Now that you know what straight-line depreciation is and why it’s important, let’s look at how to calculate it.

Step 1: Calculate the asset's purchase price

The purchase price refers to the total cost of an asset. You can calculate an asset's purchase price by adding the following figures together:

- Price: the original price you purchased the asset for

- Shipping: any fees that relate to the delivery of your asset

- Taxes: an additional fee that reflects a percentage of the asset’s price

- Maintenance: costs associated with maintaining the asset

- Any applicable fees: anything that adds to the cost of the asset

After you gather these figures, add them up to determine the total purchase price. Now it’s time to calculate the asset’s life span and salvage value.

Step 2: Determine the asset’s life span and salvage value

You can calculate the asset’s life span by determining the number of years it will remain useful. It’s possible to find this information on the product’s packaging, website or by speaking to a brand representative.

Next, you’ll estimate the cost of the salvage value by considering how much the product will be worth at the end of its useful life span.

Step 3: Subtract the salvage value from the purchase price

Now that you have calculated the purchase price, life span and salvage value, it's time to subtract these figures.

Subtract the asset’s salvage value from the purchase price. This number will show you how much money the asset is ultimately worth while calculating its depreciation.

Step 4: Calculate depreciation expenses

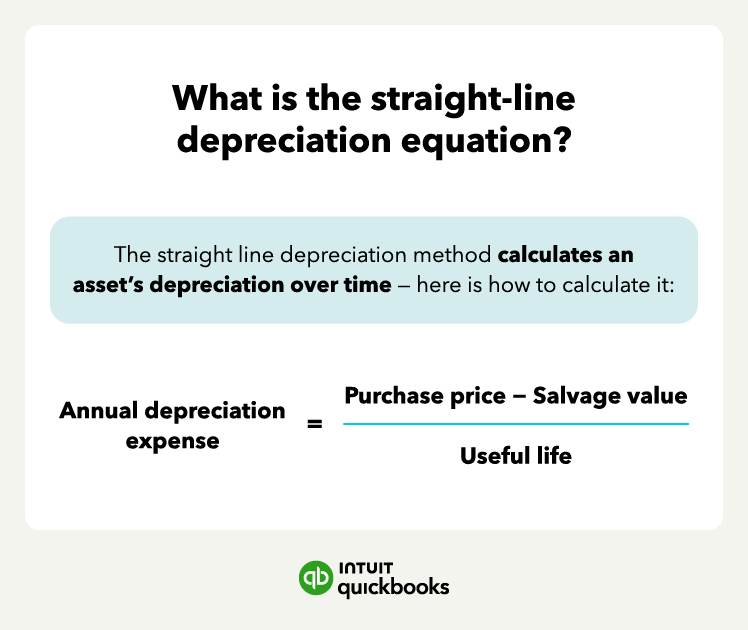

Once you understand the asset’s worth, it’s time to calculate depreciation expense using the straight-line depreciation equation.

This means taking the asset’s worth (the salvage value subtracted from the purchase price) and dividing it by its useful life. This number will give you an asset’s annual depreciation expense.

Step 5: Divide by 12 for monthly depreciation (optional)

If you want to take the equation a step further, you can divide the annual depreciation expense by twelve to determine monthly depreciation. This step is optional, however, it can shed light on monthly depreciation expenses.

With these numbers on hand, you’ll be able to use the straight-line depreciation formula to determine the amount of depreciation for an asset on an annual or monthly basis.

Accelerated depreciation vs straight-line depreciation

The straight-line depreciation method is not to be confused with accelerated depreciation. The two systems differ in a few ways:

- Accelerated depreciation: an assets loses value fasterin th beginning of its lifespan and depreciation begins to slow down over time.

- Straight-line depreciation: an asset loses value at the same rate over time.

Now that you know the difference between the depreciation models, let’s see the straight-line depreciation method being used in real-world situations.

Straight-line depreciation examples in the real world

Straight-line depreciation is used in everyday scenarios to calculate the with of business assets. To get a better understanding of how to calculate straight-line depreciation, let’s look at a few examples below.

