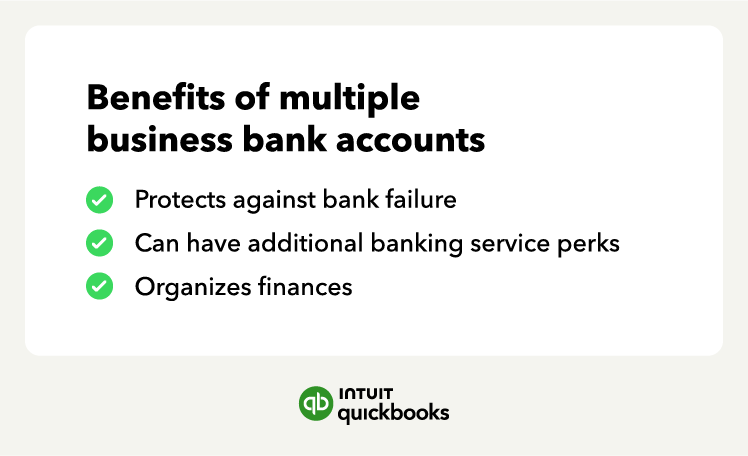

One of the biggest advantages of having multiple business checking accounts is managing and monitoring cash flow easily, but it can also bring other benefits. Here are the top three advantages of opening multiple business accounts:

Keep your cash safe

Staying safe with your cash is an important part of managing your small business finances. Multiple bank accounts for business can protect you from bank failures and security concerns, like:

- Identify theft

- Hacking

- Cyberattacks

- Theft

Placing your money across multiple accounts can help protect your business from fraud and cyberattacks. If you experience a cyberattack on one account, having multiple accounts increases the likelihood that you’ll still have access to cash through your other accounts.

Additionally, having multiple accounts can make it easier to monitor and flag any suspicious activity or unusual activity that could indicate fraudulent activity.

Take advantage of perks

Earning interest on your bank account is just one perk you might find with another bank account. You may also get access to other perks, such as:

Having a relationship with various banks may also help you gain access to their other products, such as credit cards or business loans.

Streamline business finances

One of the primary advantages of maintaining two or more business bank accounts is the ease of managing your finances. Multiple accounts can make it easier to identify shortfalls in your finances.

For example, say you have an operating and payroll checking account. You can see if your payroll bank account is short for the current payroll cycle without having to account for operating expenses that might come through.

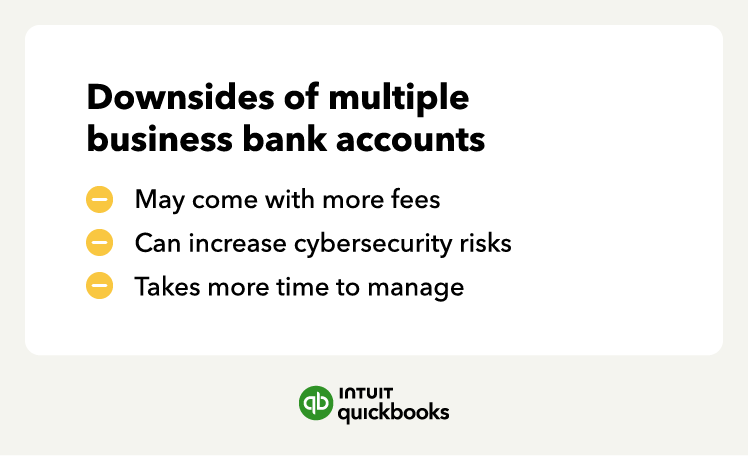

Cons of multiple bank accounts for business