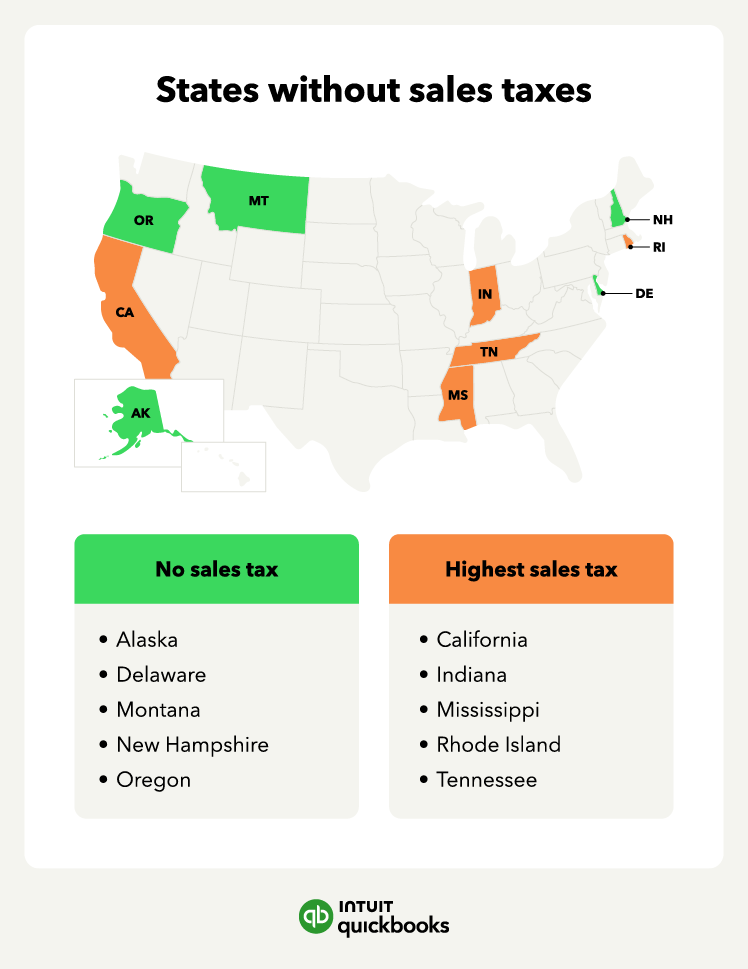

There are many ways you can run a business and sell products to customers all over the country. However, doing so can create sales tax obligations for the state you sell in—meaning you need to charge and collect sales tax in these states.

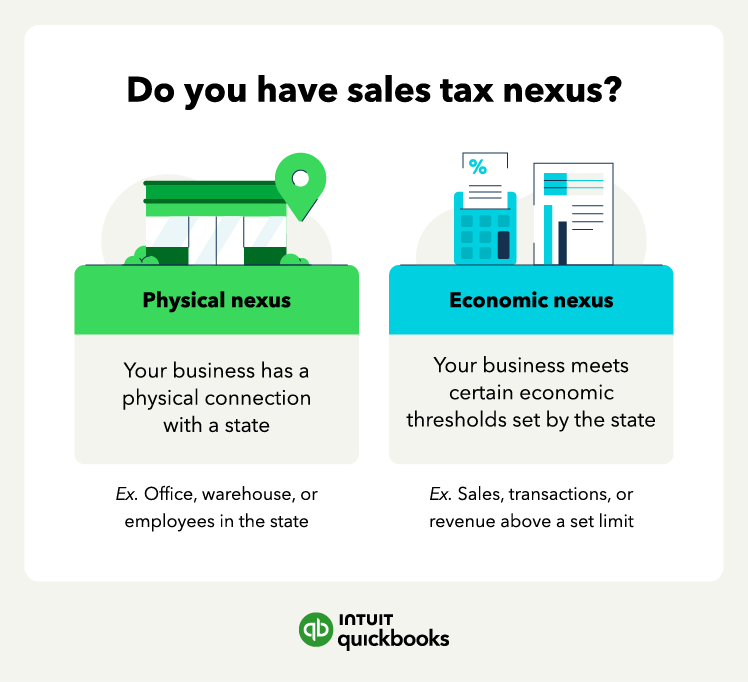

Sales tax nexus is when you must pay sales tax in a state. Establishing a sales tax nexus means you have a connection with the state. Various circumstances may trigger sales tax nexus for your business, even if you don’t have a physical store there.

Here’s what sales tax nexus is, the various requirements, and why it matters for your business: