The depreciation equation you choose depends on how you use the asset to generate revenue.

If you use the asset heavily in its early years, you should choose a depreciation method that posts more expenses in the early years. The annual depreciation expense amount should be fixed if you expect to use an asset at the same rate year over year.

1. Straight-line depreciation method

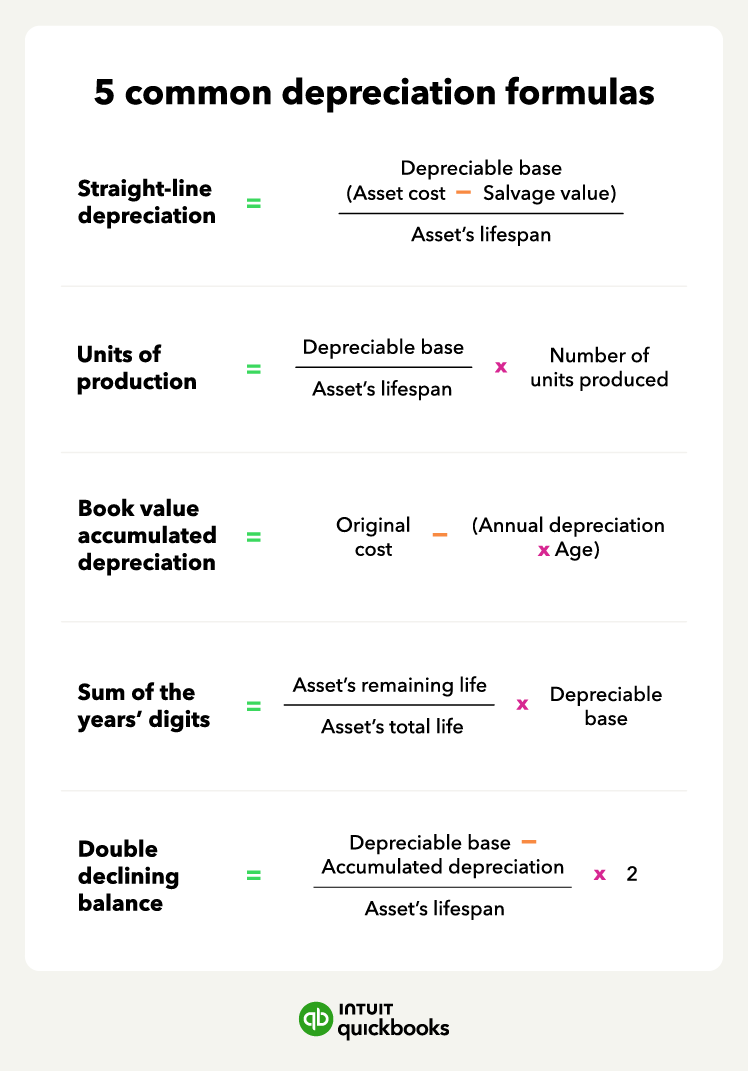

The most common depreciation method is straight-line depreciation. When determining how to calculate straight-line depreciation, the formula shows that an asset depreciates by the same amount each year.

Take this straight-line depreciation example, for instance. Let’s say you need to determine the depreciation of a delivery truck. The truck costs $30,000. It has a salvage value of $3,000, a depreciable base of $27,000, and a five-year useful life.

- Truck cost: $30,000

- Salvage value: $3,000

- Depreciable base: $27,000

- Five-year useful life

- Straight-line depreciation: $5,400 per year ($27,000 / 5 years)

To find the annual depreciation expense, divide the truck’s depreciable base by its useful life to get $5,400 per year. You find that you can sell the truck for $3,000 after five years because you subtracted the cost of the truck from its depreciable base.

2. Double-declining balance depreciation method

The double-declining balance method posts more depreciation expenses in the early years of an asset’s useful life. The double-declining balance method is an accelerated depreciation method because expenses post more in the early years and less in the later years.

This method computes the depreciation as a percentage and then depreciates the asset at twice the percentage rate.

Let’s say you need to determine the depreciation of a van using the double-declining balance method.

The van costs $25,000. It has a salvage value of $3,000, a depreciable base of $22,000, and a five-year useful life. The straight-line depreciation method would show a 20% depreciation per year of useful life.

The double-declining balance method would show a 40% depreciation rate per year:

- Van cost: $25,000

- Salvage value: $3,000

- Depreciable base: $22,000

- Five-year life span

- Double-declining balance depreciation: Deduct 40% from the current depreciable value each year ($8,800 for the first year, $5,280 for the second year, and so on)

The double-declining balance method is an accelerated depreciation method because expenses post more in their early years and less in their later years. It computes the depreciation as a percentage and then depreciates the asset at twice the percentage rate.

3. The book value, accumulated depreciation method

This method uses an asset’s book value to compute depreciation. Book value is the asset’s cost minus its accumulated depreciation. Accumulated depreciation is the total amount of depreciation recognized to date.

Let’s say you want to find the van’s depreciation expense in the first, second, and third year you own it. Multiply the van’s cost ($25,000) by 40% to get a $10,000 depreciation expense in the first year.

The van’s book value at the beginning of the second year is $15,000, or the van’s cost ($25,000) subtracted from its first-year depreciation ($10,000). Now, multiply the van’s book value ($15,000) by 40% to get a $6,000 depreciation expense in the second year.

The van’s book value at the beginning of the third year is $9,000, or the van’s cost minus its accumulated depreciation ($16,000). Now, multiply the van’s book value ($9,000) by 40% to get a $3,600 depreciation expense in the third year.

Total depreciation expenses decline each year until the asset’s remaining book value equals its salvage value. At that point, depreciation expenses stop because the asset’s useful life is over. You can now sell the van for $3,000.

The double-declining balance method does not subtract the asset’s salvage value before it calculates the 40% depreciation amount each year. That’s because the asset’s salvage value is addressed at the end of its useful life.

4. The sum of the years’ digits depreciation method

To use the sum of the years’ digits depreciation method, you’ll use a ratio. The numerator is the years left in the asset’s useful life, and the denominator is the sum of the years in the asset’s original useful life. The sum of the years’ digits depreciates the most in the first year, and the depreciation is reduced with each passing year.

Let’s say you have a machine that costs $30,000. The machine has a salvage value of $3,000, a depreciable base of $27,000, and a five-year useful life. So, the sum of all the years in the asset’s original useful life is 15.

In the first year, the ratio is five-fifteenths. Multiply the $27,000 depreciable base by the first-year ratio to get a $9,000 depreciation expense in the second year.

In the second year, the machine’s remaining useful life is four years or four-fifteenths. Multiply the $27,000 depreciable base by the second-year ratio to get a $7,200 depreciation expense in the second year.

When you compute depreciation expense for all five years, the total equals the $27,000 depreciable base.

5. The units of production depreciation method

Many manufacturing companies use the units of production method. This method is useful for companies with large production variations each year.

The units of production method calculates depreciation based on the number of units produced in a particular year.

If you own a piece of machinery, you should recognize more depreciation when you use the asset to make more units of product. If production declines, this method reduces the depreciation expense from one year to the next.

Let’s say you have a machine that costs $50,000. The machine has a salvage value of $10,000 and a depreciable base of $40,000. It can produce 100,000 units over a five-year useful life.

To find the depreciation amount per unit produced, divide the $40,000 depreciable base by 100,000 units to get 40¢ per unit. If the machine produced 40,000 units in the first year of its useful life, the depreciation expense was $16,000.

- Machine cost: $50,000

- Salvage value: $10,000

- Depreciable base: $40,000

- Five-year life span

- Can produce 100,000 units over five years

Depreciation is calculated by the 40 cents cost per unit of production and deducted from the depreciable value of $40,000. If the machine produces 20,000 units each year, it will depreciate at a rate of $8,000 per year.

6. The modified accelerated cost recovery system (MACRS)

MACRS is a depreciation method that posts depreciation expenses for tax purposes.

It’s common for businesses to use different methods of depreciation for accounting records and tax purposes. Accountants must create a reconciliation report that explains the differences between the accounting and tax depreciation for a business’s tax return.

IRS Publication 946 provides the tax depreciation method for each depreciable asset that your business owns.

Streamline your accounting and save time

You can better plan for asset purchases if you learn how to calculate depreciation. Posting depreciation helps you monitor the current status of your fixed assets. To determine when you must replace assets, review each fixed asset’s detailed listing.

You can use accounting software to track depreciation using any depreciation method. The software will calculate the annual depreciation expense and post it to the necessary journal entries for you. An accounting solution can help you make more informed decisions to grow your business with confidence.