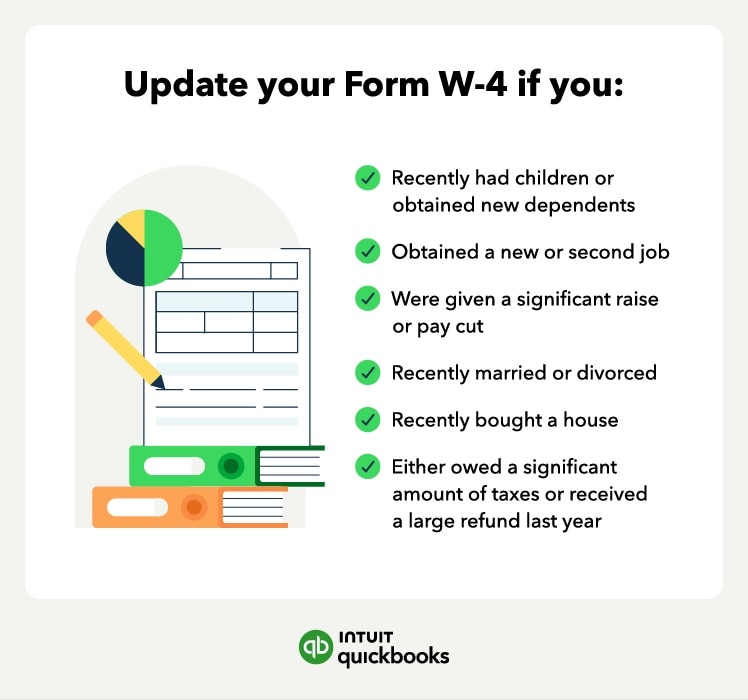

There are a few different reasons why you may want to fill out a new W-4 tax form. Here’s a list of questions you can use to determine if you should change your withholdings on your W-4 form:

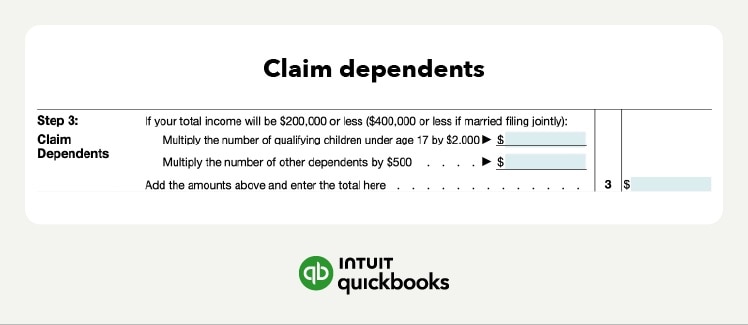

- Did you have children or new dependents?

- Did you get a new job?

- Did you get a significant raise or pay cut?

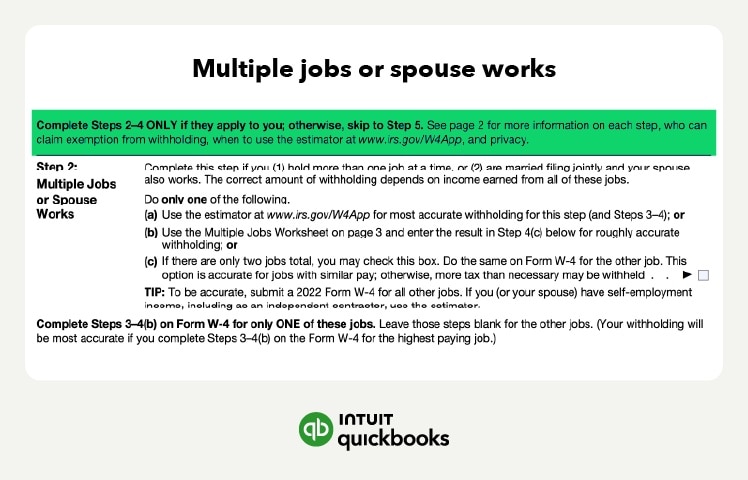

- Do you or your spouse have a second job or form of income?

- Are you married? If yes, does your spouse work as well?

- Did you get divorced?

- Did you buy a house?

- Do you freelance on the side?

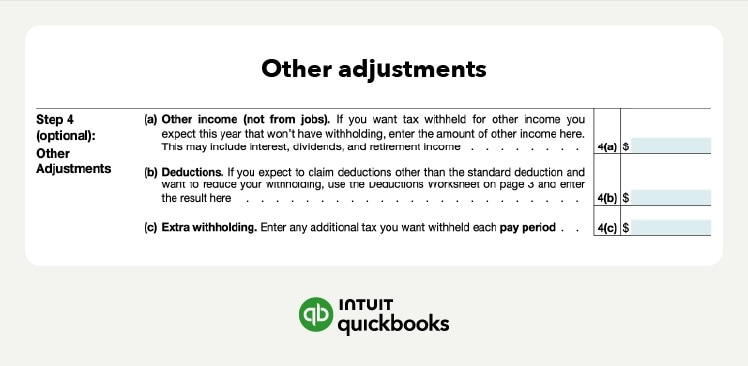

- Is there a chance that you won’t use the standard deduction?

- Did you get a big refund or owe a large amount of taxes last year?

If you answered yes to any of the questions above, it’s a good idea to revisit your W-4 and figure out your new income tax withholdings. All of these types of life changes can affect the amount of taxes you owe. In some cases, you’ll owe additional taxes, and in other cases, you might owe less.

What changed on the new W-4?

Previously, employees could elect to claim allowances to lower the amount withheld from their wages. Essentially, the more allowances an employee claimed, the less money was withheld, making their regular paychecks higher. However, this sometimes created issues down the road, causing the employee to pay additional taxes at the end of the tax year.

In 2020, a new W-4 form was introduced to alleviate any confusion and underpaying that the previous form provided. This change was due to the 2017 Tax Cuts and Jobs Act. On the new form, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet.

Do W-4 forms need to be completed yearly?

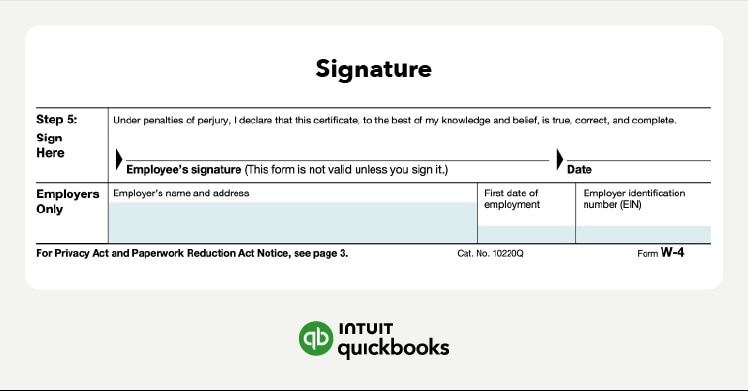

The W-4 does not need to be filled out yearly. However, if you have a change in circumstances that affects how much money should be withheld from your paycheck, completing a new W-4 is advised.

Do I claim 0 or 1 on my W-4?

A frequently asked question about the W-4 is if you should claim 0 or 1. The difference between claiming 0 or 1 determines whether you’ll get more money in each paycheck or in a larger lump sum during tax season. Claiming 0 will take out more taxes per paycheck, and claiming 1 will take out less taxes per paycheck, giving you more money each month rather than at the end of tax season.