Time for everyone’s favorite topic: taxes!

Still with us? If you’ve just launched your new business and are ready to start making sales, you might be asking yourself, “Do I need to charge sales tax?”

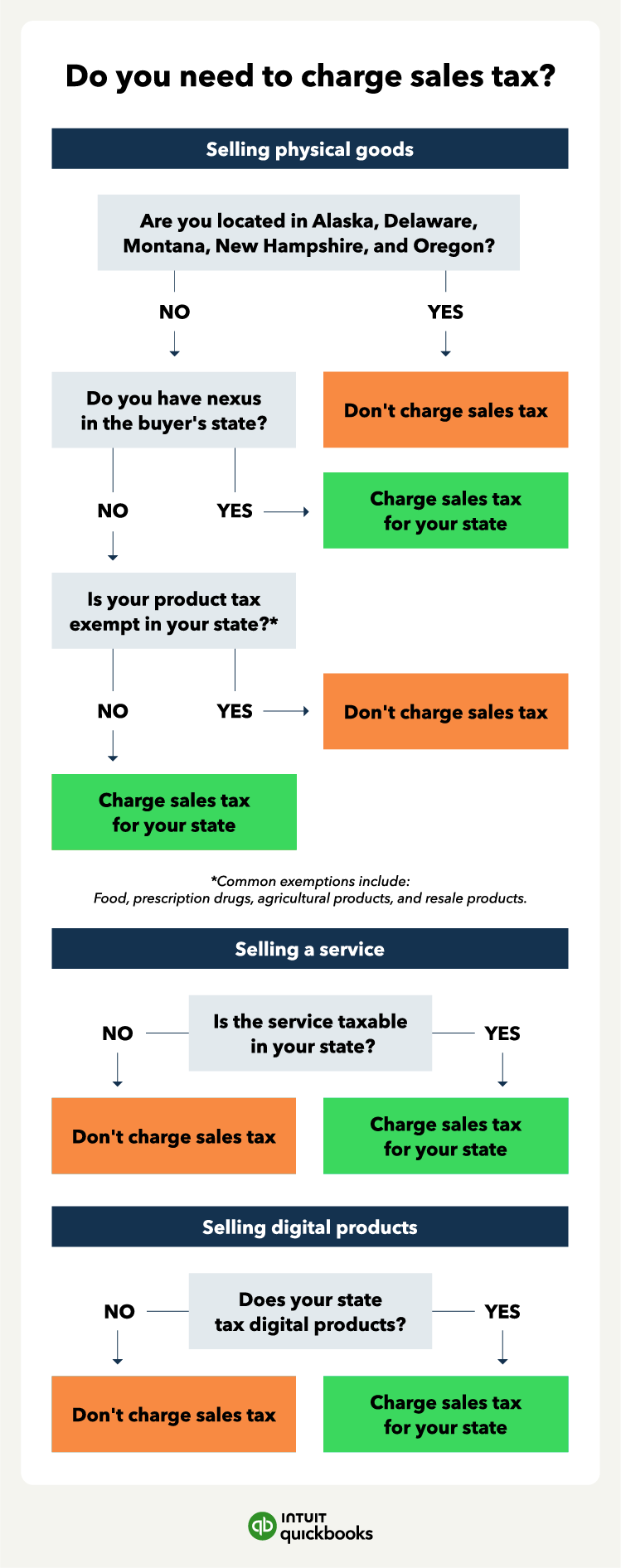

Knowing whether you need to charge sales tax is—no surprise—pretty complex. Especially when sales tax laws make for dry reading and can differ from state to state. Still, understanding your tax obligations is crucial for small businesses and retailers—and it doesn’t need to be quite as baffling as you might think.

In this guide, we’ll help you understand when to charge sales tax, including how much sales tax you need to collect depending on your state.

Jump to: