SUTA tax credits

If you file and pay your SUTA taxes on time with the state, you may be eligible for a tax credit when it comes time to file your annual FUTA taxes. You can report the SUTA tax you pay using Form 940 to get the tax credit—as long as your business is not located in a credit reduction state.

A credit reduction state owes money to the federal government’s unemployment fund to pay their workers’ unemployment insurance. You can check the Department of Labor’s updated list of credit reduction states.

FUTA offers a maximum 5.4% tax credit to companies that pay their state unemployment contributions on time. When you subtract that 5.4% FUTA credit from the standard 6% rate, this greatly reduces the amount of FUTA tax your company owes to a much lower 0.6%.

Example of SUTA tax calculation

Say you run a small marketing agency in Texas with six employees.

For 2024, Texas’ taxable wage base for employees is $9,000, and the tax rates range from 0.25% to 6.25%.

Assume that your company’s SUTA tax rate for 2024 is 2.7%. Using the formula below, you would need to pay $1,458 into your state’s unemployment fund:

($9,000 taxable wage base x 2.7% tax rate) x 6 employees = $1,458 SUTA taxes

Given that you must pay FUTA tax only on the first $7,000 of each employee’s wages, your total wage base is $7,000 for each of your six employees, or $42,000. Your FUTA tax liability is $2,520 ($42,000 x 6%).

Recall that you can get a 5.4% FUTA tax credit for paying your SUTA taxes on time. Your FUTA tax rate is 0.6%. So, in the case of our Texas agency, you’d have a much lower FUTA tax liability of $252 ($42,000 x 0.6%) after the tax credit.

Tips on keeping your SUTA tax rate low

Your company may not be eligible for the FUTA tax credit if you don’t file and pay its SUTA taxes on time. Here are some tips to keep your SUTA tax rate as low as possible:

- Know your state’s filing schedule: Many state unemployment tax programs require tax deposits each quarter, which is similar to the FUTA requirements.

- Reduce employee turnover: To improve employee retention, find workers with diverse skill sets who you can transfer to new departments or locations as the needs of your business change.

- Implement human resource policies: Clearly define the responsibilities of HR and payroll departments to ensure you’re keeping detailed documentation with employees.

Good HR practices allow you to lay out expectations of employees, as well as keep track of potential issues with employees. If an employee files a wrongful unemployment claim, use your documentation to improve the chances of getting the claim denied and thereby avoid paying out unemployment insurance.

Find peace of mind come tax time

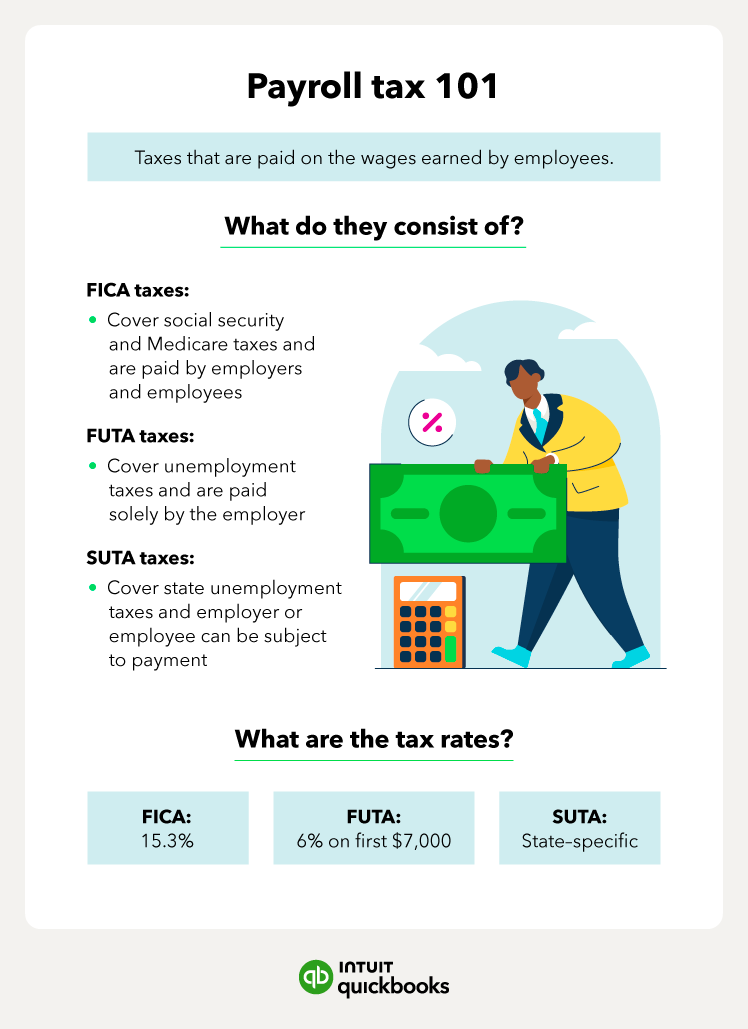

Unemployment taxes like SUTA taxes are an important component of payroll taxes. While payroll is notoriously complicated, you can easily navigate the various tax dates, rates, and payments with a good system in place.

Luckily, there are payroll software programs available, like QuickBooks Payroll, that offer a full suite of payroll tools for businesses of any size. With software to simplify your SUTA and FUTA calculations, you can get back to doing what you do best—running and growing your business.