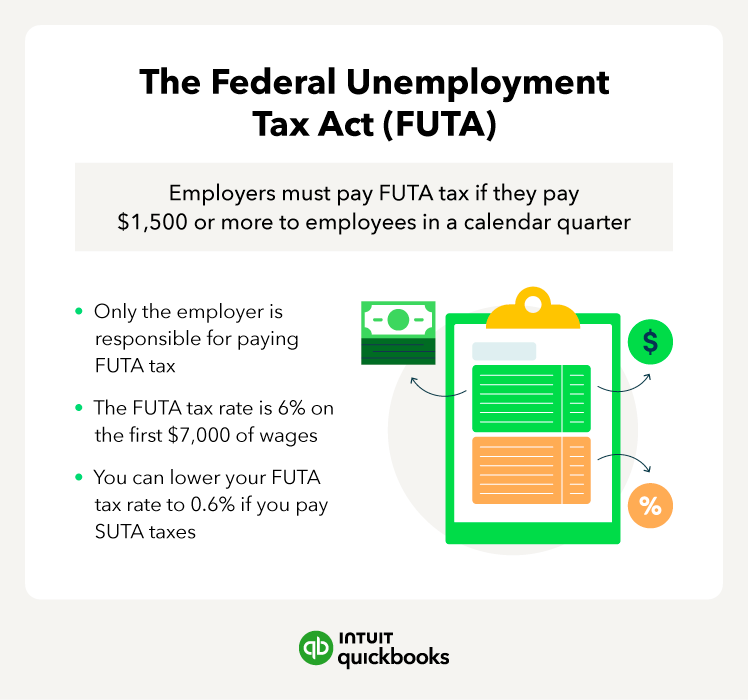

Passed in 1939 in response to the Great Depression, FUTA provides federal and state governments with money for programs, such as unemployment insurance. FUTA is the responsibility of only the employer and is not a payroll deduction for employees as they do not pay this tax.

FUTA vs. SUTA taxes

The State Unemployment Tax Act (SUTA) is essentially FUTA on the state level. It’s a payroll tax that many states impose on employers to fund state unemployment insurance and other employment programs.

The SUTA tax rate ranges from 2% to 5% of each employee’s salary, depending on your state.

How do you calculate FUTA taxes

Calculating FUTA taxes is a straightforward process. If everyone at your company earns more than $7,000 per year, the basic equation for determining FUTA tax is as follows:

$7,000 x 0.06 x Number of employees = FUTA tax liability

For example, say you run a company with 20 employees and each employee earns $50,000 per year.

Since everyone makes over $7,000 per year—and FUTA tax only applies to the first $7,000—we can calculate your company’s FUTA payroll liability with the following formula:

$7,000 x 0.06 x 20 = $8,400

Your company’s FUTA tax liability is $8,400. Depending on the state your business is in, you may also owe state unemployment taxes and get a credit to lower your FUTA tax rate.

Your equation will differ if you have one or more employees who make less than $7,000.

Let’s say you run a company with 10 employees—eight employees earn $40,000, one earns $6,500, and one earns $4,000.

Here’s how to calculate your FUTA taxes if you have a mixture of employees making above and $7,000 a year:

- Calculate your liability for eight employees making over $7,000, which is $7,000 x 0.06 x 8 = $3,360.

- Calculate your liability for your employee making $6,500, which is $6,500 x 0.06 = $390.

- Calculate your liability for your employee making $4,000, which is $4,000 x 0.06 = $240.

- Add up each to get your total liability of $3,390.

Depending on the state your business or employees are in, you may also owe state unemployment taxes.

How do you file and pay FUTA taxes?

You’ll make your FUTA tax filings via Form 940 annually, but will likely need to make payments via the IRS’ Electronic Federal Tax Payment System (EFTPS) quarterly.

You need to file a Form 940 if you meet either of these conditions:

- You pay wages of $1,500 or more in any given quarter during the current or previous calendar year.

- You pay wages to at least one employee for 20 weeks or more during the current or previous year.

The general deadline for filing Form 940 is January 31.

The frequency that you’ll need to make FUTA tax depends on your FUTA tax liability—if your FUTA tax is:

- Over $500 in a quarter you’ll pay quarterly.

- $500 or less for the quarter you’ll carry the liability forward to the next quarter until your tax liability is over $500.

The quarterly deadlines for making your FUTA tax payments are January 31, April 30, July 31, and October 31.

FUTA vs. FICA

Similar to FUTA, the Federal Insurance Contributions Act (FICA) is another payroll tax for businesses. The main difference between FUTA and FICA lies in the rates who pays each, for example:

- The FUTA tax rate is 6% on up to $7,000 of an employee’s wages. However, this rate can be as low as 0.6% if you pay state unemployment taxes. Only the employer pays FUTA taxes.

- The FICA tax rate is 7.65% since you withhold 6.2% of your employee’s wages for Social Security and 1.45% for Medicare. Both the employee and employer must pay FICA taxes since you match the employee’s 7.65% in FICA taxes when paying the federal government.

FUTA and FICA fund different programs. While money for FUTA taxes goes toward unemployment insurance, revenue from FICA goes toward Social Security and Medicare benefits.

Best practices for meeting your FUTA obligations

If you run a small business, it’s important to stay on top of your FUTA taxes. Missing deadlines or making mistakes can result in costly fees.