When it comes to retirement planning, various savings options are available. One of the most popular retirement savings options is the 401(k) plan. What is a 401(k) plan? Simply put, a 401(k) is a retirement savings plan that’s sponsored by an employer. The only way to open a 401(k) account is through an employer who offers one.

But there’s more to 401(k) plans than meets the eye. As you begin to think about and prepare for retirement, it’s important to know how 401(k) plans work and what their benefits are. Throughout this guide, we’ll dive into the ins and outs of 401(k) plans, so you can better understand how they can help you save for retirement. Read through to learn all about 401(k) plans, or use the links below to navigate throughout the post.

- What is a 401(k) plan?

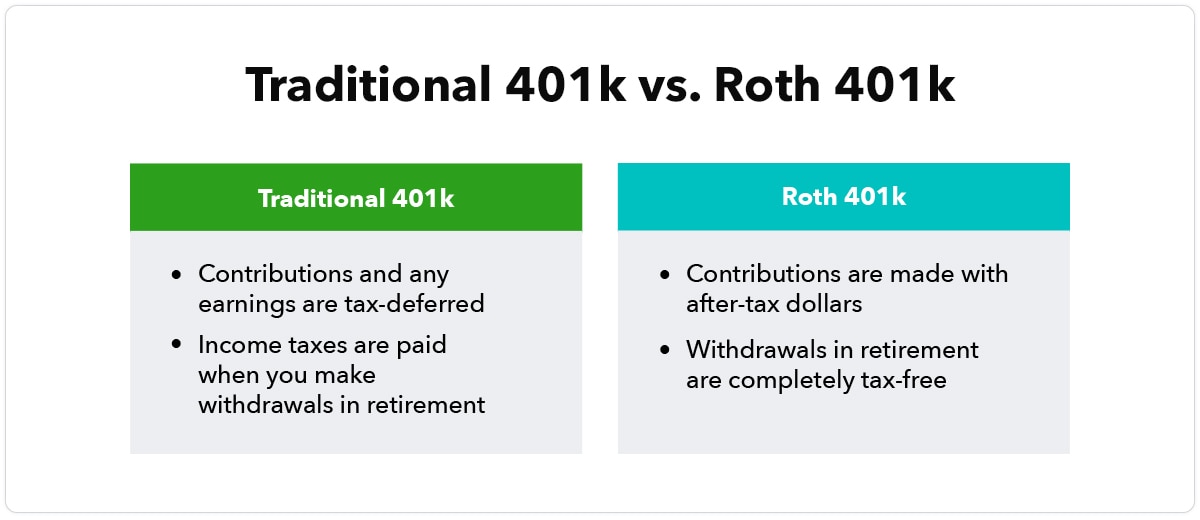

- What is the difference between a 401(k) and a Roth 401(k)?

