As a small business owner, setting up a payroll system can be a serious challenge if accounting isn’t your strong suit. However, it’s essential to the success of your business. But how do you find a system that’s easy to use without spending too much? Because payroll costs extend beyond just what you’re paying your staff, it’s important to know what you’re likely to pay before making a decision.

The right choice for your business depends on several factors, such as the size of your company, how you pay your employees, how often you pay them, and the kind of payroll expenses you have.

This article will take a deeper look at what payroll for small businesses includes and what it costs.

How much does it cost to have someone do your payroll?

Payroll service providers handle your payroll accounting by charging a monthly base fee and additional fees for every employee at your company or every check sent out. Pricing for payroll service packages varies depending on the payroll company you use.

However, many payroll providers charge between $29-150 in monthly fees plus $2-12 per employee, per pay period.

What is included in payroll costs

The payroll costs you pay go toward covering the labor, automation, and distribution of payroll to your employees. Providers also keep records, withhold taxes, distribute funds to retirement accounts, and sometimes pay the appropriate taxes.

A provider may charge extra for:

- Workers comp

- 401(k)

- Time tracking

- Tax penalty protection

- Automatic check signatures

- A direct deposit option

- State and federal tax filing

- Printing and check delivery

- Tax form processing

The cost of each add-on may change depending on the number of employees you have, with discounts for companies with more employees.

Factors that impact payroll costs

Many factors can impact how much it costs to run payroll. However, some of the most important parts of the equation can be confusing and may open your business up to liability and even fines if done incorrectly.

- The number of employees: Since many payroll providers charge a fee per employee, you increase payroll costs with each additional employee on your team. If you do payroll manually, the more employees you have, the more likely you’ll spend more time calculating payroll.

- Payroll frequency: Payroll providers typically charge a fee for every employee at your company payroll schedule or for each check sent out. For instance, if there’s a $3 fee per employee every pay period and you pay employees every two weeks, that fee will add up to $6 per month for each employee. But if you choose to pay your employees weekly, that fee jumps to $12 per month. For more information, see the 2024-2025 payroll calendar to be aware of pay frequency.

- The number of states employees are paid in: State payroll taxes differ, and each state has different tax laws. You could pay more taxes in one state than another. Payroll providers may also charge extra fees to cover employees located in multiple states.

- Direct deposit costs: Setting up a direct deposit is an additional cost for your business, but most employees will expect it, as it’s a convenient way to get paid.

- Tax filing: Payroll providers often charge extra fees for performing tasks. These tasks include filing state and federal taxes, FICA taxes for Social Security and Medicare, preparing year-end taxes, and processing tax forms.

- End-of-year processing: At the end of the year, a payroll provider can calculate taxes that need to be paid and send out W-2 forms to employees.

- Software costs: If your provider has an online system or software that you use to upload and update employee records, the provider will probably charge for using it. These fees also go towards helping it maintain these systems.

- Subscription costs: Some of the services offered by payroll companies are covered by the cost of your subscription, while others aren’t. Ask the company for clarification on which features are extra.

- Add-on services: Add-on services can mean anything from printing and mailing physical checks to filing payroll taxes on your behalf.

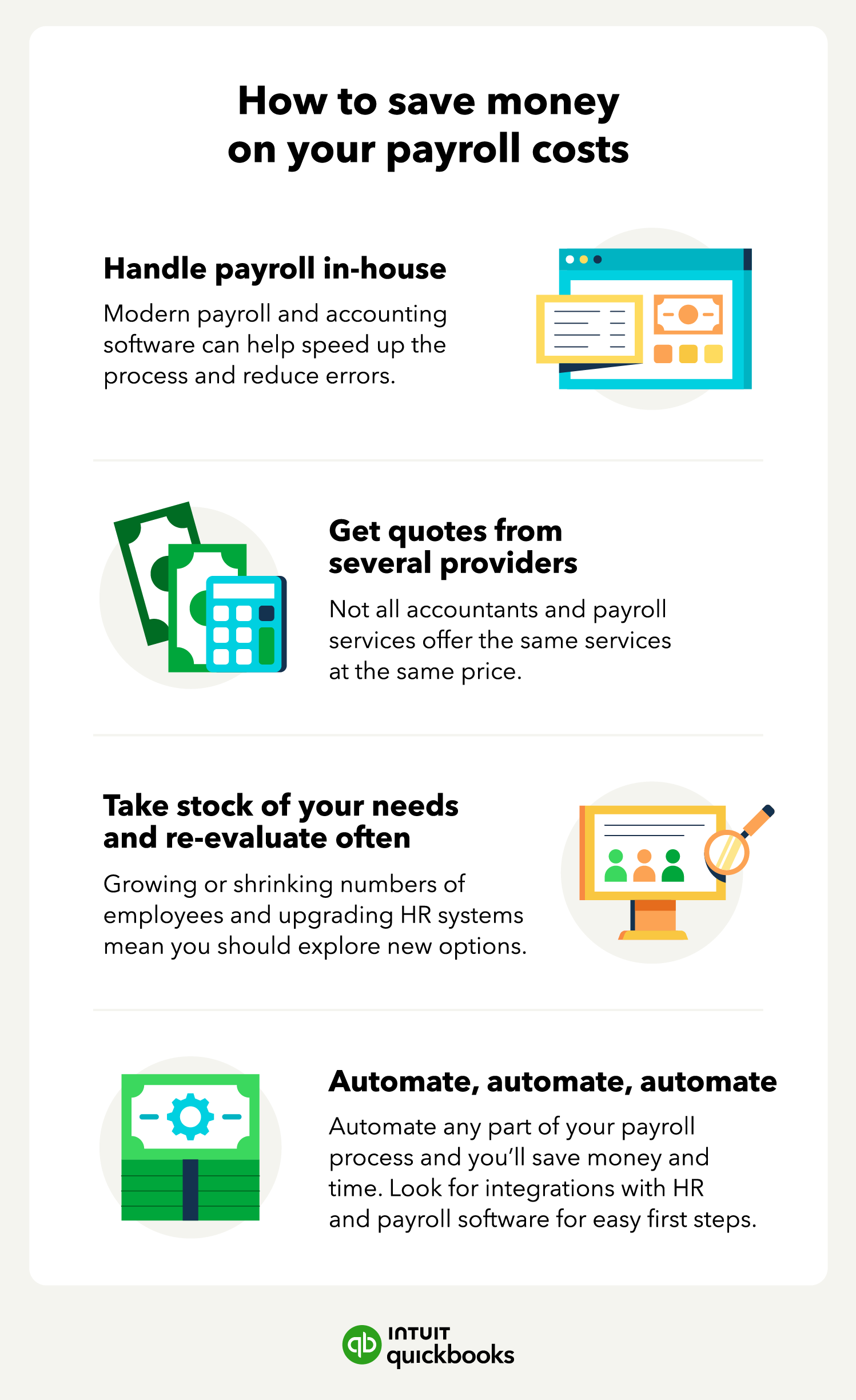

It’s easy to feel overwhelmed thinking about the cost of paying someone else to handle the different parts of your payroll, but the amount of time it can save you and your team might make it a worthwhile investment. Let’s look at some prices for a number of payroll services.