As a small business owner, you know that the payroll process requires keeping track of a lot of information.

From tracking retirement contributions to payroll withholdings, there’s plenty of data associated with every paycheck and employee. Fortunately, you can leverage payroll reports to gain a bird's-eye view of your payroll process.

So what exactly is a payroll report, and what are the different types you can use for your small business?

Follow this guide to learn more about payroll reports and how to use them to meet payroll reporting requirements and gain actionable insights for your business.

Benefits of payroll reports

While filing taxes requires some payroll reports, you can also use them internally to help make your life a little bit easier. By maintaining accurate payroll reports, your business can reap the following benefits:

- Streamlined tax reporting: When it comes time to file your small business taxes, having the proper payroll reports can help make the tax filing process run more smoothly.

- Valuable budgeting information: Payroll reports provide important data that can help you predict your payroll expenses and allow you to make informed decisions.

- Accurate paid time off (PTO) tracking: You can use payroll reports to help keep track of your employees use of PTO, allowing you to make sure people are using their time off appropriately.

- Actionable employee data: Lastly, payroll reports provide you with actionable employee data that allows you to see a variety of insights, from total retirement contributions to total tax withholdings for each employee.

Now that you understand the benefits of payroll reporting, let’s look at the different types of payroll reports your business can utilize.

Types of payroll reports

Throughout the payroll process, you may generate different types of payroll reports for various reasons, such as tracking your employees’ use of paid time off and their total hours worked. Read along to learn more about common types of payroll reports and their uses.

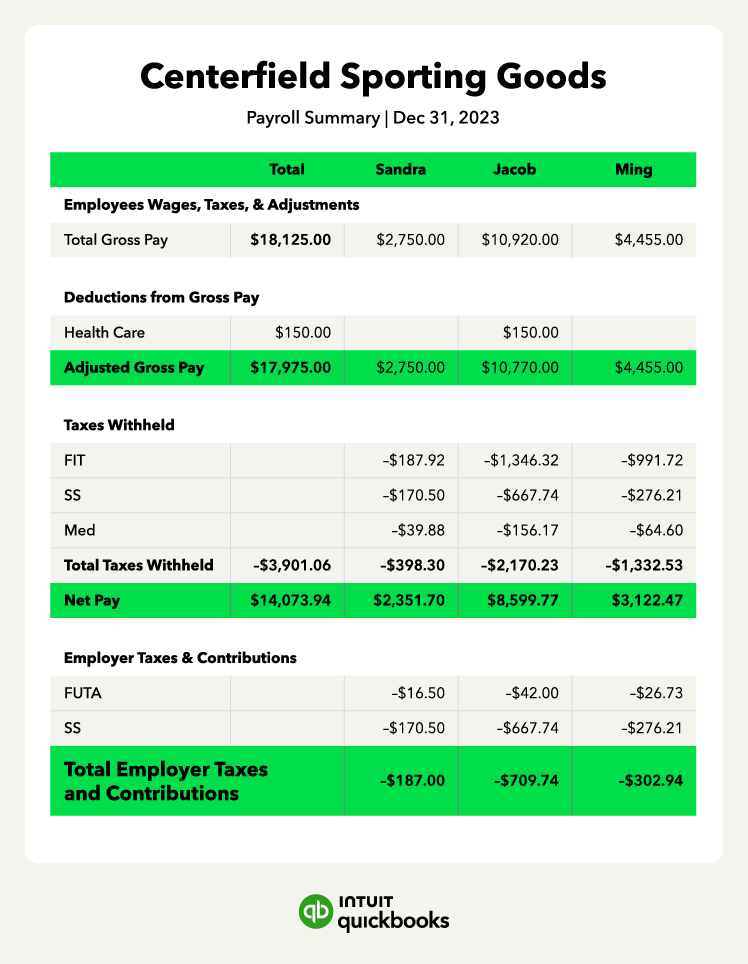

Payroll summary reports

A payroll summary report provides a great overview of your payroll activity, including the total gross pay, adjusted gross pay, net pay, and all employer taxes and contributions. These reports are used internally and can provide a big-picture view of your business’s overall payroll expenses for the pay period. This information can help business owners with budgeting out employee costs.

Employee payroll reports

In an employee payroll report, a payroll administrator may see information such as wages and payroll deductions for a specific employee. These reports are for internal use and can be useful in determining an employee's total wages or tax withholdings.

Retirement contributions reports

If your business offers a 401(k) or another retirement plan, you can run a retirement contributions report to see an overview of retirement contributions made by yourself and your employees.

Paid time off reports

Have you ever wondered how many PTO days each of your employees has taken? With a PTO report, you can combine time tracking and payroll information to determine exactly that. This information can help you see how often your employees use PTO, and make informed scheduling decisions.

Workers’ compensation reports

If your business offers workers’ compensation, a workers’ compensation report may be useful in helping determine your insurance premiums, as the cost of payroll influences these rates.

Payroll tax liability reports

A payroll tax liability report can help employers see the taxes they’ve withheld from employee wages, how much they’ve paid, and the taxes they still owe. This provides employers with a general overview of their payroll liabilities.

What types of payroll reports do employers need to file?

Employers generate payroll reports for federal taxes, state taxes, unemployment compensation, and Medicare and Social Security. As you'll see below, employers submit some tax forms quarterly and others annually. Keep in mind that the date to submit tax withholdings and the date to file reports may differ.

Form 941

Form 941 reports federal income tax withholdings and Federal Insurance Contributions Act (FICA) taxes. These are collected to fund Social Security and Medicare taxes. Form 941 reports FICA taxes withheld from worker pay and the employer’s share of FICA taxes. Businesses submit the form with quarterly tax payments.

For the 2023 tax year, employers and workers each pay a 7.65% FICA tax rate on a worker’s gross wages. Taxes are withheld from gross pay and are sent to the federal government by the employer.

Medicare assesses a tax on every dollar of earnings. Social Security taxes, however, have a wage base limit. For tax year 2023, workers pay Social Security tax on the first $160,200 in earnings. Recent tax law changes have added an additional 0.9% Medicare tax on wages above $200,000.

Form 940

Employers submit Form 940 to report Federal Unemployment Tax Act (FUTA) tax annually. FUTA and State Unemployment Tax Act (SUTA) provide temporary income for workers who lose employment, generally when the employee is not at fault.

In 2023, the FUTA tax rate is 6% and applies to the first $7,000 paid to employees during the year. If you also pay SUTA tax, you may be eligible for a tax credit of up to 5.4%. Keep in mind that SUTA tax rates can vary from state to state.

Form 1096

Form 1096, Annual Summary and Transmittal of US Information Returns, reports the dollars paid using Form 1099 and the gross earnings paid. Businesses issue Form 1099-NEC (or simply Form 1099) to report non-employee compensation to freelancers and independent contractors. Form 1099 doesn’t include withholdings for FICA tax or income taxes.

Companies have to send a Form 1099 to workers paid $600 or more during the year. Freelancers and independent contractors must pay income taxes and FICA taxes on all earnings, even if a 1099-NEC isn’t issued.

Form 944

If your business liability for federal income taxes and FICA taxes is $1,000 or less in a particular year, you can file Form 944 and pay taxes annually.

Forms W-2 and W-3

Employees file Form W-2 annually with their personal tax return to report gross wages and federal tax withholdings.

Form W-3, Transmittal of Wage and Tax Statements, reports an employer's total wages and tax withholdings. When you submit Form W-3, include a copy of each W-2 you issued for the tax year.

State payroll reports

Companies must also withhold and submit state income taxes using state tax forms. The requirements depend on the state, and some states do not assess state income taxes.

Local payroll reports

Similar to state payroll reports, businesses may also be subject to income tax at the local level, whether city or state. These reports may be due annually or quarterly, so check with your local authorities.