Schedule C will ask whether you use the cash or accrual accounting method. With accrual accounting, you’ll report expenses as you incur them and income as you earn it. Most large companies use the accrual method, but many small businesses use the cash method.

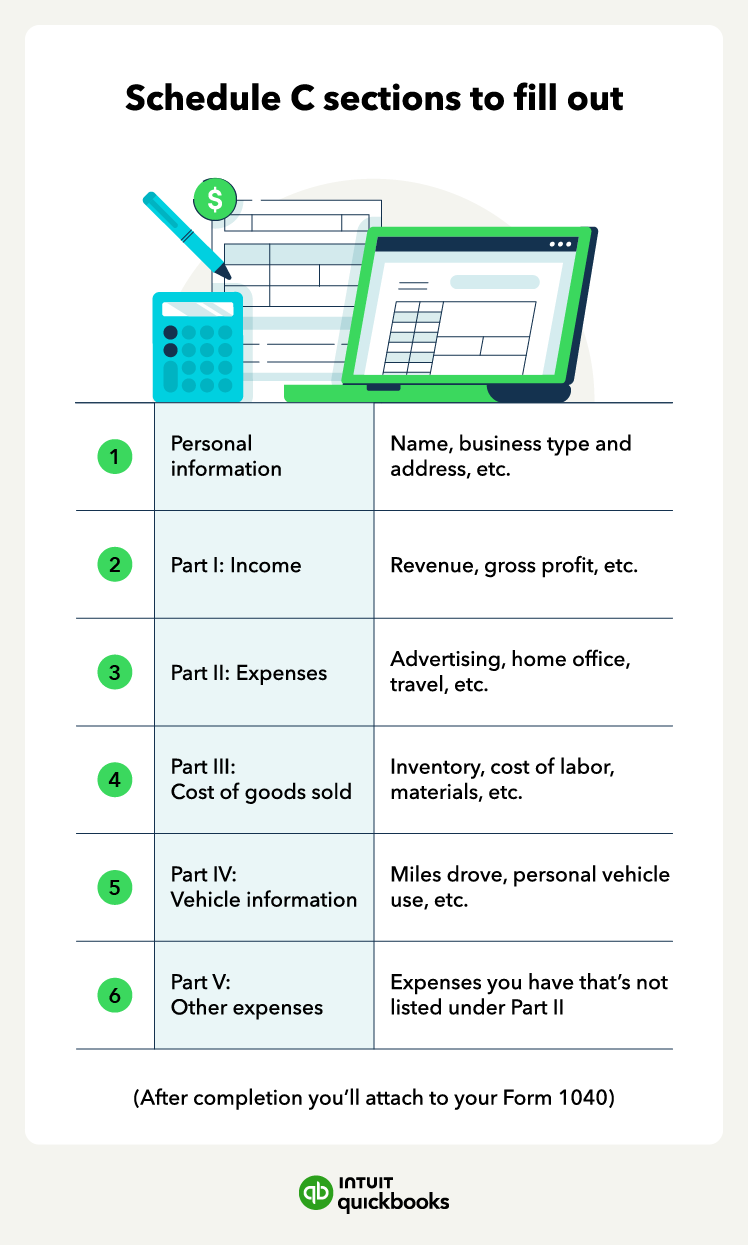

Here's a quick step-by-step guide on completing a Schedule C:

Step 1: Fill in personal information

Begin by filling out the top part of the form, including your name, Social Security number, and the type of business entity.

Step 2: Tally your business revenue in Part I

Report the total sales, fees, or any other income your business generates during the tax year.

Step 3: Deduct your business expenses in Part II

List your itemized business expenses, such as advertising, travel, and office supplies.

Step 4: Calculate your cost of goods sold (COGS) in Part III

If applicable, indicate the direct expenses for producing or purchasing the goods you sell. The cost of goods sold also includes the cost of materials and labor from the production process.

Step 5: Report vehicle expenses and other expenses in Parts IV and V

Calculate and deduct the allowable vehicle expenses if you use your vehicle for business purposes. If you have other legitimate business expenses that don’t fit into any of the categories in Part II, you can itemize them in Part V.

Step 6: Summarize your business profit or loss

Subtract your total business expenses, cost of goods sold, and other deductible amounts from your business revenue. The resulting figure represents your net profit or loss.

Step 7: Transfer amounts to Form 1040

Once you have your net profit or loss, report the amount on Form 1040 or your personal income tax return. You’ll also attach your 1040 Schedule C to your tax return when filing.

Filling out a Schedule C can seem intimidating, but it can be a straightforward process with the right approach.

For example, having all your income and expenses in one place—where you can get paid and manage your money all in one with a business bank account like QuickBooks Money—can help streamline tax time.