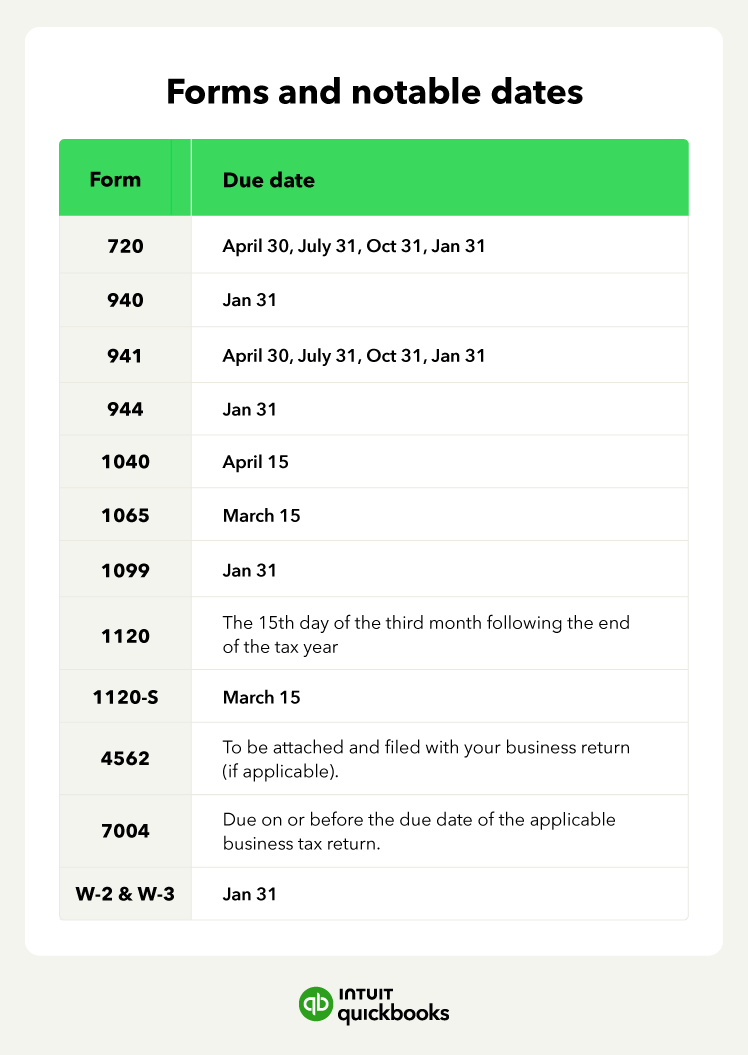

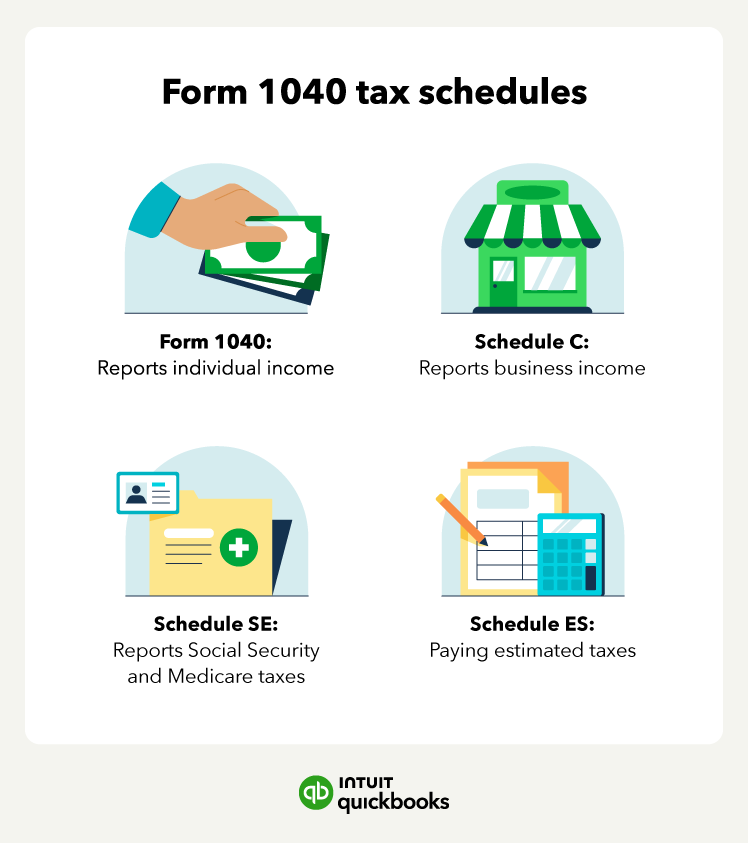

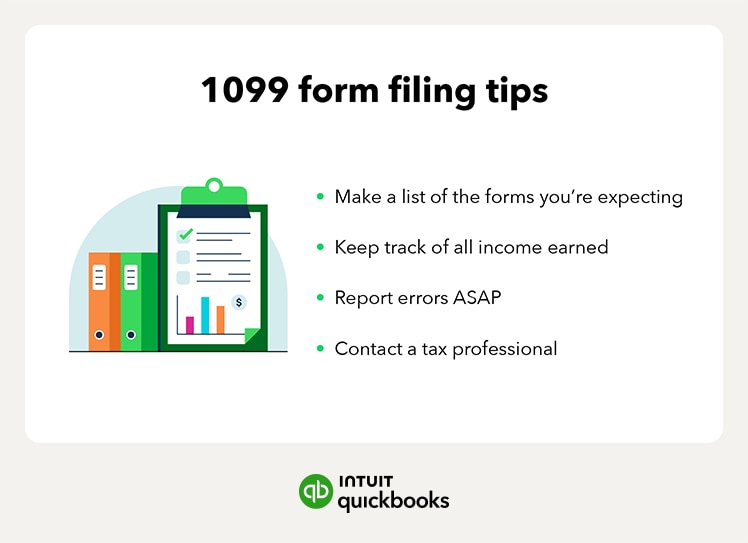

If you’re a small business owner, you have to file taxes every year. Learning how to file dozens of tax forms with unique due dates and schedules can be overwhelming. Small business owners also need to avoid mistakes that incur penalties and stay on top of deductions. For a small business, taxes are stressful, to say the least.

