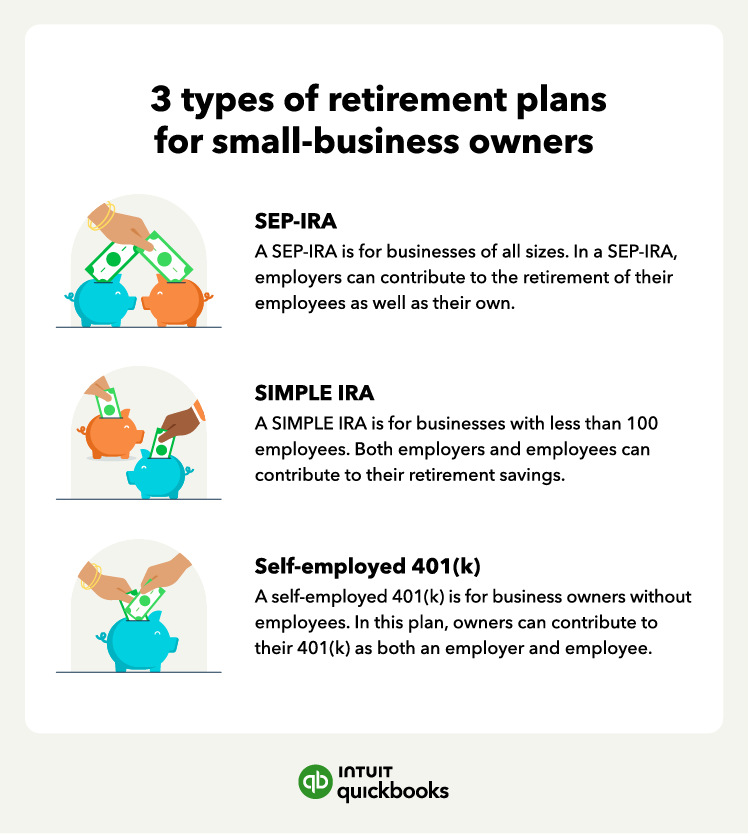

Continue reading to learn more about each of these small-business retirement plan options.

SEP-IRA

A SEP-IRA is an employer-sponsored retirement arrangement eligible for the self-employed and business owners with more than one employee. As a small-business owner, you can make tax-deductible contributions on behalf of your employees.

In addition, small-business owners are also considered employees, so you’ll be able to contribute to your retirement account as well.

Because of this, a SEP-IRA is a cost-effective way to help both you and your employees with retirement. SEP-IRAs offer a range of investment options, including mutual funds, stocks, and bonds. As of 2023, SEP-IRA contribution limits are the lesser of either 25% of the employee’s compensation or $66,000.

SIMPLE IRA

A SIMPLE IRA is for small-business owners with less than 100 employees. Similar to a SEP-IRA, a SIMPLE IRA allows you to contribute to your and your employees' retirement. On the other hand, a SIMPLE IRA allows employees to contribute to their retirement, whereas only employers can contribute to a SEP-IRA.

As a small-business owner, you’re generally required to make a dollar-for-dollar contribution match up to 3% of employee compensation or a nonelective contribution equal to 2% of their annual salary.

As of 2023, employees face SIMPLE IRA contribution limits of $15,500. If you’re over the age of 50, you’re eligible for a total contribution of $19,000, thanks to a $3,500 catch-up contribution.

Self-employed 401(k)

Another retirement plan option for small-business owners is a self-employed 401(k), also known as a solo 401(k). Unlike a SEP- or SIMPLE IRA, a solo 401(k) is a type of 401(k) available to small-business owners without any employees (aside from a spouse).

With a solo 401(K), you’re essentially acting as both the employer and employee, allowing you to contribute in both capacities. Like an IRA, 401(k) plans include a range of investments such as mutual funds, stocks, and bonds.

As of 2023, you’re limited to contributions of $22,500 as an employee and up to 25% of your compensation as an employer, with the total 401(k) contribution limit the lowest of either 25% of your adjusted gross income or $66,000.