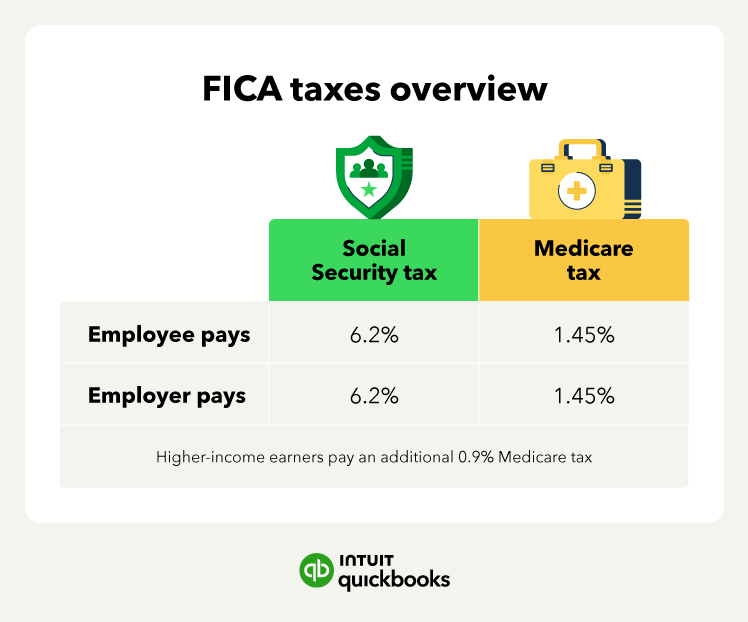

If a company doesn’t report these taxes, it can get in trouble with the law. The amount an employee pays in FICA taxes per pay period depends on their pre-tax deductions, which lower their taxable income.

2. Federal income tax

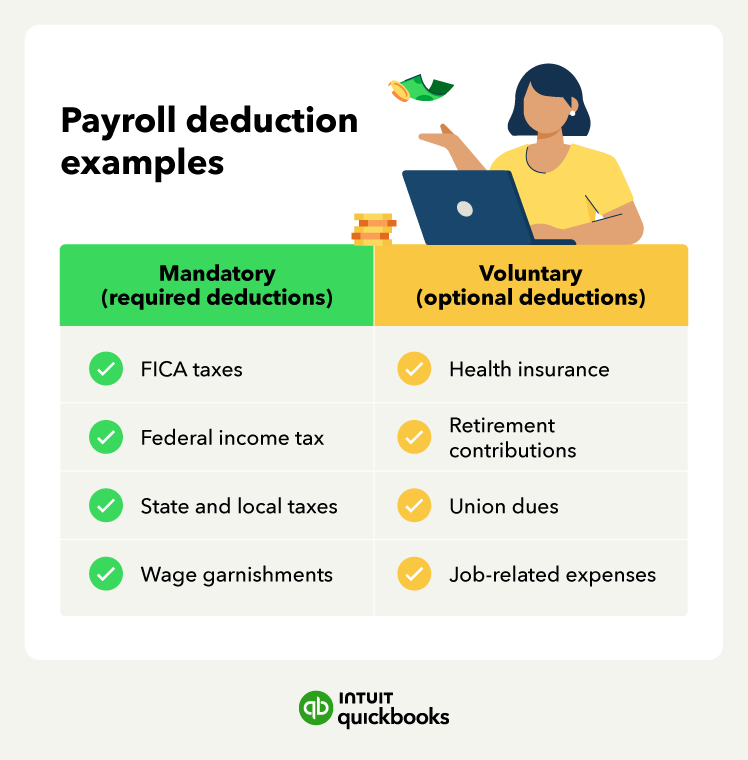

Mandatory payroll deduction

The amount of federal income tax you’ll withhold from your employee’s paychecks will depend on their Form W-4. Each employee will fill out a W-4 form, one of these forms, and the amount of federal income tax withholding.

Using a W-4 form, your employees can choose to have a certain amount deducted from their taxes. Deductions are decided by a bunch of parameters—the W4 serves as both a form and an instruction sheet for the employee.

3. State and local taxes

Mandatory payroll deduction

Like federal income taxes, state and local payroll taxes are mandatory payroll deductions and must be paid to the appropriate tax authorities. Each state sets its income tax rate. An employee’s gross income and any pre-tax deductions will determine the amount they pay in state and local taxes.