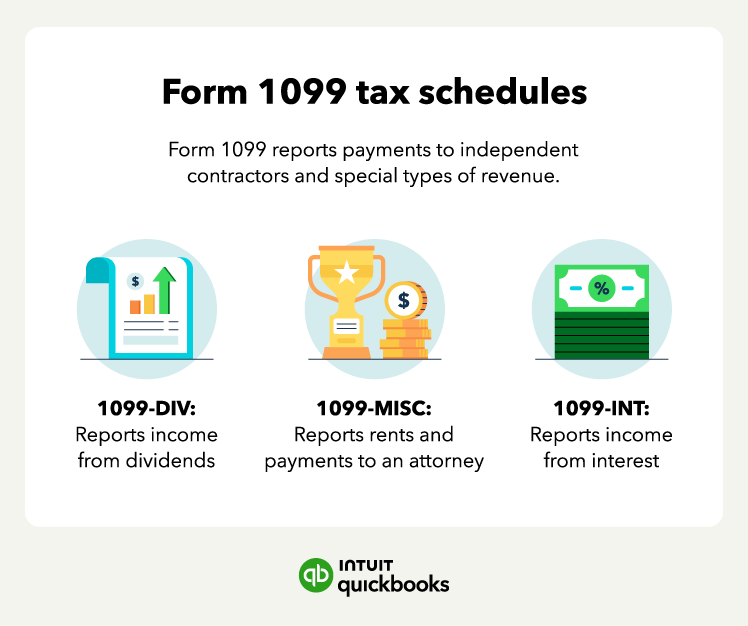

Whether you need filing advice or accounting software, we’re here to help. This streamlined guide explains the 25 most important small business tax forms. By reviewing these forms and their tax dates, you’ll learn how to file taxes for a small business.

We recommend reading through the entire article to learn the ins and outs of taxes for small businesses. You can also use the menu below to skip to the business tax form that’s most important to you: