When do you need to send 1099-NEC forms?

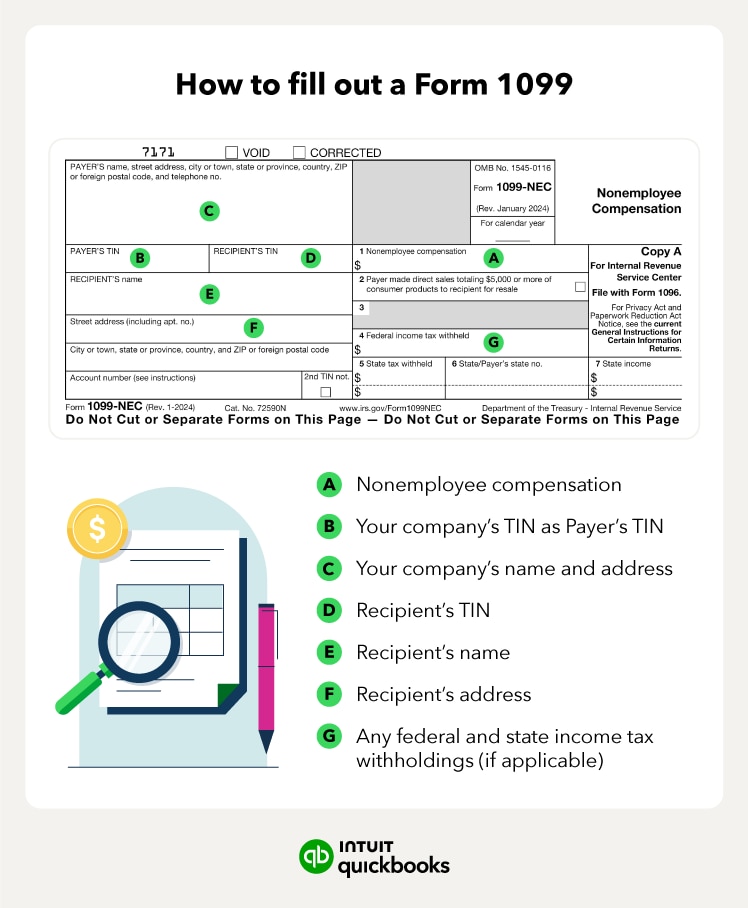

When it comes to issuing 1099-NEC forms in particular, if you pay any freelancer or contractor over $600 for the calendar year, you’ll need to send them one. In other words, you send a 1099-NEC to each contractor you pay over $600.

1099-NEC forms serve two purposes:

- Reports nonemployee compensation payments to the IRS

- Allows your contractor or freelancer to do their taxes

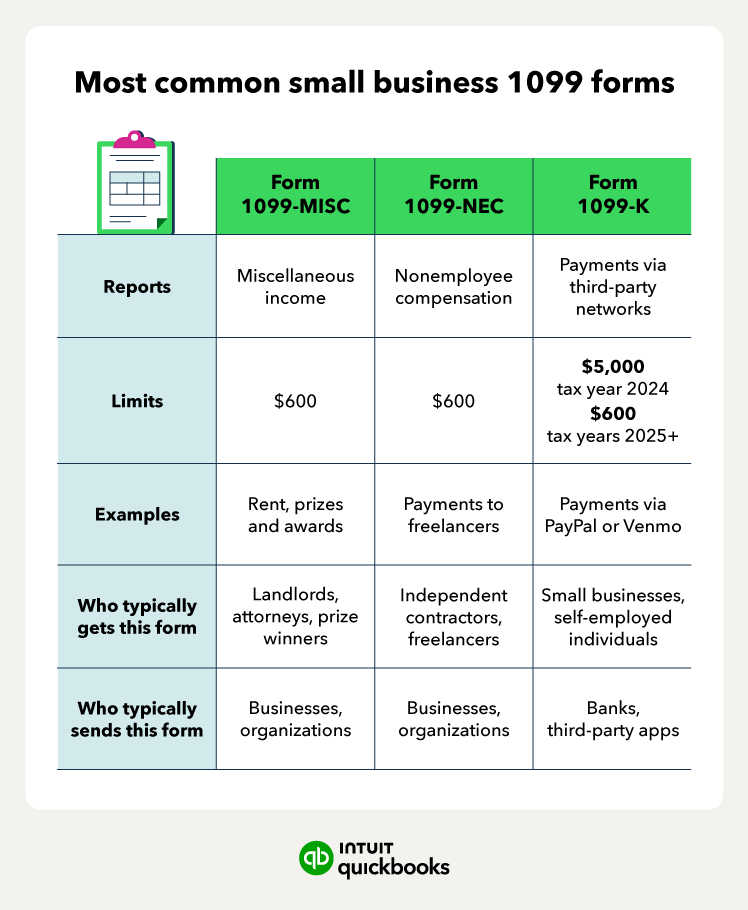

If you are a small business with employees that you issue a paycheck to and withhold payroll taxes, you won’t issue a 1099-NEC to them. Instead, you issue employees a W-2 tax form. However, there are other 1099 forms your small business may need to send or receive that have nothing to do with your workers.

Note that Form 1099-NEC is for nonemployee compensation. If you need to report payments of over $600 for other things, such as rent, prizes and rewards, attorney fees, and medical and health care payments, you’ll use Form 1099-MISC.

State-specific considerations

Remote work and cloud-based platforms have made it easier for small businesses to hire contractors and freelancers across the US. However, managing 1099 reporting across multiple states can be complex.

Here are key considerations:

- State-specific forms: Some states require additional forms or have unique reporting 1099 requirements.

- State taxpayer identification numbers (TINs): Independent contractors may need state-specific TINs, which employers should verify for accuracy.

- State tax withholding: Some states require employers to withhold state income tax from payments to independent contractors and report the withheld amounts on state 1099 forms.

- State-specific filing deadlines and requirements: Deadlines and reporting requirements can vary.

- State-specific penalties: Noncompliance can result in penalties and interest.

While the IRS Combined Federal State Filing Program (CF/SF) simplifies reporting for some states, certain 1099 forms often require direct filing, especially the 1099-NEC form. This can be challenging due to differing thresholds, deadlines, and filing methods across states.

Remember to provide recipients of 1099 forms, including

Remember to provide recipients of 1099 forms, including