Tree removal service example

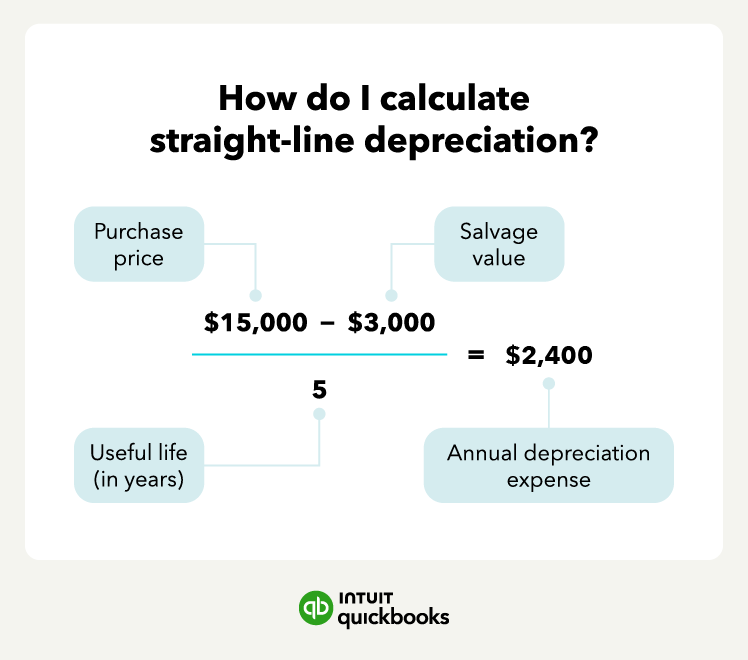

Let’s say you own a tree removal service, and you buy a brand-new commercial wood chipper for $15,000 (purchase price). Your tree removal business is such a success that your wood chipper will last for only five years before you need to replace it (useful life).

You believe after five years you’ll be able to sell your wood chipper for $3,000 (salvage value). Here’s how you would calculate your wood chipper’s depreciation using the straight-line method:

Annual depreciation per year = (Purchase price of $15,000 − salvage life of $3,000) / useful life of five years

Annual depreciation per year = $12,000 / 5

Annual depreciation per year = $2,400

According to the straight-line method of depreciation, your wood chipper will depreciate $2,400 every year.

Fishing business example

Now, let’s assume you run a large fishing business that sets out on the Bering Sea every summer to capture fresh salmon. You buy a new vessel for $280,000 to help increase production.

According to the IRS’s standard use of life, vessels fall under the 10-year property life. Once that 10-year period is up, you believe you can sell your vessel for $70,000. Using the straight-line depreciation formula, here’s how much your fishing vessel will depreciate each year:

Annual depreciation per year = (Purchase price of $280,000 − salvage life of $70,000) / useful life of 10 years

Annual depreciation per year = $210,000 / 10

Annual depreciation per year = $21,000

When crunching numbers in the office, you can record your vessel depreciating $21,000 per year over 10 years using the straight-line method.

Real estate example

Lastly, let’s pretend you just bought property to build a new storefront for your bakery. You installed a fence around the entire plot of land, which falls under the 15-year property life. The initial cost of the fence was $25,000, and you think you can scrap the wood for $3,000 at the end of its useful life.

Using the straight-line depreciation method, here’s how much your fence will depreciate each year:

Annual depreciation per year = (Purchase price of $25,000 − salvage life of $3,000) / useful life of 15 years

Annual depreciation per year = $22,000 / 15

Annual depreciation per year = $1,467

After building your fence, you can expect it to depreciate by $1,467 each year. Additionally, you can calculate the depreciation rate by dividing the depreciation amount by the total depreciable cost (purchase price − estimated salvage value).

In this case, the depreciation rate of your fence will be 6.67% ($1,467 / $22,000 = 0.067 x 100). With an asset’s depreciation rate, you can create a depreciation schedule to see how much value an asset loses each year.

Other depreciation methods to consider

The straight-line method of depreciation isn’t the only way businesses can calculate the value of their depreciable assets. While the straight-line method is the easiest, sometimes companies may need a more accurate method. Below are a few other methods one can use to calculate depreciation.