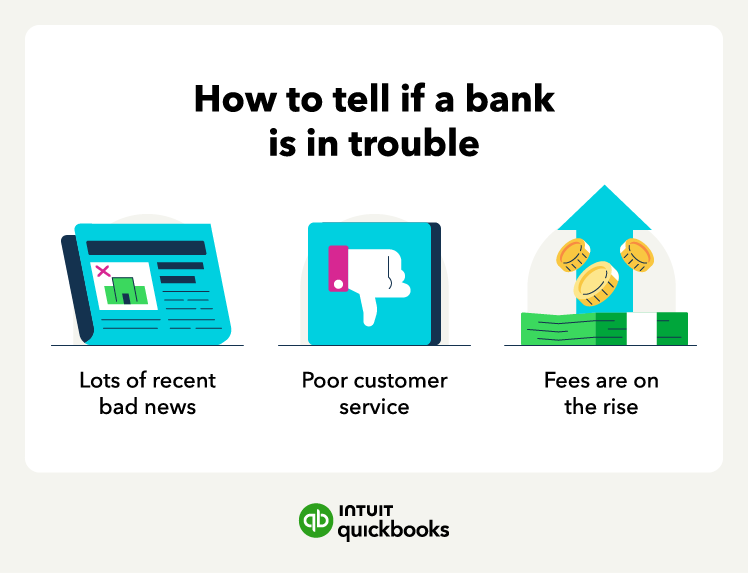

So, is your money safe in the bank—really? No one wants to find out their bank is in trouble, but it’s important to be aware of any potential warning signs. Here are some red flags that a bank may be struggling:

- Bad news: If a bank that a business uses is in the news for doing a lot of staff layoffs or closing multiple branches, this could be a sign they are in trouble. Especially if the bank has a recent history of surprising or negative news, or if it's under regulatory scrutiny.

- Poor customer service: A decrease in customer service levels, such as longer wait times or an increase in unhelpful customer service representatives. This could be a sign of low employee morale.

- Higher fees: An increase in fees, especially for accounts and services you previously could use for free, is a bad sign.

It's key to keep an eye on the news and watch for any such developments involving banks, as they may be signs of deeper issues that could impact the safety of a business’s deposits.

How to determine if a bank is safe?

Depositing money into a bank is a smart way to take advantage of financial products and services while keeping funds safe. But are banks safe? Use these determiners to gauge how safe money is in a given bank:

It’s FDIC-insured

If a bank is FDIC-insured, the money is insured up to $250,000. Banking with an FDIC-insured bank means the agency will reimburse you for any deposits up to an insurance limit of $250,000.

The $250,000 limit is per depositor, per institution. FDIC insurance covers you in case a bank fails. If you have a credit union account, the National Credit Union Administration (NCUA) provides the same insurance.

It has a strong balance sheet

A bank’s balance sheet shows its financial position at a given time. It lists the bank’s assets, which are the resources it owns or controls, and its liabilities, which are the obligations it owes to others. The difference between the assets and liabilities is the bank’s capital, representing the owners’ stake in the bank.

To examine the details of a bank’s balance sheet, you can use the FDIC database. Look for a bank with strong capital levels.

Its financial ratios are good

If you want to compare the performance and health of different banks and credit unions, you need reliable and consistent data. One source of such data is the Federal Financial Institutions Examination Council (FFIEC), which collects and publishes financial information from thousands of institutions across the US.

The FFIEC website offers a variety of reports and tools that you can use to analyze and compare financial ratios, trends, risks, and other indicators. You can access these reports by selecting the type of institution, the reporting period, and the geographic area. You can also download the data in various formats or use the online query tool to customize the search process.

One of the key uses of the FFIEC data is financial ratios. These are useful measures of how well a financial institution manages its assets, liabilities, income, and expenses. They can help you assess a bank or credit union's profitability, liquidity, efficiency, and solvency.

Its bank ratings are positive

Another way to check the financial health and stability of a financial institution is to look at its ratings from independent agencies that evaluate its performance and risk profile.

Some of the most reputable rating services for banks and credit unions are Moody’s, Standard & Poor’s (S&P), and Fitch Ratings. These agencies use different criteria and scales to assign ratings that reflect the institution’s ability to meet its obligations, withstand adverse economic conditions, and protect its depositors. You can access these ratings online or by contacting the agencies directly.

For example, S&P rates banks using letter grades. The higher, the better, where AAA is the highest. The lowest rating is D. A bank with an AAA rating has a strong balance sheet and the ability to manage debts.

Even FDIC-insured banks can struggle financially, so it’s still important to do research and stay informed about any potential red flags that could indicate trouble for the bank.