Types of checks that go stale

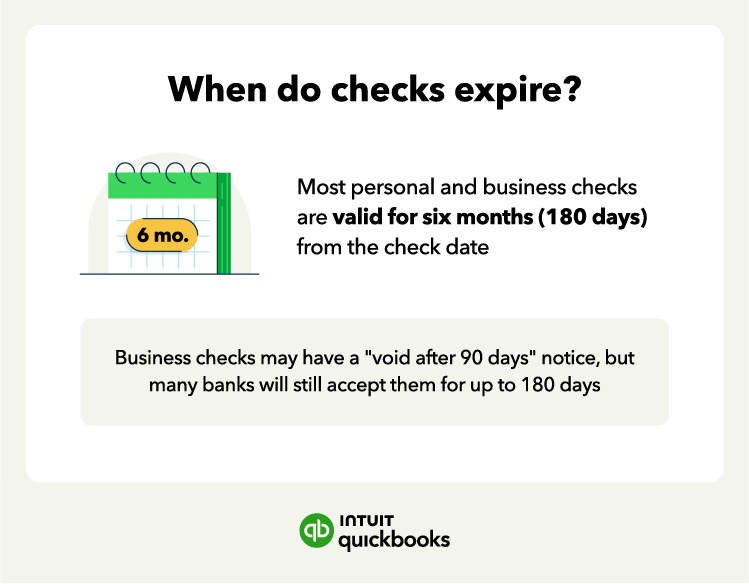

While personal and business account checks expire after 180 days, other types of checks can have different expiration dates.

Here are the key expiration dates for various types of checks:

- Personal checks: Valid for 180 days

- Business checks: Valid for 180 days

- Payroll checks: Valid for 180 days

- US Treasury checks: Valid for one year

- Cashier’s checks: Typically 180 days

- Certified checks: Typically do not expire

- Money orders: Typically do not expire

US Treasury checks are government-issued checks valid for one year from the date issued. Even if they expire, you can still get a replacement by contacting the agency that authorized the check.

A cashier's check is essentially a check drawn on the bank's own funds. The bank guarantees the funds. These are typically valid for 180 days. Certified checks are personal checks from a bank account and guaranteed by the bank. They typically don't expire but are often subject to state unclaimed property laws.

Money orders generally don't expire, but some issuers may charge a fee if the payee doesn’t cash it within a certain time frame.

Uncashed checks to vendors, contractors,

Uncashed checks to vendors, contractors,  Some businesses may print "Void after 90 days" on their checks. While banks will usually still honor these for up to six months, it's best to deposit them sooner rather than later.

Some businesses may print "Void after 90 days" on their checks. While banks will usually still honor these for up to six months, it's best to deposit them sooner rather than later.