Estimated payments ensure that you pay a large percentage of the estimated tax liability during the year rather than in one payment when filing the tax return.

Business taxes due dates

For corporations with a calendar year-end, the deadline to send your 1120 form to the IRS is April 15, 2024. However, the Form 1120 due date for corporations with a fiscal year-end is the 15th day of the fourth month after the end of the corporation’s tax year.

A fiscal year-end is any business that ends its year on any day other than December 31. Note that a corporation with a fiscal tax year ending June 30 must file by September 15. For S-corps, multimember LLCs, and partnerships, the business tax filing deadline is March 15, 2024.

Here are the key business tax dates you need to know:

- January 31, 2024 – W-2 form distribution deadline: Send W-2s to employees before the end of January for the previous tax year.

- January 31, 2024 – 1099 form distribution deadline: Date to send the 1099 forms like 1099-MISC and 1099-NEC to recipients. This is also the deadline to file 1099-NEC forms with the IRS.

- March 15, 2024 – Forms 1065 or 1120-S filing deadline: Tax filing deadline for partnerships, multi-member LLCs, and S-corps.

- March 31, 2024 – 1099 form filing deadline: Date to file 1099 forms (except Form 1099-NEC) electronically with the IRS.

- April 15, 2024 – Tax day: Single-member LLCs, sole proprietors, and C-corps must file their income tax returns by this day to avoid penalties.

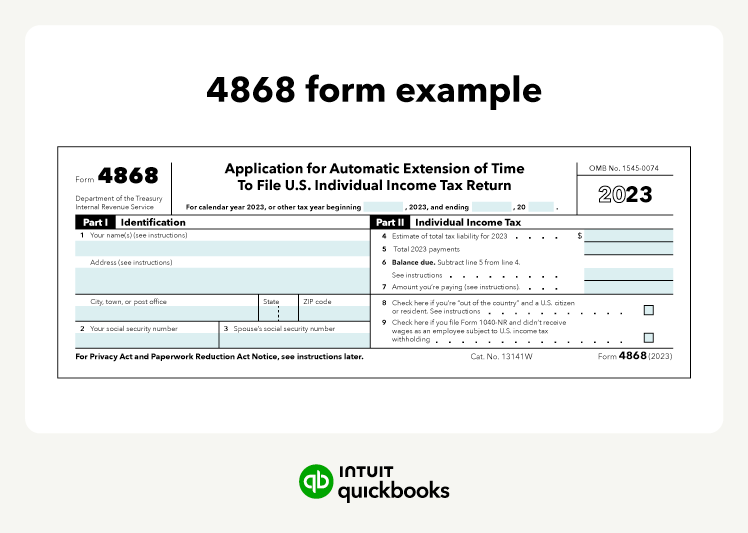

- April 15, 2024 – Extension request deadline: File Form 4868 before the tax day if you need more time to file your tax return.

- September 16, 2024 – Extended tax deadline for S-corps and partnerships: If you applied for a tax filing extension before tax day, you must submit your return by this date. This day is also the extension filing deadline for C-corps with a June 30 fiscal year-end.

- October 15, 2024 – Extended filing deadline for calendar year C-corps: If you apply for a tax filing extension before tax day, you must submit your return by this date.

Note the extension filing deadline is different for individuals and C-corps. The filing extension deadline for C-corps is October 15, 2024, versus September 16, 2024, for S-corps, multi-member LLCs, and partnerships.

Tax due dates for individuals

Individual income tax returns are typically due April 15 unless the date falls on a weekend or holiday. For individuals, the last day to file your 2023 taxes without an extension is April 15, 2024. You can submit Form 4868 to request a tax filing extension.

Here are the key tax deadlines for individuals, such as employees, independent contractors, and self-employed individuals:

- Jan 16, 2024 – Quarterly estimated taxes due: For the fourth quarter of 2023.

- Jan 31, 2024 – W-2 and 1099 form distribution deadline: Date for companies to send you your W-2 and 1099 forms.

- April 1, 2024 – Deadline for RMD: You have until this date to take your first required distribution from your requirement account if you turned 73 in 2023.

- April 15, 2024 – Tax day: Deadline for individuals to file their tax returns. It’s also the deadline to file Form 4868 to request a tax filing deadline extension.

- April 15, 2024 - Deadline for IRA and HSA contributions: This is the last day to contribute to your IRA or HSA for the previous tax year.

- April 15, 2024 – Quarterly estimated taxes due: For the first quarter of 2024.

- June 17, 2024 – Quarterly estimated taxes due: For the second quarter of 2024.

- September 16, 2024 – Quarterly estimated taxes due: For the third quarter of 2024.

- October 15, 2024 – Extended tax deadline: Tax filing deadline for individuals who applied for a tax filing extension.

- December 31, 2024 – Deadline for RMD: Required minimum distribution deadline for individuals age 73 or older.

- January 15, 2025 – Quarterly estimated taxes due: Fourth quarter 2024 estimated tax payment due

The dates do not cover all tax deadlines, just the most important. You can find a list of all important tax dates on the IRS website.

Tax filing extension deadlines

If you need to request an individual tax extension, you must file an extension request with the IRS by April 15, 2024. You’ll use Form 4868 to request an extension.