Straight-line depreciation examples in the real world

Straight-line depreciation is used in everyday scenarios to calculate the width of business assets. To get a better understanding of how to calculate straight-line depreciation, let’s look at a few examples below.

Tree removal service example

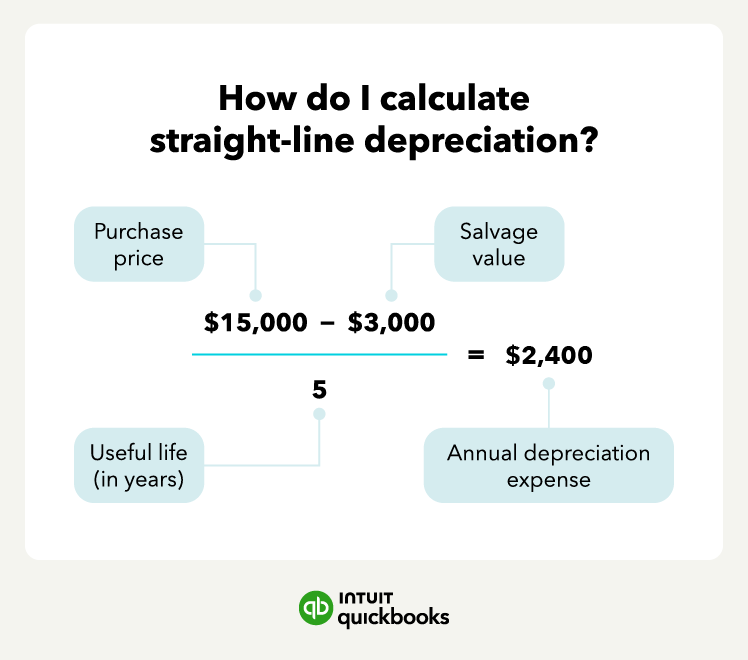

Let’s say you own a tree removal service, and you buy a brand-new commercial wood chipper for $15,000 (purchase price). Your tree removal business is such a success that your wood chipper will last for only five years before you need to replace it (useful life).

You believe after five years you’ll be able to sell your wood chipper for $3,000 (salvage value). Here’s how you would calculate your wood chipper’s depreciation using the straight-line method:

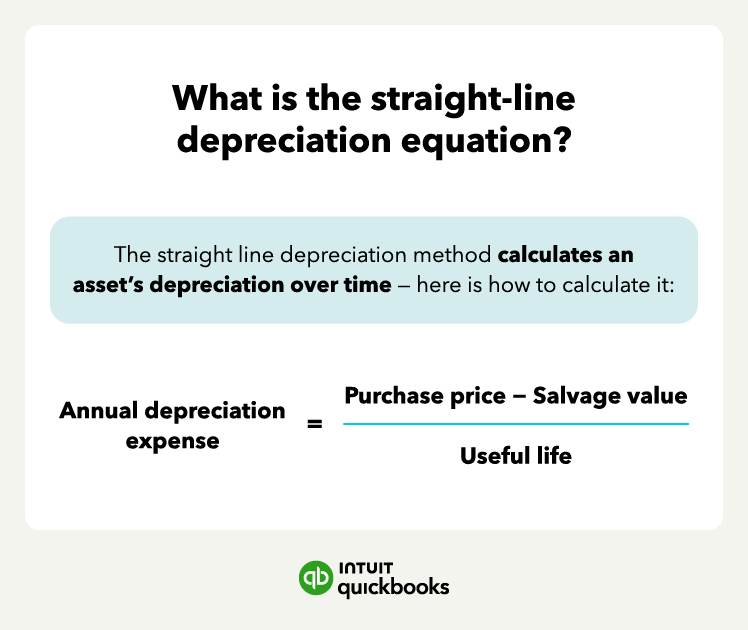

Annual depreciation per year = (Purchase price of $15,000 − salvage life of $3,000) / useful life of five years

Annual depreciation per year = $12,000 / 5

Annual depreciation per year = $2,400

According to the straight-line method of depreciation, your wood chipper will depreciate $2,400 every year.

Fishing business example

Now, let’s assume you run a large fishing business that sets out on the Bering Sea every summer to capture fresh salmon. You buy a new vessel for $280,000 to help increase production.

According to the IRS’s standard use of life, vessels fall under the 10-year property life. Once that 10-year period is up, you believe you can sell your vessel for $70,000. Using the straight-line depreciation formula, here’s how much your fishing vessel will depreciate each year:

Annual depreciation per year = (Purchase price of $280,000 − salvage life of $70,000) / useful life of 10 years

Annual depreciation per year = $210,000 / 10

Annual depreciation per year = $21,000

When crunching numbers in the office, you can record your vessel depreciating $21,000 per year over 10 years using the straight-line method.

Real estate example

Lastly, let’s pretend you just bought property to build a new storefront for your bakery. You installed a fence around the entire plot of land, which falls under the 15-year property life. The initial cost of the fence was $25,000, and you think you can scrap the wood for $3,000 at the end of its useful life.

Using the straight-line depreciation method, here’s how much your fence will depreciate each year:

Annual depreciation per year = (Purchase price of $25,000 − salvage life of $3,000) / useful life of 15 years

Annual depreciation per year = $22,000 / 15

Annual depreciation per year = $1,467

After building your fence, you can expect it to depreciate by $1,467 each year. Additionally, you can calculate the depreciation rate by dividing the depreciation amount by the total depreciable cost (purchase price − estimated salvage value).

In this case, the depreciation rate of your fence will be 6.67% ($1,467 / $22,000 = 0.067 x 100). With an asset’s depreciation rate, you can create a depreciation schedule to see how much value an asset loses each year.