If you work in one state, and all of your employees live in that state, then the state tax you’ll owe is pretty straightforward. However, if you have multiple offices in different states or remote employees in different states, your state payroll liabilities will be a bit more complicated.

4. Wage garnishments

Mandatory payroll deduction

Employees with unpaid debt or other obligations may have wage garnishments as payroll deductions. Wage garnishments are sent by a court or government agency like the IRS and require employers to withhold money from an employee’s paycheck.

The deductions are on a post-tax basis and usually go toward debts or obligations like:

- Taxes

- Alimony

- Child support

- Defaulted loans.

The wage garnishment letter will explain how much of an employee’s paycheck has to be withheld and where the money has to be sent.

5. Health, disability, and life insurance

Voluntary payroll deduction

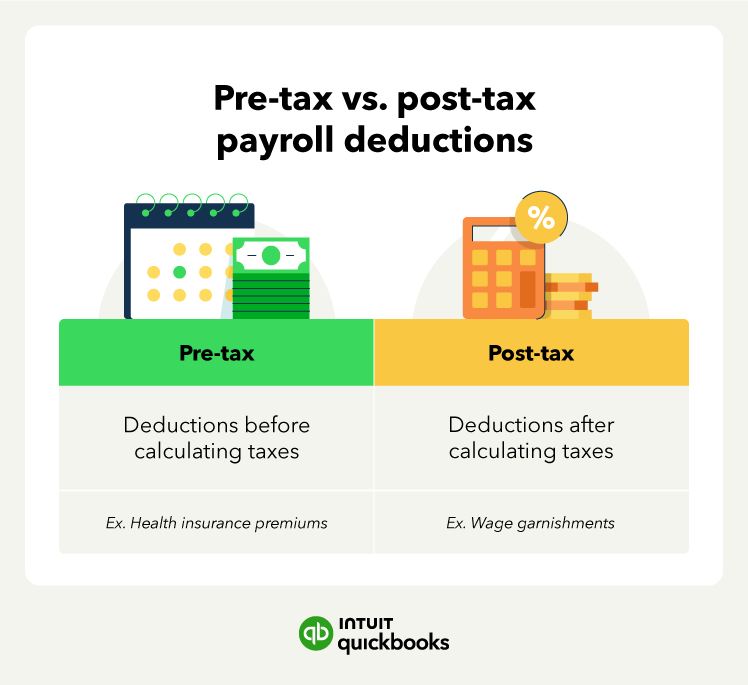

Health insurance and other premiums are voluntary payroll deductions that are typically made on a pre-tax basis. If you offer health benefits for your employees, you can have them pay part of their premiums via paycheck deductions. This also includes other health benefits, such as dental insurance or health savings plans.

6. Retirement plans

Voluntary payroll deduction

As another employee perk, companies can offer retirement plans, such as a 401(k) plan that lets employees save for retirement. Employees can have a part of their paycheck withheld as a voluntary deduction and invested in their 401(k).

An employer can offer a few retirement plan options, and the type of retirement plan will determine whether it’s pre-tax or post-tax. For example, money put into a traditional 401(k) can be pre-tax, while money put into a Roth IRA must be post-tax.

7. Union dues

Voluntary payroll deduction

Members of unions usually make regular payments to the union they’re a member of. These dues are post-tax, so they won’t offer a tax benefit.

Union dues can go toward an employee’s membership, along with other taxable benefits offered by the union, which are all deducted on a post-tax basis.

8. Job-related expenses

Voluntary payroll deduction

Other job expenses an employee might deduct include:

- Meals

- Travel

- Uniforms

- Home office equipment

- Parking

- Transit

- Medical exams.

These job-related costs are also deducted on a post-tax basis.

Tips for managing paycheck deductions

Once you have all your payroll deductions in order, you’ll want a way to manage them effectively.

Here are some tips for staying on top of paycheck deductions:

- Ensure you have up-to-date employee records: This includes having a process in place for updating employee pay rates, addresses, and tax withholdings.

- Track employee hours reliably: Use time-tracking software or apps, paper timesheets, or time clocks to ensure precise payroll if you have hourly employees.

- Create a payroll policy: Establish a clear policy outlining the payroll process, employee classifications, salary determinations, and reporting obligations.

- Categorize employees accurately: Properly classify employees as hourly or salaried to comply with legal regulations, and adhere to the Fair Labor Standards Act (FLSA).

- Invest in a payroll system: Pick a system that works best for your business, whether it’s manual processing, outsourcing, or using payroll software.