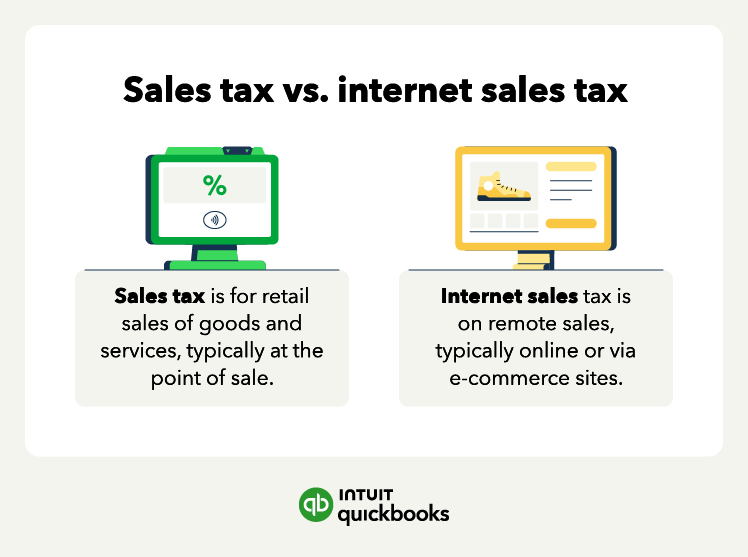

If you purchase an item in a store you likely pay sales tax. The same goes for selling. If you sell goods, you need to collect sales tax. But when it comes to online and e-commerce sales, the rules can be a bit different.

For many years, online retailers did not have to charge and collect sales tax in states where they were not located. That is no longer the case, and most remote sales now require you to collect internet sales tax. Let’s look at whether you need to collect sales tax and how to meet online sales tax requirements: