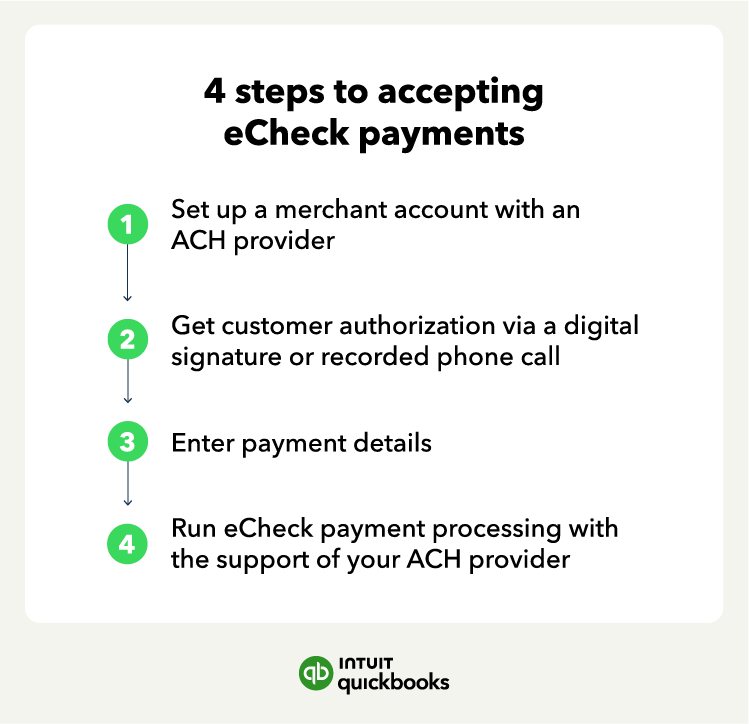

To accept eCheck payments as a business, you need a payment processor that supports this method and a secure online form that collects the customer's bank information. If you decide to use eChecks as a payment option, follow these steps:

1. Set up an ACH merchant account

Only work with reputable ACH transaction providers that encrypt customer data. For security reasons, Keep the number of employees who can access this financial data to a minimum if possible.

2. Get customer authorization

You can get customer authorization via a digital signature or recorded phone call. You’ll need your customer to approve this transaction before you can access the funds. Your customer will need to provide their checking account number, bank routing number, and their payment amount.

3. Enter payment details

Before you begin accepting eCheck payments, you’ll need to gather and submit the following information to the ACH merchant:

- Federal Tax ID number

- Business name and address

- Transaction processing volumes

- Years in business

- Bank account details

- Customer’s checking account number

- Customer’s bank routing number

- Customer’s payment amount

As with any form of payment, merchants and customers are encouraged to protect their payment information. Notify your ACH provider if you need to change this information or suspect any fraudulent activity.

4. Run eCheck payment processing with the support of your ACH provider

Once you’ve set up your account, received customer authorization, and entered your payment details, you’re ready to process the payment and access your funds. Keep in mind that the process can take a few days to complete.

Since eChecks are a form of EFT that enables you to easily collect recurring payments, process payroll, and initiate online payments, prepare to enjoy a more streamlined payment process.

Advantages of electronic checks

eCheck transactions can be useful for recurring payments and direct deposit, but several other perks may benefit your business.

Ease of use

If your business frequently processes paper checks or has recurring customer transactions, eChecks can save you time. Your customers will benefit from having easier ways to pay, and you’ll reduce the risks of human error during payment processing. eChecks also provide a digital transaction log that feeds data to your accounting system, making reconciliation simple.

Reliability

eChecks are generally a reliable way of transferring funds. They use the ACH network to process transactions. The ACH system is governed by the Federal Reserve as well as the National Automated Clearing House Association, which upholds strict regulatory guidelines for participating banks and providers.

eChecks pass through far fewer hands than paper checks, which speeds up the transaction process and mitigates fraud risk (more on that in a moment). If your business collects recurring customer payments, eChecks can be a more consistent payment method than credit cards.

Cost-effectiveness

Another big benefit eChecks offer merchants and other small businesses is their cost-effectiveness. Processing fees for eChecks are typically more affordable than other payment methods, like credit cards, which can range between 1.5% to 3.5% of each transaction. All in all, accepting eChecks can reduce payment processing costs by up to 60%.

Security

eChecks are generally considered a safe, reliable payment option for both merchants and customers. On the customer’s side, eChecks leverage data encryption to protect sensitive details like bank routing information and account numbers. In addition, eChecks exchange fewer hands than sending or cashing a check.

As for the merchant, data encryption works in your favor too. To mitigate the risk of receiving a bad check, it’s a good idea to research payment processors and ensure you’re only working with reputable providers.