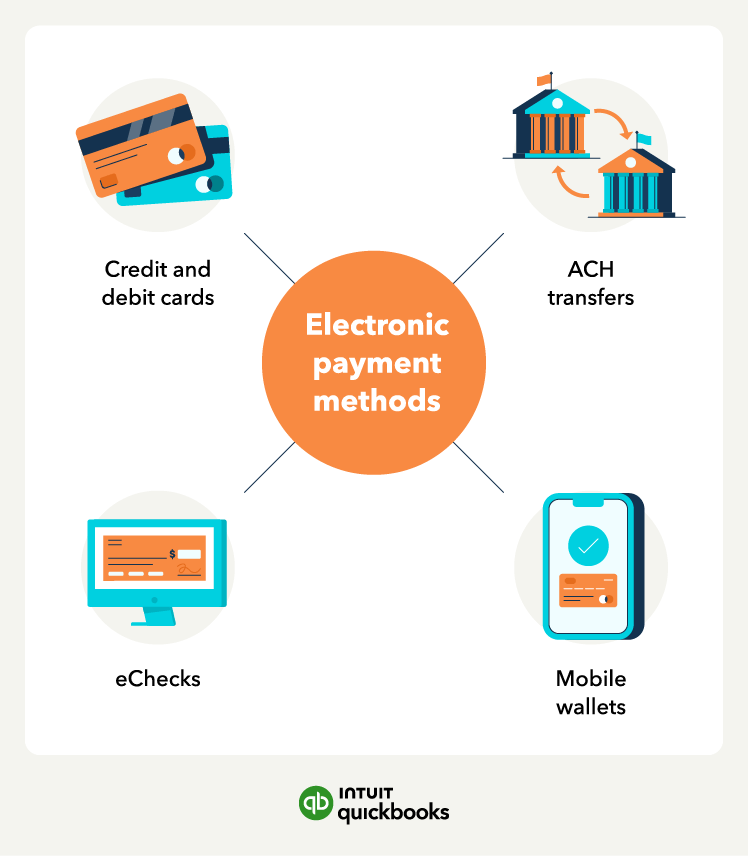

eChecks

Typically have lower fees than ACH transfers and card payments but are likely not as familiar to the customer.

An eCheck is a lot like when a customer pays with a paper check—similar to traditional paper checks, eChecks use the ACH network. To initiate an eCheck payment, the recipient typically requests authorization from the payer to debit their bank account for the specified amount.

The money is then taken directly out of their bank account to pay for the purchase, so this is also sometimes called a “direct debit.” Be aware that banks can take several days to process and clear this payment type, but they are one of the cheapest options.

One key difference between ACH transfers and eChecks is the form of authorization. ACH transfers require the account holder's permission, usually in the form of an authorization form or through online banking. In contrast, eChecks are similar to traditional paper checks, but instead of physically being printed and mailed, they are processed electronically through the ACH network.

On the downside, eChecks may not be suitable for international transactions, as they typically only operate within the domestic banking system. Additionally, processing delays may occur on weekends and holidays (similar to ACH transfers).

Mobile wallets

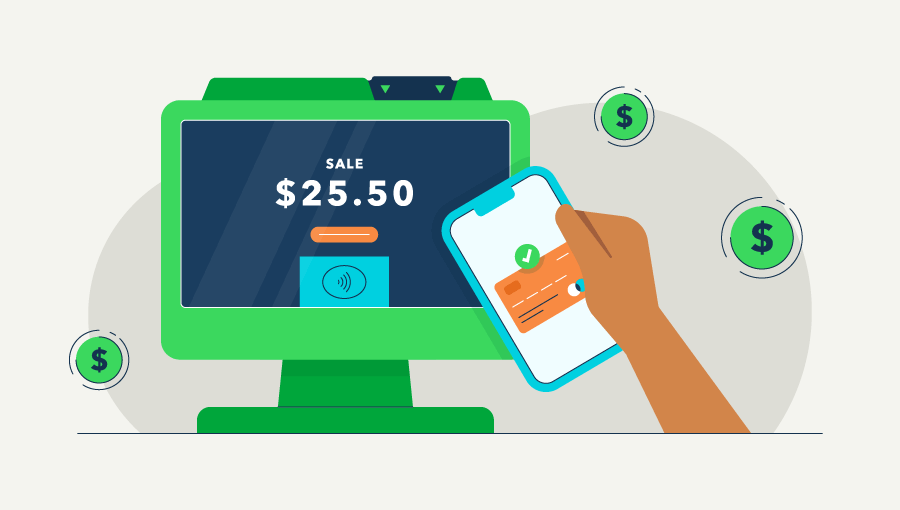

Allow contactless payments and reduce the risk of fraud, as the user’s payment info is stored securely on their devices.

Mobile wallets, also known as digital wallets, include services like Apple Pay and Google Wallet, allowing users to store their credit or debit cards on their mobile devices. They then have a convenient and more secure way to make electronic payments.

With mobile wallets, users can simply tap their phones or scan a QR code to complete a transaction, eliminating the need to carry physical debit or credit cards—making it quicker and more efficient than traditional payment methods.

The fees for mobile wallet payments will vary depending on the wallet provider and type of transactions. Generally, they are in line with card payment fees and may even be cheaper in some cases.