Update, November 29, 2023: The IRS is delaying the 1099-K threshold change for third-party settlement organizations (TPSO) like PayPal and Venmo. Taxpayers and small businesses will not receive a 1099-K from TPSOs for tax year 2023 (taxes you’ll file in 2024) unless they receive over $20,000 in payments from over 200 transactions. The IRS now plans to use the 2024 tax year (taxes you’ll file in 2025) as a transition year with a threshold of $5,000 before implementing the planned $600 threshold. The original article below focuses on the $600 threshold — we’ll provide an update when the IRS provides more information.

Original article continues below:

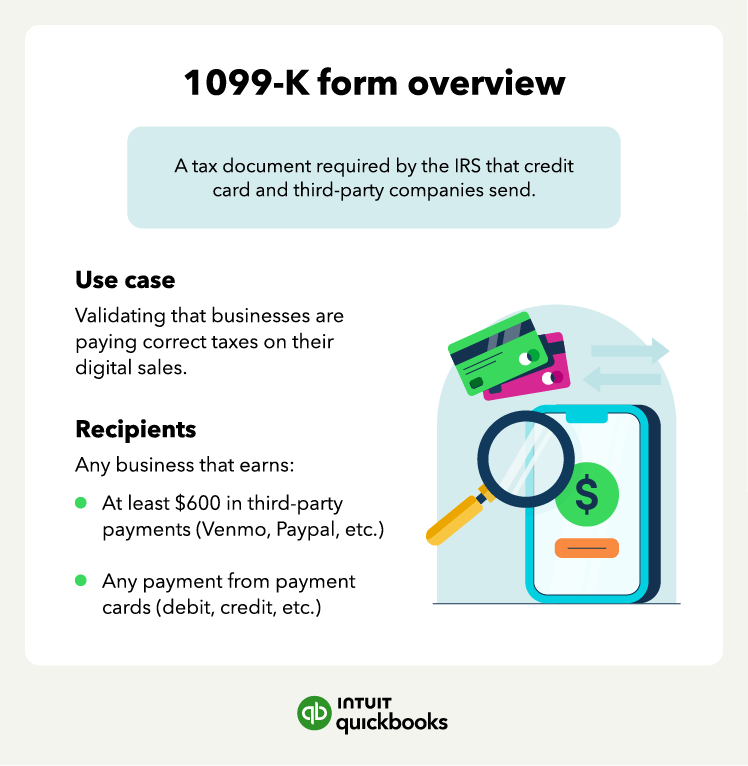

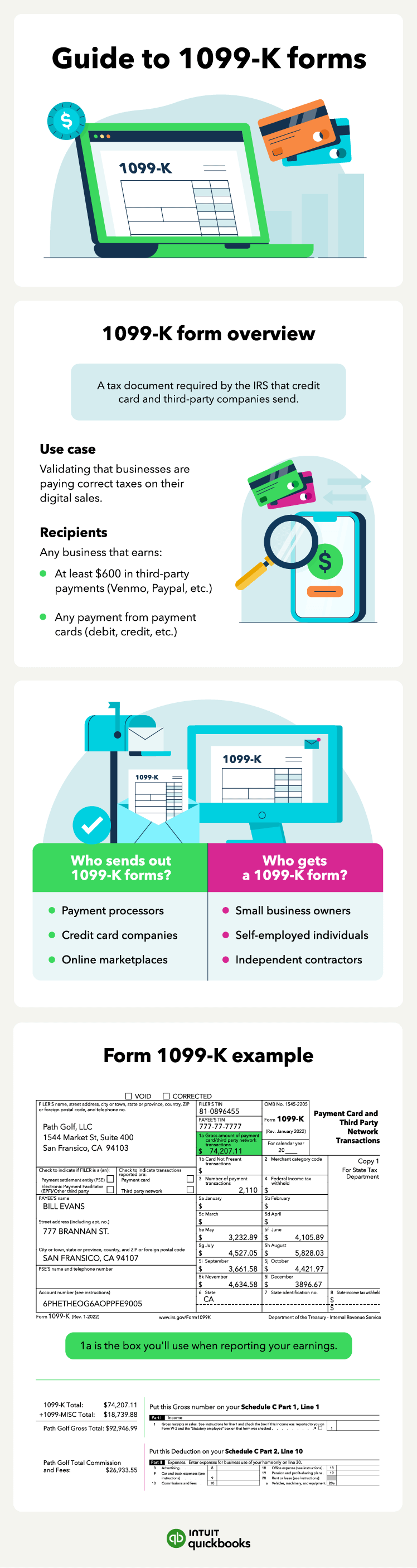

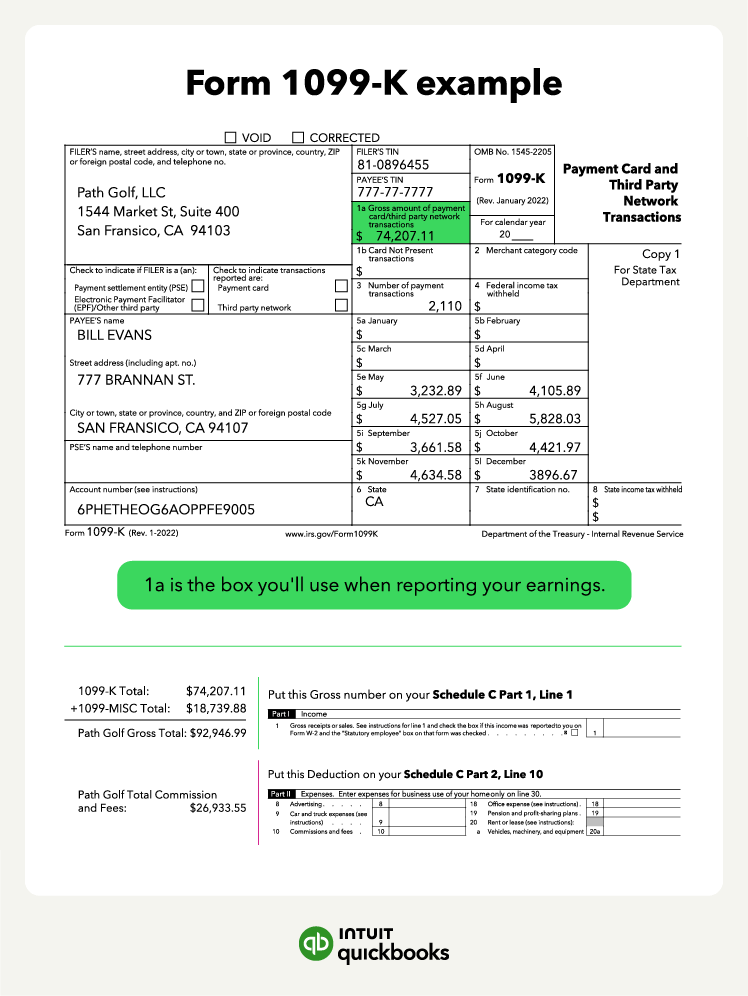

As a small business owner, you may be swimming in various tax documents, from issuing Form W-2s to your employees or gathering your income and expenses for your tax return. Due to recent changes, the IRS now has a lower reporting threshold for 1099-k forms. As a result more 1099-K forms are expected to be sent to individuals and businesses starting in 2024.

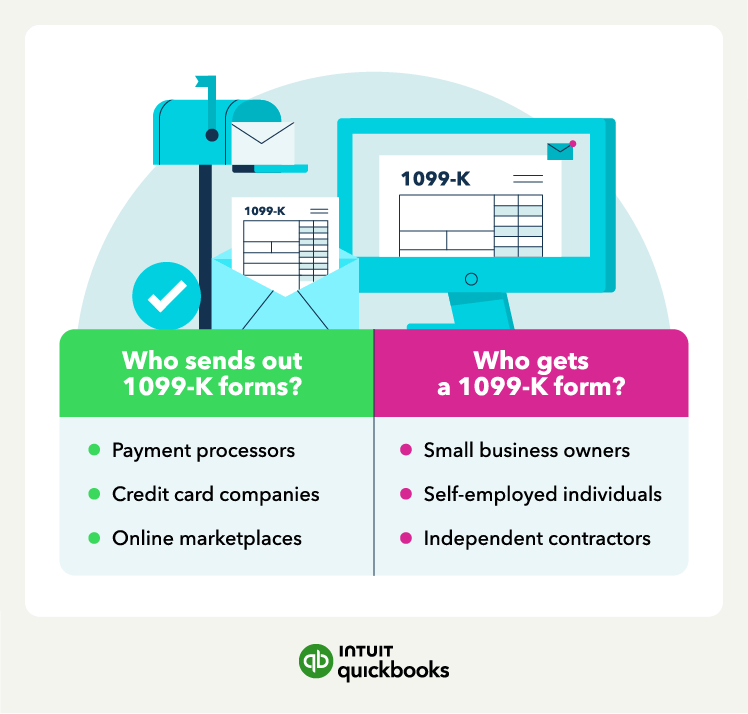

Most small businesses didn’t get a 1099-K form last year, but given the recent changes to Form 1099-K requirements, you might get one (or more) this year. 1099-K forms come from payment cards (think merchant services processing credit, debit, and gift cards) or third-party payment networks that include marketplaces (such as eBay or Etsy) or payment apps and processors (such as PayPal or Venmo) you use.

Each of those companies is responsible for sending you a 1099-K form (they also send a copy to the IRS and in some instances your state too). So you may get more than one if you do business on many marketplaces or use various payment apps.

Let’s dig into what a Form 1099-K is and what you need to do with it.