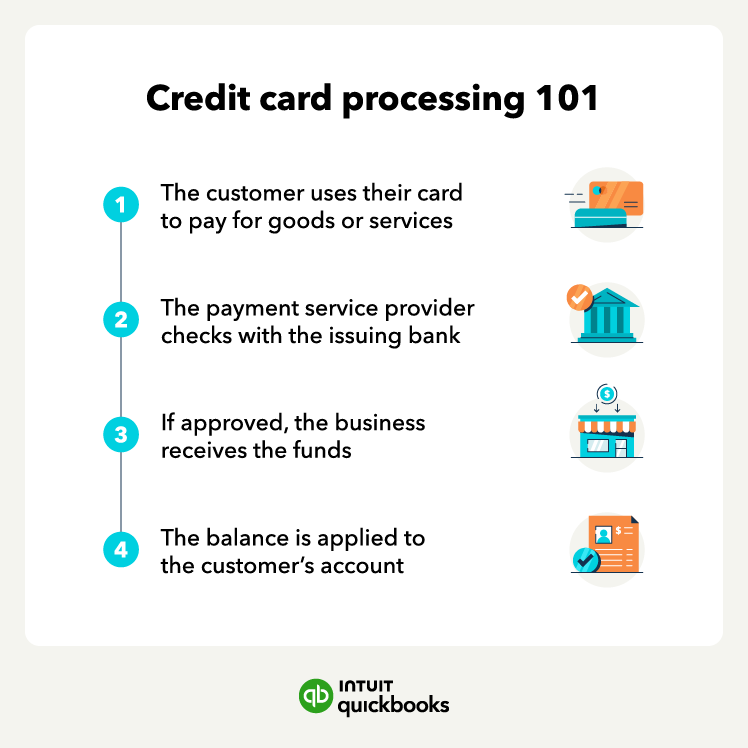

The process seems pretty simple on the surface: a customer swipes their card and then you get your money. But there’s actually quite a bit of complexity involved in credit card transactions.

Let’s break it down into three main parts: authorization, authentication, settlement, and clearing.

1. Authorization

When a customer pays with a credit card (by inserting, swiping, or tapping on a terminal or using it online on a website or through a digital wallet like PayPal), the merchant’s payment processor reaches out to the issuing bank through a credit card network. Then, the credit card network sends an authorization request to the bank that issued the card.

Those authorization requests include:

- The credit card number

- The card’s expiration date

- The CVV (Card Verification Value) security code (the 3-digit code on the back of the card

- The payment amount

- Optional: The billing address (as a part of the fraud-prevention Address Verification System (AVS))

Next comes the authentication process.

2. Authentication

Once the authorization request arrives at the issuing bank, they verify that the card number, billing address, and CVV match. Then the bank approves or declines the request. Denials can be based on a lack of funds, if a card is expired, if the card has been reported stolen, or if there is fraud suspected.

That response is bounced back through the same channels and reaches the merchant.

If the transaction is approved, the customer will see a hold on the purchase amount on their account, and at this stage, the transaction will be pending. At the end of the day, the merchant will start the settlement and clearing process to complete the transaction.

3. Settlement and clearing

At this point in the transaction, the customer’s part in the process is over. Batches of authorizations are sent to the processor at the end of the day or another preset time, though there are some processors that offer real-time processing that don’t need to be batched. This may require manual processing or it may happen automatically depending on which processor you use. The processor will then request each issuing bank to transfer the funds to the merchant account.

This process usually takes a day or two. Once payments are processed, the merchant will receive their funds. The payment received will be what the seller has charged their customer for the goods or services they provided, minus any fees associated with processing the payment.