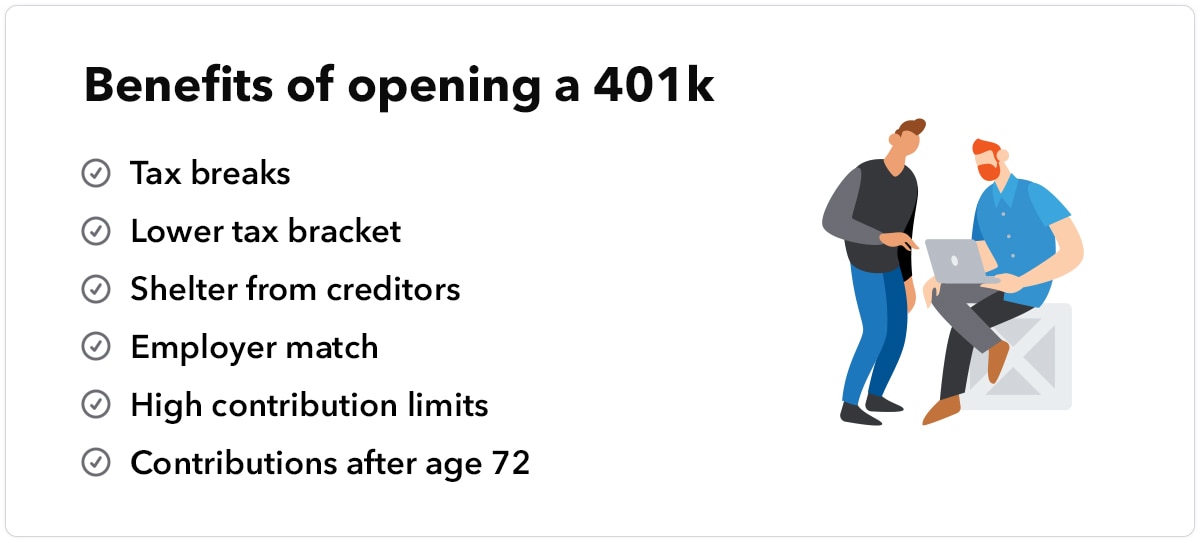

- Benefits of opening a 401(k)

- 401(k) contribution limits

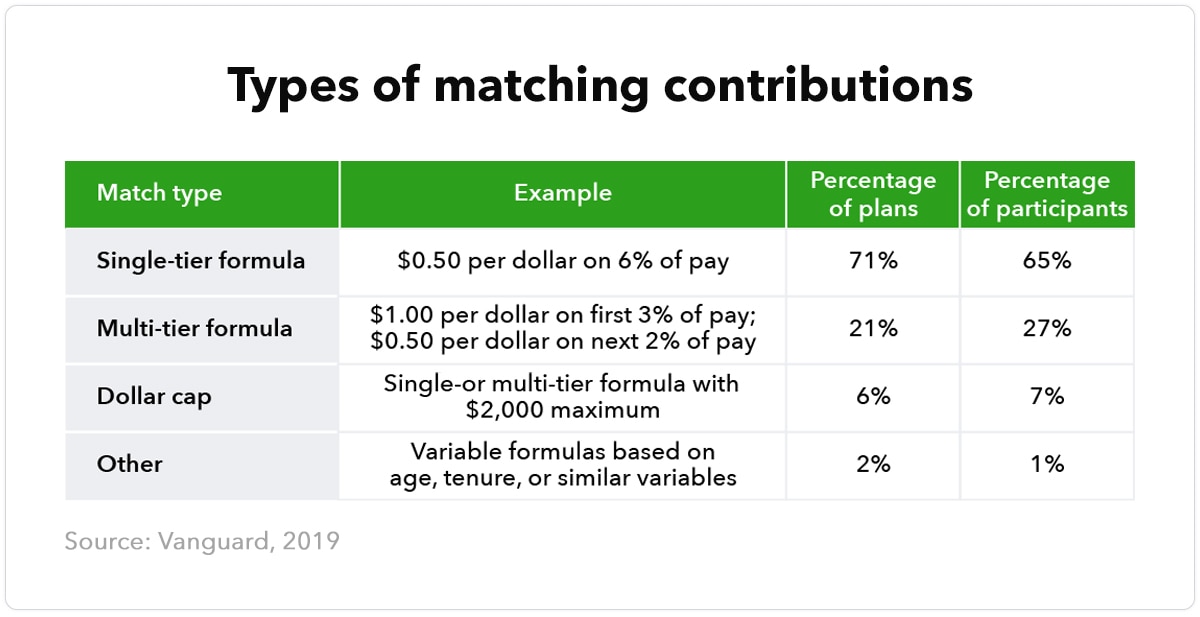

- Employer matching

- How to invest your 401(k)

- Rules for withdrawing from your 401(k)

- 401(k) plan loans

- Post-retirement 401(k) withdrawal rules

- How to rollover your 401(k) money

- Final thoughts