One of the toughest things for a small business owner to learn is how to calculate sales tax correctly. Miscalculating sales tax is a common error that can trigger an audit. With the explosion of e-commerce, calculating sales tax has become even more critical. It’s especially challenging for online retailers, as they often don’t understand what’s taxable, which sales tax rate they should use, and which government agency receives the sales tax that they collect.

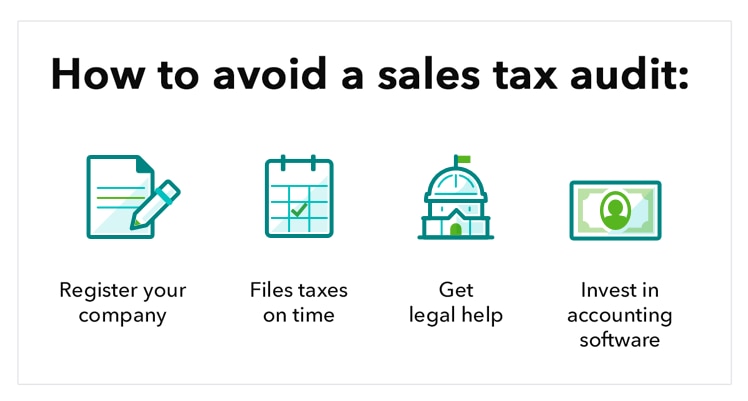

Using this guide, we’ll walk you through the intricacies of sales tax. We’ll start by defining sales tax, including how to collect it and how to pay it. Then we’ll dive into how to avoid sales tax audits.