If you work as a freelancer—or you’re a small business contracting out employment—filing your taxes may look a bit different than those who receive standard W-2 forms.

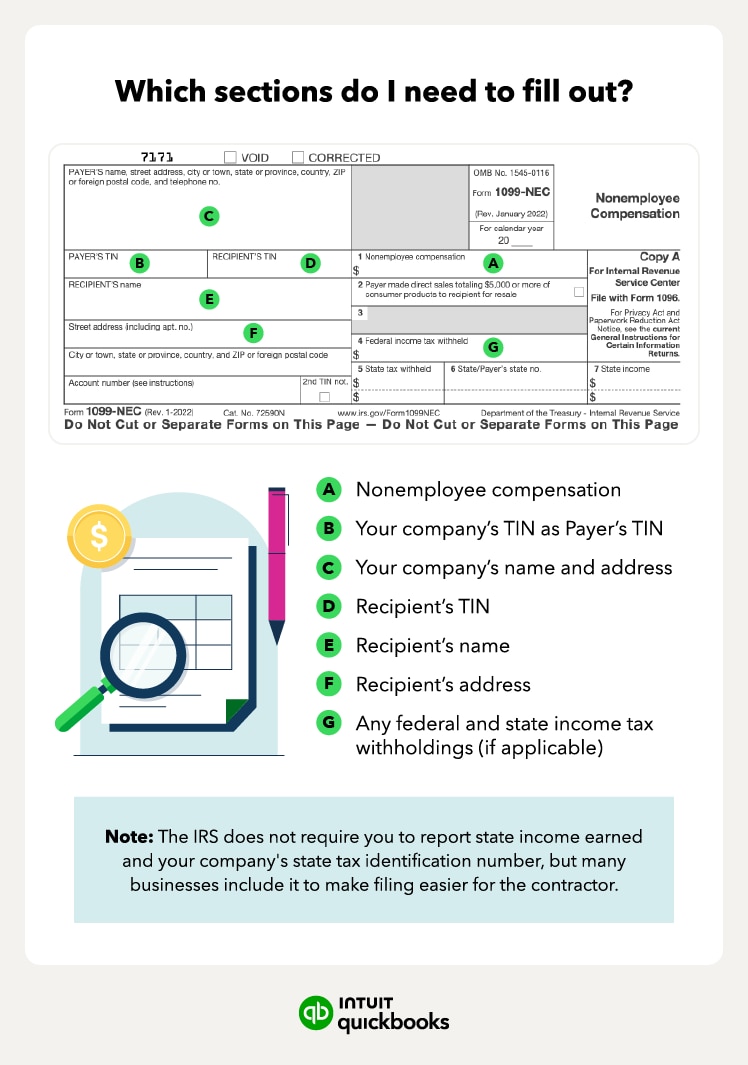

Small business owners have a number of tasks to complete during tax season, and one important step is providing 1099 forms to independent contractors. Before understanding how to fill out a 1099 form, you’ll need to identify workers who are contractors, understand the process for completing a 1099-NEC form, and submit the forms properly.

If you’ve provided Form 1099-MISC to contractors in prior years, you’re still in the right place. The new Form 1099-NEC has replaced 1099-MISC to report nonemployee compensation.

Read on to answer all your questions regarding filling out a 1099 and ensure tax season is a breeze.

Jump to: