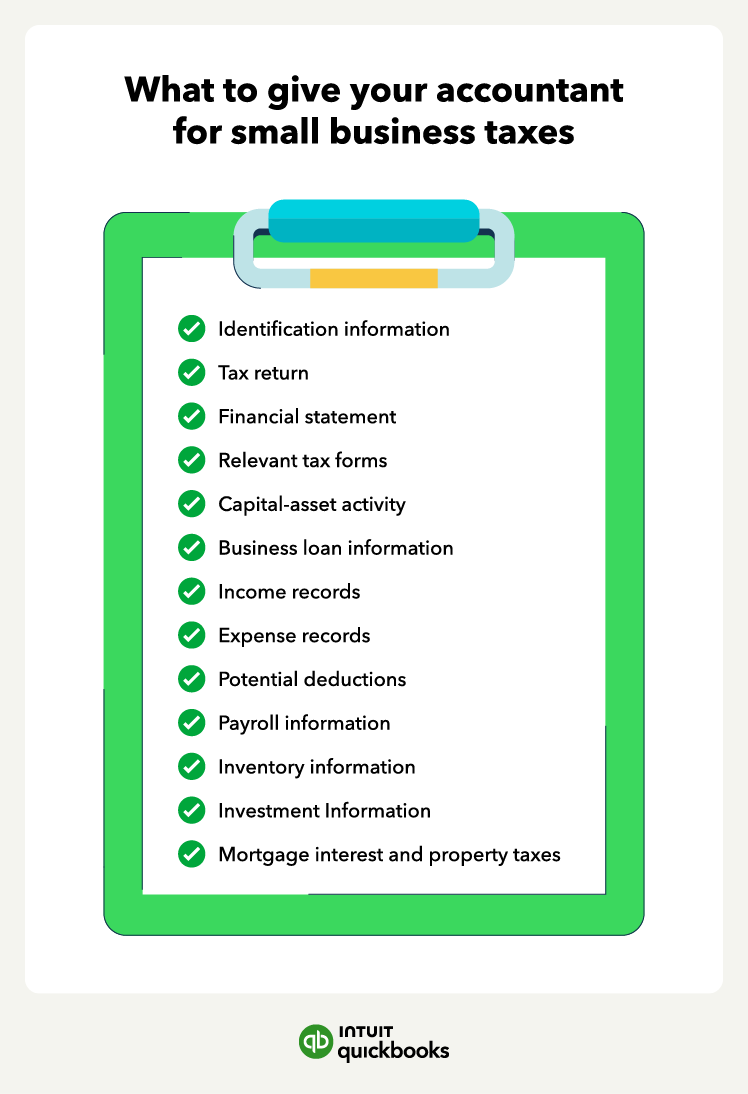

As a small business owner, you wear many hats, from CEO to social media manager. When it comes to small business taxes and finances, bringing in a tax professional could be a smart move. But you might wonder, "What do I need to give my accountant for small business taxes?"

When tax season rolls around, having an accountant manage the details frees you up to focus on growing your business. Make sure to have all your documents ready for a smoother tax process and maximize savings. Read on to learn about the 13 essential things you’ll need to share.

- Identification information

- Tax return

- Financial statement

- Relevant tax forms

- Capital-asset activity

- Business loan information

- Income records

- Expense records

- Potential deductions

- Payroll information

- Inventory information

- Investment Information

- Mortgage interest and property taxes

We even include a small business tax preparation checklist at the end to help you keep track of every document.

For optimal results, share any documents that have a chance of qualifying as a deduction. Speak with your tax accountant if you are unsure which expenses will meet the mark.

For optimal results, share any documents that have a chance of qualifying as a deduction. Speak with your tax accountant if you are unsure which expenses will meet the mark.