TAXES AND BOOKKEEPING

A self-employment tax calculator will help you estimate how much you’ll owe on your self-employment income. You’ll need to pay self-employment tax if you make more than $400. Let’s look at everything you’ll need to know when calculating and filing self-employment taxes:

What is self-employment tax?

Self-employment tax is a tax that self-employed individuals have to pay to cover Social Security and Medicare taxes. If you earn income that is not subject to payroll withholding, you likely need to pay self-employment tax.

If you are an employee, Social Security and Medicare taxes are known as FICA taxes, and your employer pays half of your Social Security and Medicare taxes—you pay the other half through payroll deductions. However, for self-employment income, you are responsible for paying the full amount.

FYI: Self-employment tax is in addition to income tax—you’re responsible for paying both self-employment tax and income tax on your earnings.

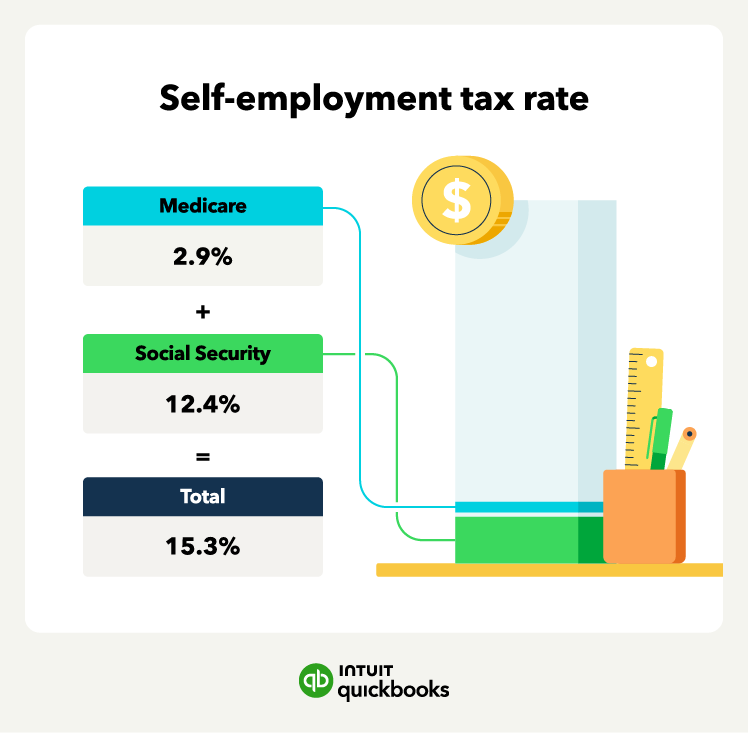

What is the self-employment tax rate?

The current self-employment tax rate is 15.3%, which includes 12.4% for Social Security taxes and 2.9% for Medicare taxes. You only have to pay Social Security taxes on income up to $168,600 for 2024, but there is no income limit for Medicare taxes.

Note that an Additional Medicare Tax of 0.9% applies to household income over certain thresholds. You’ll pay this additional tax if you earn over $200,000 as a single filer, $250,000 for married filing jointly, or $125,000 for married filing separately. This additional tax is not part of your self-employment taxes—you’ll calculate and pay this with your income tax return.

Who has to pay self-employment tax?

Individuals who work for themselves and make more than $400 in net earnings from self-employment must pay self-employment taxes. Self-employment income can include money you make from contract work, freelancing, or selling products online.

Typical individuals that need to pay self-employment tax include:

- Sole proprietors

- Freelancers

- Independent contractors

- Owner of a single-member LLC

- Consultants

- Gig workers

Note that many members of limited liability companies (LLC) must also pay self-employment tax, as well as church employees with income over $108.28.

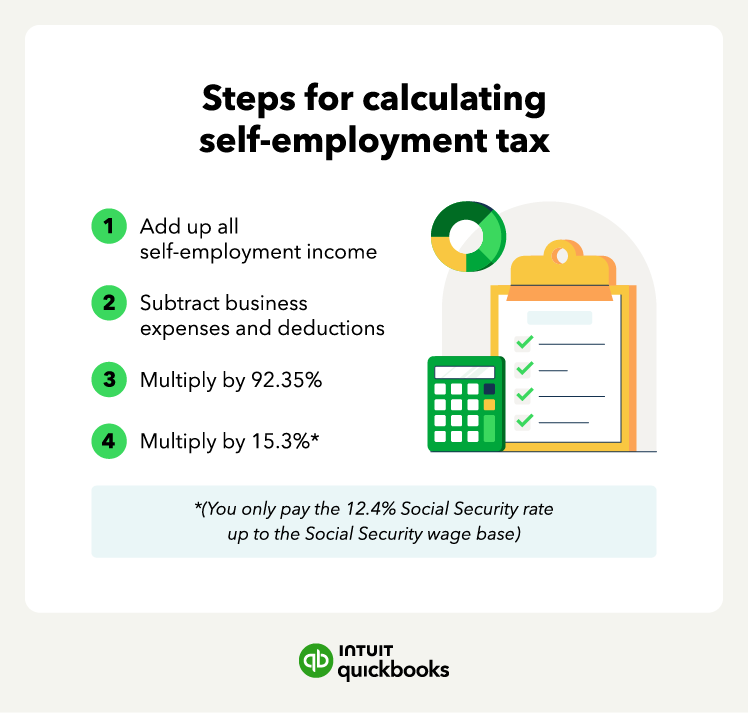

How do you calculate self-employment tax?

You calculate and pay self-employment tax using your self-employment tax base. You’ll need to know your self-employment net earnings, also known as net income, which is the total amount of money you make from self-employed work minus your business expenses. Your self-employment tax base is then 92.35% of your net earnings from self-employment.

The formula for figuring out your self-employment tax is:

Net earnings from self-employment x 92.35% x self-employment tax rate

Before calculating your self-employment tax, you’ll need to gather key tax and business documents, such as 1099-NEC forms, bank records, and receipts.

Here’s how to calculate your self-employment tax:

- Total your self-employment income: Add up the total amount of money you make from self-employment, including the income from your 1099 forms.

- Get your net earnings from self-employment: Tally up all of your business expenses and deductions and subtract them from your total self-employment income.

- Figure your self-employment tax base: Multiply your net earnings from self-employment by 92.35%.

- Calculate your self-employment tax: You will use the self-employment tax rate of 15.3% unless your self-employment tax base is over $168,600 in 2024.

You’ll only pay the 12.4% Social Security tax rate on the first $168,600, but you’ll pay the 2.9% Medicare tax rate on all of your self-employment tax base. Using a self-employment calculator is an easy way to estimate the amount of self-employment tax you’ll need to pay.

Self-employment tax calculation example

For example, say you’re a self-employed individual who’s a single filer, and you need to figure out how much self-employment tax you owe. You would calculate your self-employment tax as follows:

- Add up all of your 1099 forms and other freelance income to see your total self-employment income is $300,000.

- Your net self-employment earnings come out to $280,000 after subtracting your business expenses like travel and other small business tax breaks.

- Your self-employment tax base is $258,580 ($280,000 x 92.35%).

- Your self-employment tax is $28,405.22, which includes $20,906.40 for your Social Security tax ($168,600 x 12.4%) and $7,498.82 for Medicare tax (258,580 x 2.9%).

Note that you also owe an Additional Medicare Tax of 0.9% since you make over $200,000 as a single filer.

What are self-employment tax deductions?

Self-employed individuals can use self-employed tax deductions to reduce the amount of tax they owe. Self-employed tax deductions can include expenses you incur while running your business as well as the Qualified Business Income deduction, which allows you to deduct up to 20% of your business income.

Major deductions self-employed individuals should consider:

- Retirement: You can deduct contributions you make to certain retirement plans, such as a solo 401(k).

- Self-employment tax: You can deduct half of your self-employment tax from your net income.

- Vehicle use: If you use your vehicle for business purposes, you can deduct expenses or use the IRS standard mileage deduction.

- Home office: If you use a space in your home to run your business, you can use the IRS simplified square footage calculator or deduct expenses.

- Health insurance: You can deduct the cost of paying your health insurance premiums for you and your family.

- Travel and other business expenses: You can deduct your travel if you have to visit clients as well as other expenses like advertising.

When looking to lower your tax bill by deducting expenses, you’ll want to keep solid records and consider using accounting software to help make tax time easier.

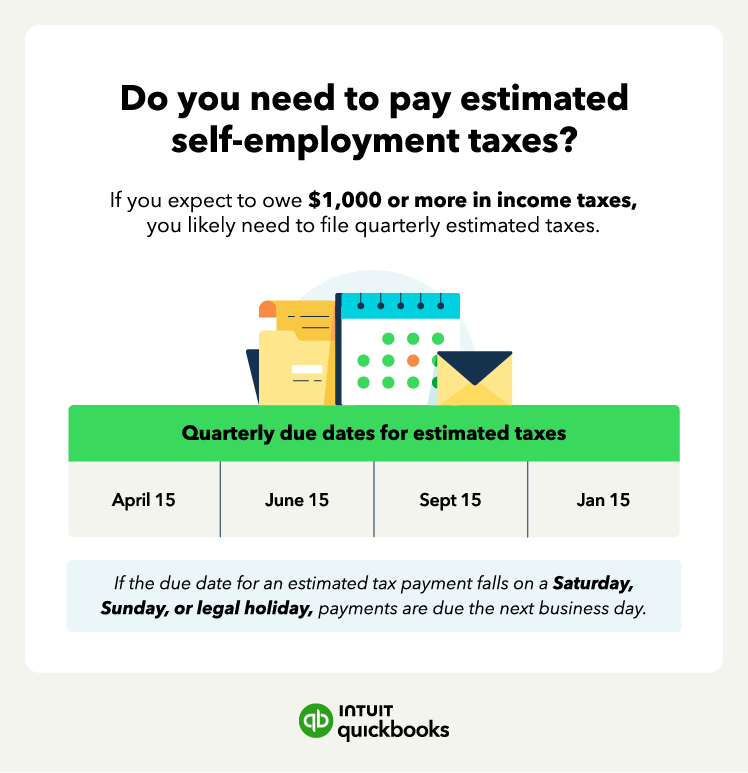

When do you have to pay estimated taxes?

If you expect to owe over $1,000 in taxes when you file your income tax return with the IRS, you likely need to make estimated tax payments quarterly.

Quarterly estimated taxes are due:

- January 16, 2024 for fourth-quarter earnings from 9/1 to 12/31

- April 15, 2024 for first-quarter earnings from 1/1 to 3/31

- June 17, 2024 for the second-quarter earnings from 4/1 to 5/31

- September 16, 2024 for third-quarter earnings from 6/1 to 8/31

For example, you can use the self-employment tax calculator above to estimate how much you expect to owe in self-employment tax for the current year. If it’s over $1,000, you’ll want to divide that by the number of remaining quarterly due dates for the tax year.

Find peace of mind come tax time

A self-employment tax calculator is an easy way to stay on top of your self-employed tax obligations. However, receiving multiple 1099 forms or both 1099 and W-2 income paying self-employment taxes can be even more tricky.

You can use accounting software built for self-employed individuals like QuickBooks Solopreneur to accurately calculate all your tax obligations and ensure you don’t miss any tax deadlines.

Self-employment tax calculator FAQ

Simplify tax time by keeping your books ready all year long. QuickBooks Solopreneur is right sized for solo business owners, and includes an easy-to-use suite of tools to help you understand where your business stands, manage your business more seamlessly, and help you stay ready for tax time.

Disclaimers

*QuickBooks Live Tax, powered by TurboTax, is an integrated service available with a QuickBooks Online subscription. Additional terms, conditions and limitations apply. Pay when you file.

Terms and conditions, features, support, pricing, and service options subject to change without notice.