the work manually.

Tips on how to run payroll successfully

Business owners can make their payroll process more efficient. Here are some important tips to follow:

- Make sure your employee records are accurate

- Keep up-to-date on payroll legislation

- Follow a payroll calendar

- Document the payroll process

- Automate your payroll process if possible

Running your payroll doesn’t have to be difficult, but also make sure you’re staying on top of your payroll taxes.

Next steps for streamlining your payroll process

Now that you can answer the question “what is payroll?” you’re ready to learn more about how to prepare your small businesses taxes in 2024. Better yet, you might consider using payroll software to simplify both your payroll process and how you file and pay your taxes, so consider making the investment to save yourself a lot of time.

What is payroll FAQ

Have questions about payroll? We can help.

What is payroll tax?

A payroll tax is any tax that comes out of an employee’s gross pay.

What is a payroll tax cut?

A payroll tax cut is when the government decides to stop collecting certain taxes from people’s paychecks. This can be a temporary or permanent measure and it doesn’t necessarily apply to everyone or every business.

What is a payroll tax holiday?

A payroll tax holiday is a deferred or suspended collection of taxes. These deferrals are used to provide some financial relief to people during tough economic times.

What is a certified payroll?

Certified payroll is a federal payroll report. This report needs to be filed every week by businesses whose employees are working on projects funded with federal funds.

Related:

- https://quickbooks.intuit.com/r/payroll/how-to-process-payroll/

- https://quickbooks.intuit.com/r/payroll/how-to-do-payroll/

- https://quickbooks.intuit.com/r/payroll/payroll-questions/

- https://quickbooks.intuit.com/r/payroll/payroll-ledger-template/

- https://quickbooks.intuit.com/r/payroll/employee-compensation-benefits-guide/

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

Prior to joining the QuickBooks marketing team, Katie McBeth spent her time writing for various blogs across the web, including Quiet Revolution, Fortune Magazine, and many more. Her writing focus is on small business management, marketing, and recruitment. When she’s not writing, she’s hanging out with her small private zoo of three cats, two dogs, and dozens of plants.