Please note this is an estimation tool and should not be taken as financial or tax advice. Always refer to IRS guidelines for the latest updates.

5. File your write-off correctly

Once tax season rolls around, you need to make sure that you properly file your travel expenses. For self-employed travel expenses, you will list travel write-offs on Schedule C Form 1040. Businesses must claim travel expenses on Form 2106 and report them on Form 1040 or Form 1040-SR as an adjustment to their total income.

While there’s no annual travel deduction limit, the IRS scrutinizes higher write-offs. Be sure to calculate your business expenses with a tax attorney before submitting a large filing.

How to calculate business travel expenses

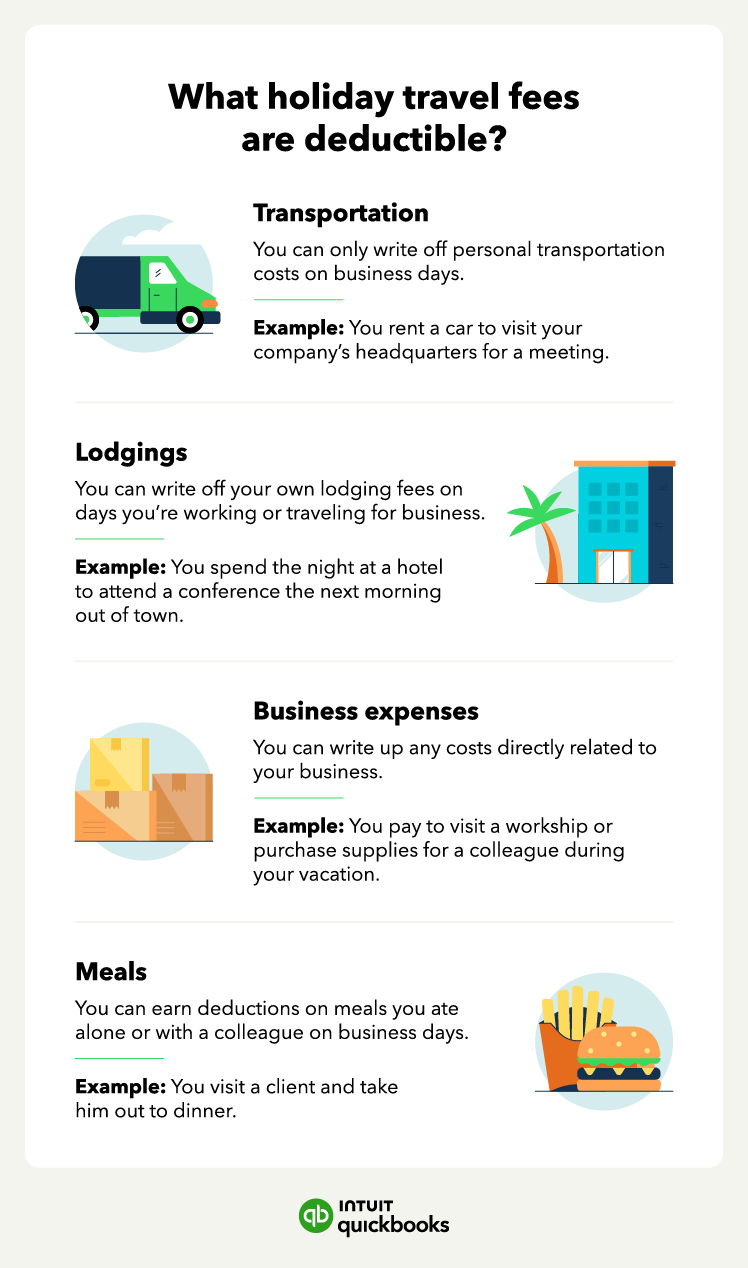

To calculate the estimated travel deductions, you can use one of the following formulas. When tallying write-offs, be careful about what you consider a business expense. While baggage fees, laundry costs, and admission to a workshop all count, you shouldn’t include personal expenses like souvenirs. Additionally, you can only write off entertainment costs when treating a client, vendor, or business acquaintance.

Business trip with no personal days

This formula applies to business trips that involve no personal days. The entire trip consists of travel and business purposes.

Travel deduction = Transportation + lodging + business expenses + (meals / 2)

Business trip with personal days in the middle

This formula applies to business trips with vacation time sandwiched between business days. As long as you spend more time on business than leisure, you can include transport and lodging costs in your deductions.

Travel deduction = Transportation on business days + lodging + business expenses + (meals on business days / 2)

Other trips involving business

This formula applies to trips that are mostly for business with vacation days at the beginning or end or personal vacations with at least one business day. You cannot deduct any fees from personal days, so you will end up spending much more on lodgings and transport.

Travel deduction = Transportation on business days + lodging on business days + business expenses + (meals on business days / 2)

Example business vacations you could write off

If your business requires you to travel, you could be missing deductions that can shrink your taxable income and grow your bottom line. While travel expenses must be business-related to be 100% deductible, taking a little vacation time during a trip isn’t unusual.

With that in mind, here are some ideas that you might be able to coordinate with or plan “in and around” your holiday travel to maximize your tax deductions.

- Attending your company’s annual meeting: The IRS offers deductions for attending a corporation or LLC's annual meeting. These meetings allow you to discuss company goals, learn more about your field, and network with other professionals.

- Visiting clients: Strengthening relationships with your customers boosts sales, attracts new customers, and provides tax deductions for businesses with clients all over the country. Try to meet as many important clients as you can when visiting their area.

- Visiting vendors: Many vendors, subcontractors, suppliers, and corporate affiliates set up shop all over the country. Take an opportunity to network, renegotiate prices, or tour the facilities.

- Attending conferences or workshops: Look into local conferences and workshops when traveling. Seminars on business, management, taxes, marketing, SEO, website building, customer service, and technical training are the most common. Workshops relevant to your profession are tax deductible.

While these ideas might begin as a tax write-off, they can grow into a relationship with clients, business partners, and vendors.

Things to consider when writing off travel expenses for holiday travel

Some businesses keep working through the holiday season, so you may find some overlap between family and business. However, IRS auditors invest time and resources into ensuring these expenses relate to business and not a holiday trip.