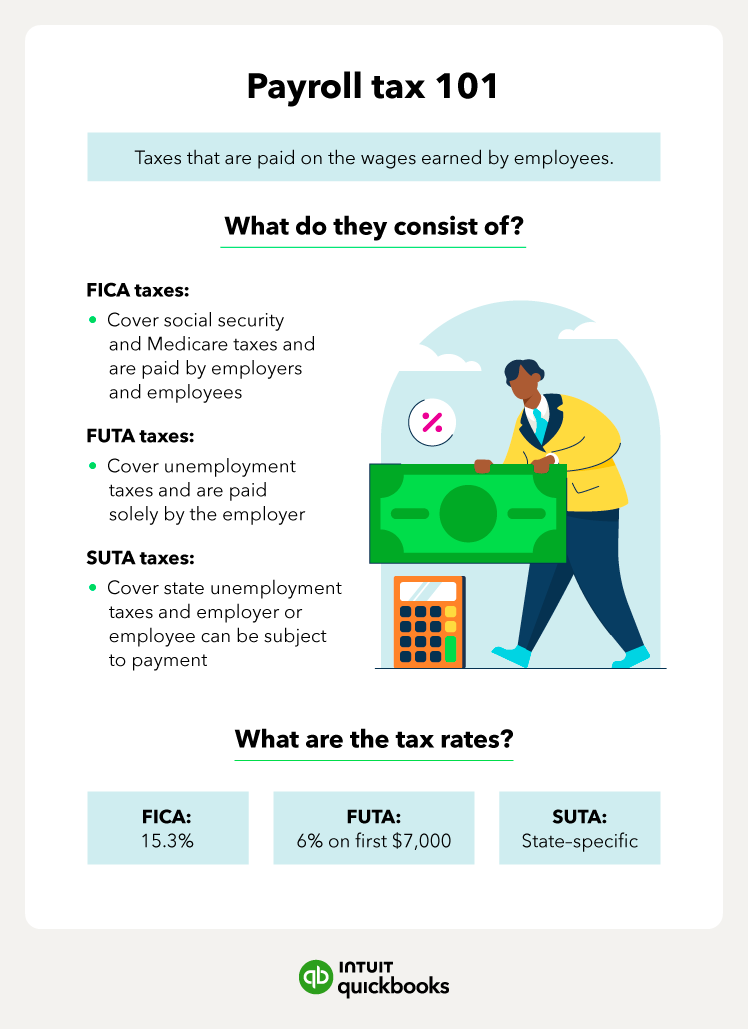

Keeping track of all the types of payroll taxes is never easy. This includes understanding Federal Insurance Contributions Act (FICA) taxes when trying to meet payroll tax withholding requirements.

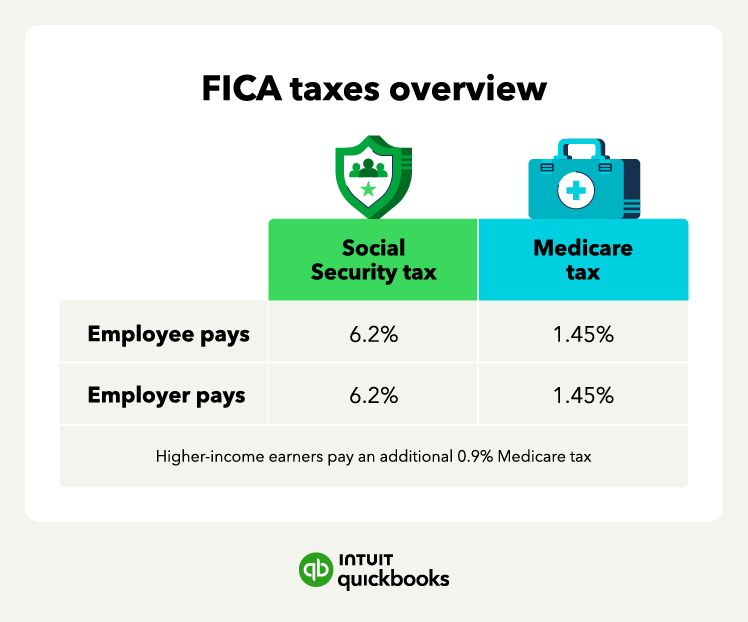

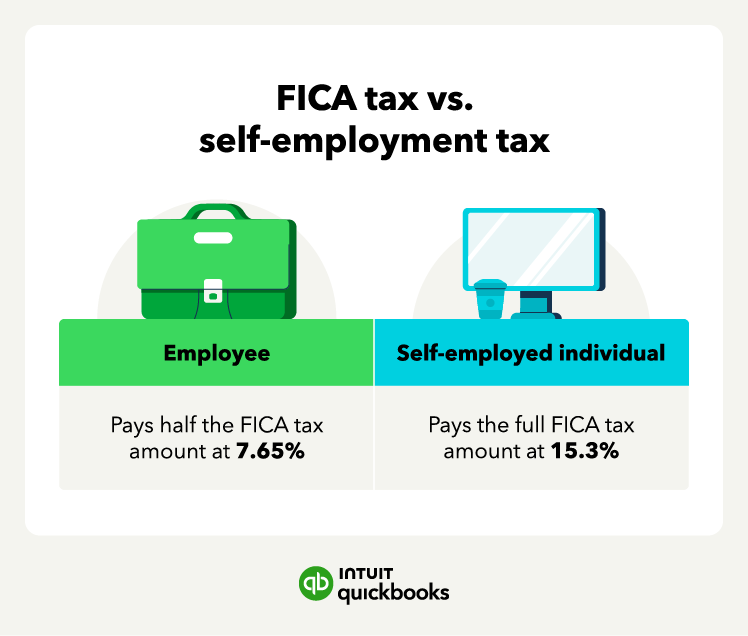

FICA taxes include Social Security and Medicare taxes for a total rate of 15.3%. Employers and employees split the FICA tax payment, each paying 7.65%. However, self-employed individuals must pay the whole FICA amount.

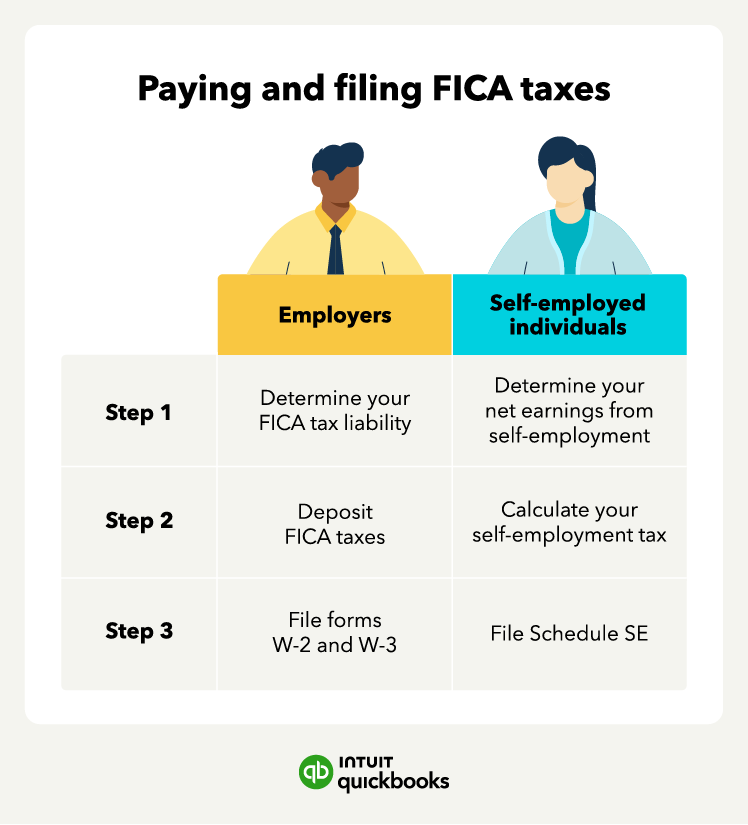

Self-employed FICA taxes are the same as self-employment taxes, but the process for reporting and paying differs if you're an employer versus a self-employed individual. Let’s look at exactly what FICA taxes are, the specific FICA tax rates and limits, and how to calculate and file these taxes.

How do FICA taxes work?

FICA taxes, short for Federal Insurance Contributions Act, are payroll taxes that fund Social Security and Medicare programs. As a small business owner, you must deduct these taxes from your employees' paychecks.

You can make calculating and deducting these taxes more streamlined and alleviate concerns of payroll penalties with payroll software that has built-in tax penalty protection like QuickBooks Payroll.

FICA taxes are split between the employer and the employee. The employer is responsible for contributing an equal amount to the employee's share of FICA taxes. For instance, if the employee pays 6.2% for Social Security, the employer also pays 6.2%. Similarly, for Medicare taxes, both the employee and employer each pay 1.45%.